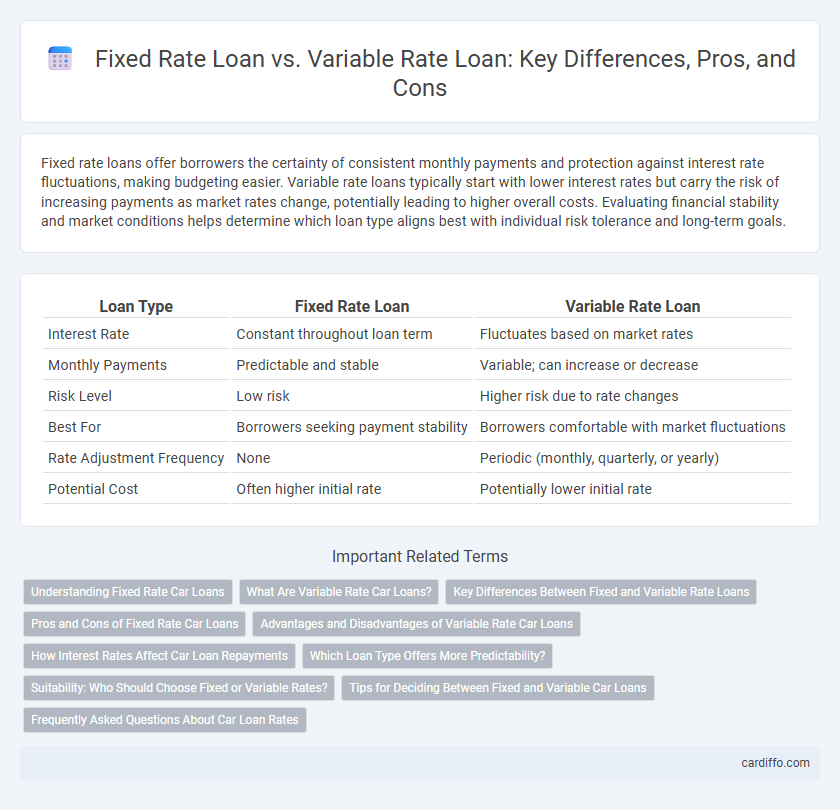

Fixed rate loans offer borrowers the certainty of consistent monthly payments and protection against interest rate fluctuations, making budgeting easier. Variable rate loans typically start with lower interest rates but carry the risk of increasing payments as market rates change, potentially leading to higher overall costs. Evaluating financial stability and market conditions helps determine which loan type aligns best with individual risk tolerance and long-term goals.

Table of Comparison

| Loan Type | Fixed Rate Loan | Variable Rate Loan |

|---|---|---|

| Interest Rate | Constant throughout loan term | Fluctuates based on market rates |

| Monthly Payments | Predictable and stable | Variable; can increase or decrease |

| Risk Level | Low risk | Higher risk due to rate changes |

| Best For | Borrowers seeking payment stability | Borrowers comfortable with market fluctuations |

| Rate Adjustment Frequency | None | Periodic (monthly, quarterly, or yearly) |

| Potential Cost | Often higher initial rate | Potentially lower initial rate |

Understanding Fixed Rate Car Loans

Fixed rate car loans offer a consistent interest rate throughout the loan term, providing predictable monthly payments and easing budget management for borrowers. These loans protect against market fluctuations, ensuring that the interest does not increase, which is particularly beneficial during periods of rising interest rates. Fixed rate car loans typically feature terms between 36 to 72 months, and borrowers often choose them for stability and long-term financial planning in vehicle financing.

What Are Variable Rate Car Loans?

Variable rate car loans have an interest rate that fluctuates based on market conditions or a benchmark index, such as the prime rate or LIBOR. These loans typically start with a lower initial rate compared to fixed rate loans, but monthly payments can increase or decrease over time, impacting affordability. Borrowers benefit from potential savings when rates drop but assume the risk of higher payments if interest rates rise.

Key Differences Between Fixed and Variable Rate Loans

Fixed rate loans maintain a consistent interest rate throughout the loan term, providing predictable monthly payments and protection against market fluctuations. Variable rate loans feature an interest rate that adjusts periodically based on benchmark rates like the prime rate or LIBOR, which can result in lower initial payments but increased risk of rising costs. Borrowers must weigh stability versus potential savings, considering factors such as economic conditions, loan duration, and personal risk tolerance when choosing between fixed and variable rate loans.

Pros and Cons of Fixed Rate Car Loans

Fixed rate car loans provide the advantage of predictable monthly payments, ensuring stability in budgeting regardless of market interest fluctuations. The fixed interest rate protects borrowers from rising rates, making long-term financial planning easier and reducing uncertainty. However, fixed rate loans typically have higher initial interest rates compared to variable loans, potentially resulting in higher overall costs if market rates decrease over time.

Advantages and Disadvantages of Variable Rate Car Loans

Variable rate car loans offer the advantage of typically lower initial interest rates compared to fixed rate loans, potentially resulting in lower monthly payments at the start of the loan term. Borrowers benefit from possible decreases in interest rates over time, which can reduce overall loan costs when market rates decline. However, the main disadvantage lies in the unpredictability of monthly payments, as rising interest rates may increase the loan burden and create budgeting challenges.

How Interest Rates Affect Car Loan Repayments

Fixed rate loans maintain a consistent interest rate throughout the loan term, providing predictable monthly car loan repayments that simplify budgeting. Variable rate loans have interest rates that fluctuate with market conditions, potentially lowering payments when rates drop but increasing them if rates rise, impacting total repayment costs. Understanding how interest rate changes influence these loan types helps borrowers choose between stability and potential savings for their car financing.

Which Loan Type Offers More Predictability?

Fixed rate loans offer more predictability by maintaining a constant interest rate and stable monthly payments throughout the loan term, shielding borrowers from market fluctuations. Variable rate loans, in contrast, can have interest rates that change based on benchmark indexes like the LIBOR or prime rate, leading to potential payment increases. For borrowers prioritizing budget stability and long-term financial planning, fixed rate loans provide greater certainty and reduced risk.

Suitability: Who Should Choose Fixed or Variable Rates?

Fixed rate loans suit borrowers seeking predictable monthly payments and protection from interest rate fluctuations, ideal for those with steady income and long-term financial plans. Variable rate loans benefit individuals comfortable with some payment variability and aiming to capitalize on potentially lower initial interest rates, often suited for short-term borrowers or those anticipating rising income. Understanding personal risk tolerance and market conditions is crucial in choosing between fixed and variable rate loans.

Tips for Deciding Between Fixed and Variable Car Loans

Consider your financial stability and risk tolerance when choosing between fixed and variable car loans, as fixed rates provide consistent monthly payments while variable rates may fluctuate with market conditions. Evaluate current interest rate trends and forecasts, since rising rates could increase variable loan costs, making fixed loans more cost-effective over time. Assess your loan term and flexibility needs to determine if you prefer predictable budgeting or potential savings from lower initial variable rates.

Frequently Asked Questions About Car Loan Rates

Fixed rate loans for car financing offer consistent monthly payments, making budgeting easier and protecting borrowers from interest rate fluctuations. Variable rate loans, however, start with lower initial rates but can increase or decrease based on market conditions, potentially affecting affordability over time. Frequently asked questions about car loan rates often focus on comparing total interest costs, risks associated with rate changes, and which loan type best suits a borrower's financial stability and future plans.

Fixed Rate Loan vs Variable Rate Loan Infographic

cardiffo.com

cardiffo.com