A Lease Buyout Loan enables drivers to purchase their leased vehicle by financing the buyout amount, often resulting in lower monthly payments compared to a Traditional Auto Loan. Unlike Traditional Auto Loans, which finance the purchase of a new or used car with set terms and interest rates, Lease Buyout Loans cater specifically to lease-end purchases, offering tailored repayment options. Understanding the differences in interest rates, loan terms, and eligibility criteria helps borrowers choose the best financing method for their needs.

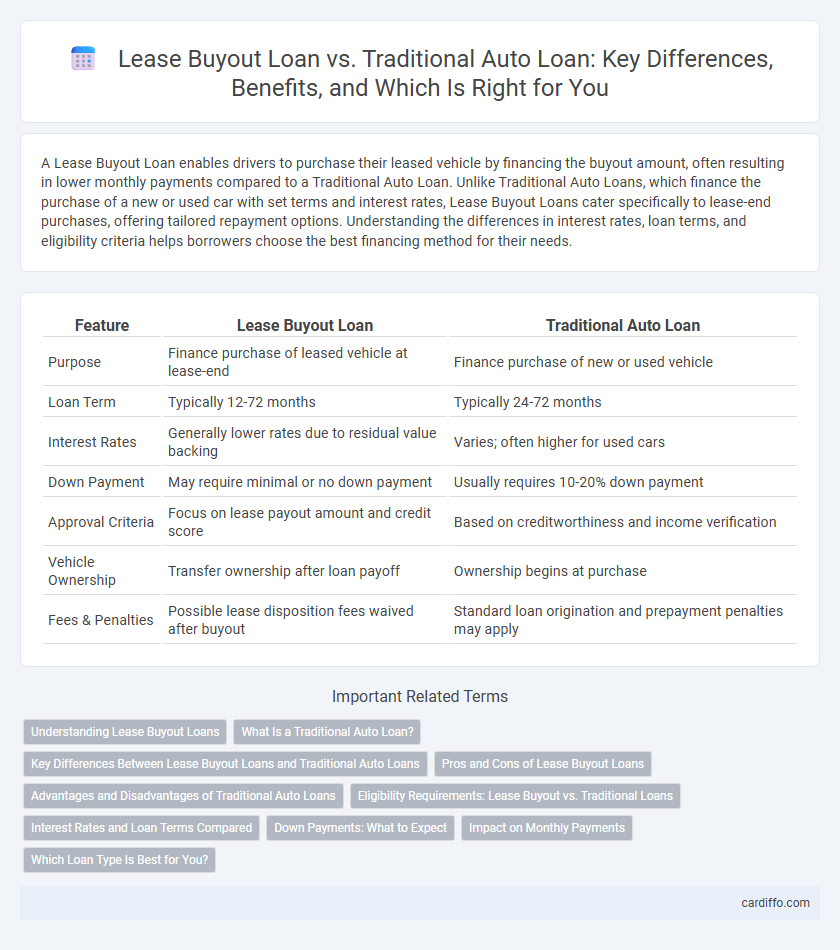

Table of Comparison

| Feature | Lease Buyout Loan | Traditional Auto Loan |

|---|---|---|

| Purpose | Finance purchase of leased vehicle at lease-end | Finance purchase of new or used vehicle |

| Loan Term | Typically 12-72 months | Typically 24-72 months |

| Interest Rates | Generally lower rates due to residual value backing | Varies; often higher for used cars |

| Down Payment | May require minimal or no down payment | Usually requires 10-20% down payment |

| Approval Criteria | Focus on lease payout amount and credit score | Based on creditworthiness and income verification |

| Vehicle Ownership | Transfer ownership after loan payoff | Ownership begins at purchase |

| Fees & Penalties | Possible lease disposition fees waived after buyout | Standard loan origination and prepayment penalties may apply |

Understanding Lease Buyout Loans

A lease buyout loan allows borrowers to purchase their leased vehicle by financing the buyout amount, often including residual value and any fees. Unlike traditional auto loans, which cover the purchase of a new or used car, lease buyout loans specifically facilitate ownership transfer at the end of a lease term. Understanding key factors such as interest rates, loan terms, and the vehicle's residual value can help determine if a lease buyout loan is more advantageous than a standard auto loan.

