Open-end lease agreements require the lessee to cover the difference if the vehicle's market value is less than the agreed residual value at lease end, posing potential financial risk. Closed-end leases limit the lessee's liability to the predetermined payments, allowing for easier budgeting and no unexpected charges beyond wear and tear. Understanding these distinctions helps consumers select the best lease type based on their financial goals and risk tolerance.

Table of Comparison

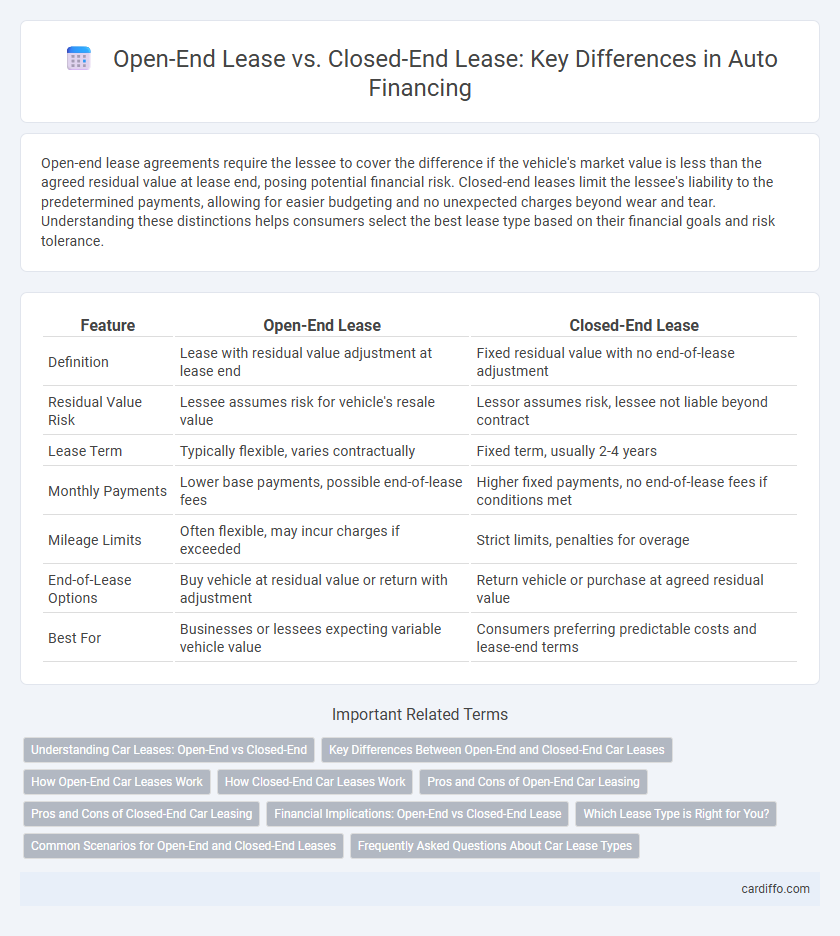

| Feature | Open-End Lease | Closed-End Lease |

|---|---|---|

| Definition | Lease with residual value adjustment at lease end | Fixed residual value with no end-of-lease adjustment |

| Residual Value Risk | Lessee assumes risk for vehicle's resale value | Lessor assumes risk, lessee not liable beyond contract |

| Lease Term | Typically flexible, varies contractually | Fixed term, usually 2-4 years |

| Monthly Payments | Lower base payments, possible end-of-lease fees | Higher fixed payments, no end-of-lease fees if conditions met |

| Mileage Limits | Often flexible, may incur charges if exceeded | Strict limits, penalties for overage |

| End-of-Lease Options | Buy vehicle at residual value or return with adjustment | Return vehicle or purchase at agreed residual value |

| Best For | Businesses or lessees expecting variable vehicle value | Consumers preferring predictable costs and lease-end terms |

Understanding Car Leases: Open-End vs Closed-End

Open-end leases require lessees to cover the difference if the car's market value at lease-end is less than the residual value, impacting total cost. Closed-end leases offer fixed payments and allow returning the vehicle without extra charges beyond agreed terms, ideal for predictable budgeting. Understanding these differences helps borrowers select a lease that aligns with their financial goals and risk tolerance in auto financing.

