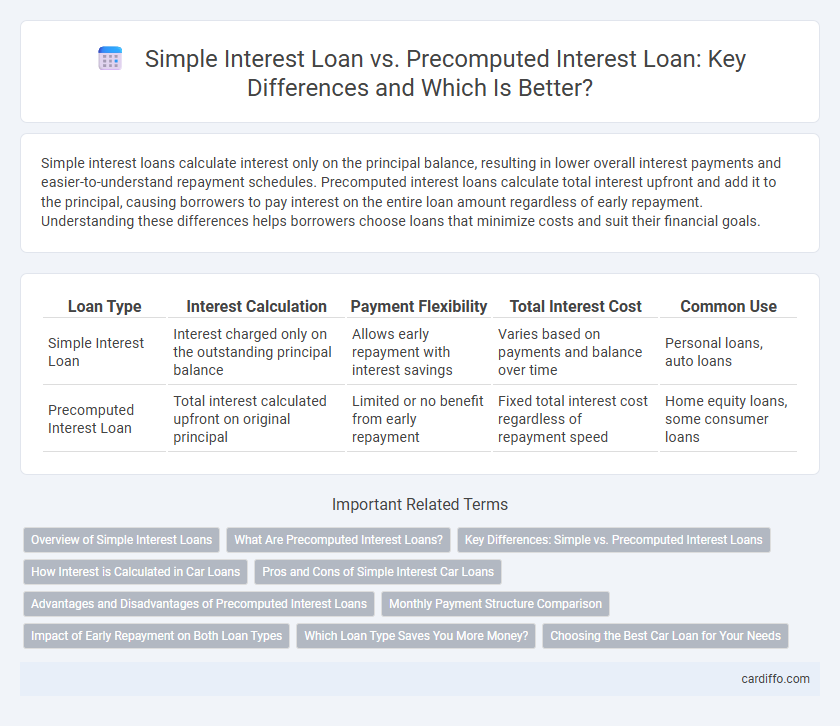

Simple interest loans calculate interest only on the principal balance, resulting in lower overall interest payments and easier-to-understand repayment schedules. Precomputed interest loans calculate total interest upfront and add it to the principal, causing borrowers to pay interest on the entire loan amount regardless of early repayment. Understanding these differences helps borrowers choose loans that minimize costs and suit their financial goals.

Table of Comparison

| Loan Type | Interest Calculation | Payment Flexibility | Total Interest Cost | Common Use |

|---|---|---|---|---|

| Simple Interest Loan | Interest charged only on the outstanding principal balance | Allows early repayment with interest savings | Varies based on payments and balance over time | Personal loans, auto loans |

| Precomputed Interest Loan | Total interest calculated upfront on original principal | Limited or no benefit from early repayment | Fixed total interest cost regardless of repayment speed | Home equity loans, some consumer loans |

Overview of Simple Interest Loans

Simple interest loans calculate interest based on the principal balance, meaning borrowers pay interest only on the remaining loan amount, reducing total interest if early payments are made. This transparent method contrasts with precomputed interest loans, where interest is calculated upfront on the full principal for the entire term, regardless of early repayment. Simple interest loans offer flexibility and potential cost savings, making them advantageous for borrowers who plan to pay off loans early.

What Are Precomputed Interest Loans?

Precomputed interest loans calculate the total interest owed at the beginning of the loan term and add it to the principal, resulting in fixed, upfront interest costs regardless of early repayment. This method often leads to higher overall interest payments compared to simple interest loans, which only charge interest on the remaining principal balance. Borrowers should carefully evaluate precomputed loan terms, as early payoff typically does not reduce the total interest owed.

Key Differences: Simple vs. Precomputed Interest Loans

Simple interest loans calculate interest only on the principal balance, resulting in lower overall interest costs as payments reduce the principal over time. Precomputed interest loans calculate total interest upfront, adding it to the principal, which can lead to higher effective interest rates and less flexibility in early repayment. Borrowers should compare these methods based on loan duration, payment structure, and total cost to select the most cost-effective option.

How Interest is Calculated in Car Loans

Simple interest on car loans is calculated only on the principal balance, meaning the interest amount decreases as the borrower pays down the loan. Precomputed interest loans calculate the total interest upfront based on the original principal and loan term, then add it to the principal, resulting in fixed payments regardless of early repayment. This difference affects total cost, with simple interest loans often being more cost-effective for borrowers who can make early or extra payments.

Pros and Cons of Simple Interest Car Loans

Simple interest car loans calculate interest only on the outstanding principal, resulting in lower total interest payments compared to precomputed loans where interest is calculated on the entire principal upfront. This structure allows borrowers to save money if they pay off the loan early or make extra payments without facing penalties. However, simple interest loans may require more frequent payments to avoid accruing additional interest, which can be challenging for some borrowers.

Advantages and Disadvantages of Precomputed Interest Loans

Precomputed interest loans require interest to be calculated on the full principal amount upfront, resulting in fixed payments that simplify budgeting for borrowers. An advantage of precomputed interest loans is predictable repayment schedules, but their major disadvantage lies in the lack of interest reduction from early payments, often leading to higher total costs. Borrowers may face financial inflexibility since paying off the loan early does not decrease the interest owed, unlike simple interest loans.

Monthly Payment Structure Comparison

Simple interest loans calculate interest only on the outstanding principal balance each month, resulting in lower monthly payments that decrease over time as the principal reduces. Precomputed interest loans require the total interest amount to be calculated upfront and added to the principal, dividing this sum into fixed monthly payments that remain constant throughout the loan term. This difference significantly impacts borrower cash flow, with simple interest loans offering more payment flexibility and potential savings if extra payments are made.

Impact of Early Repayment on Both Loan Types

Early repayment of a simple interest loan directly reduces the principal, decreasing the total interest owed and allowing borrowers to save money. In contrast, precomputed interest loans calculate total interest upfront, meaning early repayment may not reduce interest costs significantly unless the lender offers a rebate or refund policy. Understanding these differences is crucial for borrowers aiming to minimize interest expenses through early loan payoff.

Which Loan Type Saves You More Money?

Simple interest loans save more money because interest is calculated only on the principal balance, reducing overall interest costs when payments are made early or on time. Precomputed interest loans calculate total interest upfront and add it to the principal, causing borrowers to pay interest even on amounts already repaid, increasing total costs. Choosing simple interest loans minimizes unnecessary interest charges and offers greater flexibility in repayment strategies.

Choosing the Best Car Loan for Your Needs

Simple interest loans calculate interest only on the remaining principal balance, making them more cost-effective for borrowers who plan to pay off their car loan early or with extra payments. Precomputed interest loans determine the total interest upfront based on the original loan amount and term, which can result in higher overall costs if you pay off the loan early. Evaluating your payment flexibility and financial goals helps choose the best car loan, with simple interest loans generally favoring borrowers seeking savings through early repayment.

Simple Interest Loan vs Precomputed Interest Loan Infographic

cardiffo.com

cardiffo.com