What Is a Traditional Auto Loan?

A traditional auto loan is a financing option where a borrower takes out a loan to purchase a vehicle, making fixed monthly payments over a set term until the loan is fully paid off. This loan typically requires a down payment and has a fixed or variable interest rate based on creditworthiness. Once the loan is repaid, the borrower owns the vehicle outright without any further financial obligations.

Key Differences Between Lease Buyout Loans and Traditional Auto Loans

Lease buyout loans enable borrowers to purchase their leased vehicle at the end of the lease term, often involving a residual value payment, while traditional auto loans finance the purchase of a vehicle upfront with fixed monthly payments over a predetermined loan period. Lease buyout loans typically involve lower borrowing amounts tied to the residual value, whereas traditional auto loans are based on the full purchase price minus any down payment. Interest rates for lease buyout loans may differ due to shorter loan terms and specific lender policies compared to conventional auto loans.

Pros and Cons of Lease Buyout Loans

Lease buyout loans enable borrowers to purchase their leased vehicle by financing the buyout amount, offering the advantage of retaining a familiar car with known history and avoiding lease-end fees. These loans often have higher interest rates and shorter terms compared to traditional auto loans, potentially increasing overall costs. However, lease buyout loans provide flexibility for those who want to keep their leased vehicle without paying a large lump sum upfront, unlike traditional auto loans that usually require a down payment.

Advantages and Disadvantages of Traditional Auto Loans

Traditional auto loans often feature lower interest rates compared to lease buyout loans, making them cost-effective for long-term vehicle ownership. However, they require higher monthly payments and longer commitment periods, which may strain borrowers' monthly budgets. Additionally, traditional loans build equity in the car, but depreciation risk remains fully with the owner, unlike lease agreements with mileage limits and wear protections.

Eligibility Requirements: Lease Buyout vs. Traditional Loans

Lease buyout loans typically require the borrower to have completed the lease term or be near its end, with eligibility often contingent on the vehicle's residual value and condition. Traditional auto loans generally demand proof of steady income, good credit score, and a clear title for the financed vehicle, without restrictions tied to prior lease agreements. Lenders may assess debt-to-income ratios and credit history rigorously for both loan types but allow more flexibility with traditional auto loans on vehicle age and mileage.

Interest Rates and Loan Terms Compared

Lease buyout loans often feature higher interest rates compared to traditional auto loans due to the increased risk associated with financing a used vehicle under lease terms. Loan terms for lease buyout loans tend to be shorter, typically ranging from 24 to 48 months, while traditional auto loans offer more flexibility with terms extending up to 72 months or longer. Borrowers should consider that lower rates and extended terms in traditional auto loans may lead to more affordable monthly payments but could result in higher overall interest costs over the life of the loan.

Down Payments: What to Expect

Lease buyout loans typically require lower or no down payments compared to traditional auto loans, which often demand 10-20% of the vehicle's purchase price upfront. Traditional auto loan down payments reduce the principal balance, lowering monthly payments and overall interest costs. Lease buyout loans focus on covering the residual value of the leased vehicle, influencing down payment expectations based on lease terms and lender policies.

Impact on Monthly Payments

Lease buyout loans typically result in higher monthly payments compared to traditional auto loans due to the residual value and fees associated with the lease agreement. Traditional auto loans allow borrowers to finance the total purchase price of a vehicle spread over a fixed term, often resulting in more predictable and potentially lower monthly payments. The impact on monthly payments depends on factors like interest rates, loan terms, and the vehicle's depreciation.

Which Loan Type Is Best for You?

Lease buyout loans allow you to purchase your leased vehicle at the end of the term, often with lower interest rates and flexible terms compared to traditional auto loans, which finance a new or used car purchase outright. Choosing the best loan depends on factors like your current vehicle's condition, market value, credit score, and how long you plan to keep the car. Evaluating total costs, monthly payments, and potential fees can help determine if a lease buyout loan or a traditional auto loan offers greater financial benefits for your situation.

Lease Buyout Loan vs Traditional Auto Loan Infographic

cardiffo.com

cardiffo.com