Key Differences Between Open-End and Closed-End Car Leases

Open-end leases require the lessee to pay the difference if the vehicle's residual value is lower than the market value at lease end, exposing them to potential financial risk. Closed-end leases, also called "walk-away" leases, protect the lessee by locking in the residual value, limiting costs to scheduled payments and any excess wear or mileage charges. Understanding the impact on end-of-lease obligations and total cost of ownership is crucial when choosing between open-end and closed-end car leases.

How Open-End Car Leases Work

Open-end car leases require the lessee to cover the difference if the vehicle's residual value is lower than expected at lease-end, resulting in potential additional payments. These leases typically involve monthly payments based on estimated depreciation plus finance charges, with flexibility to drive more miles without excessive penalties. Open-end leases are commonly used by commercial entities due to their adaptable terms and risk management options.

How Closed-End Car Leases Work

Closed-end car leases allow lessees to return the vehicle at the end of the lease term without any obligation beyond the agreed-upon monthly payments, making it easier to predict total lease costs. The monthly payments are based on the vehicle's depreciation, estimated residual value, and interest rate, which reduces financial risk for consumers. At lease-end, customers can either return the car, purchase it at the predetermined residual value, or lease another vehicle without facing additional charges for normal wear and mileage within agreed limits.

Pros and Cons of Open-End Car Leasing

Open-end car leasing offers flexibility by allowing lessees to purchase the vehicle at lease-end for its residual value, which can be advantageous if the car's market value exceeds expectations. This lease type often involves lower monthly payments compared to closed-end leases, but exposes the lessee to potential financial risk if the vehicle depreciates more than anticipated. The primary drawback includes the uncertainty around end-of-lease costs, as lessees might owe a significant balance if the car's fair market value falls below the agreed residual value.

Pros and Cons of Closed-End Car Leasing

Closed-end car leasing offers the advantage of predictable monthly payments and the option to simply return the vehicle at lease end without worrying about its resale value. This lease type limits financial risk, as lessees are not responsible for excess depreciation beyond agreed terms, making it ideal for those seeking budget certainty. However, closed-end leases often come with mileage restrictions and potential fees for excessive wear and tear, which can increase overall costs if limits are exceeded.

Financial Implications: Open-End vs Closed-End Lease

Open-end leases require lessees to cover the vehicle's depreciation beyond the residual value, potentially leading to higher out-of-pocket costs at lease-end if the market value is lower. Closed-end leases provide fixed monthly payments with no financial liability for depreciation, making them more predictable and generally less risky for consumers. Understanding these differences helps borrowers assess potential expenses and decide which lease type aligns with their financial situation.

Which Lease Type is Right for You?

Choosing between an open-end lease and a closed-end lease depends on your budget flexibility and risk tolerance; open-end leases offer lower monthly payments but expose you to potential end-of-lease charges based on the vehicle's residual value, while closed-end leases provide predictable costs with fixed payments and no surprise fees if mileage and condition limits are met. Open-end leases are often preferred by businesses or individuals who anticipate higher mileage or wear, whereas closed-end leases suit those wanting straightforward, hassle-free agreements. Evaluating your driving habits, financial goals, and the vehicle's anticipated depreciation can help determine which lease type aligns best with your needs.

Common Scenarios for Open-End and Closed-End Leases

Open-End Leases are commonly used by businesses or individuals who drive high mileage or require flexibility in vehicle returns, as they allow for end-of-term charges based on the vehicle's residual value. Closed-End Leases are popular among consumers who prefer predictable monthly payments and a fixed lease term with no financial obligation beyond agreed-upon lease-end conditions. Fleet operators and commercial users often favor Open-End Leases due to potential cost savings tied to actual usage, while Closed-End Leases appeal to personal lessees seeking straightforward, low-risk agreements.

Frequently Asked Questions About Car Lease Types

Open-end leases require the lessee to cover the difference if the vehicle's residual value is less than expected at lease-end, while closed-end leases protect the lessee from this risk, offering fixed payments and a guaranteed buyout price. Common questions include how mileage limits affect end-of-lease costs and whether lessees can purchase the vehicle after the lease ends. Understanding the financial obligations, mileage restrictions, and buyout options is essential for choosing between open-end and closed-end car lease types.

Open-End Lease vs Closed-End Lease Infographic

cardiffo.com

cardiffo.com