Guaranteed Auto Protection (GAP) Loan covers the difference between your car's actual cash value and the remaining loan balance if your vehicle is totaled or stolen, offering financial protection beyond a standard auto loan. Standard Auto Loans only finance the purchase price of the vehicle without covering potential depreciation gaps, potentially leaving borrowers responsible for paying the difference. Opting for a GAP loan reduces out-of-pocket expense risks and provides peace of mind during unforeseen circumstances.

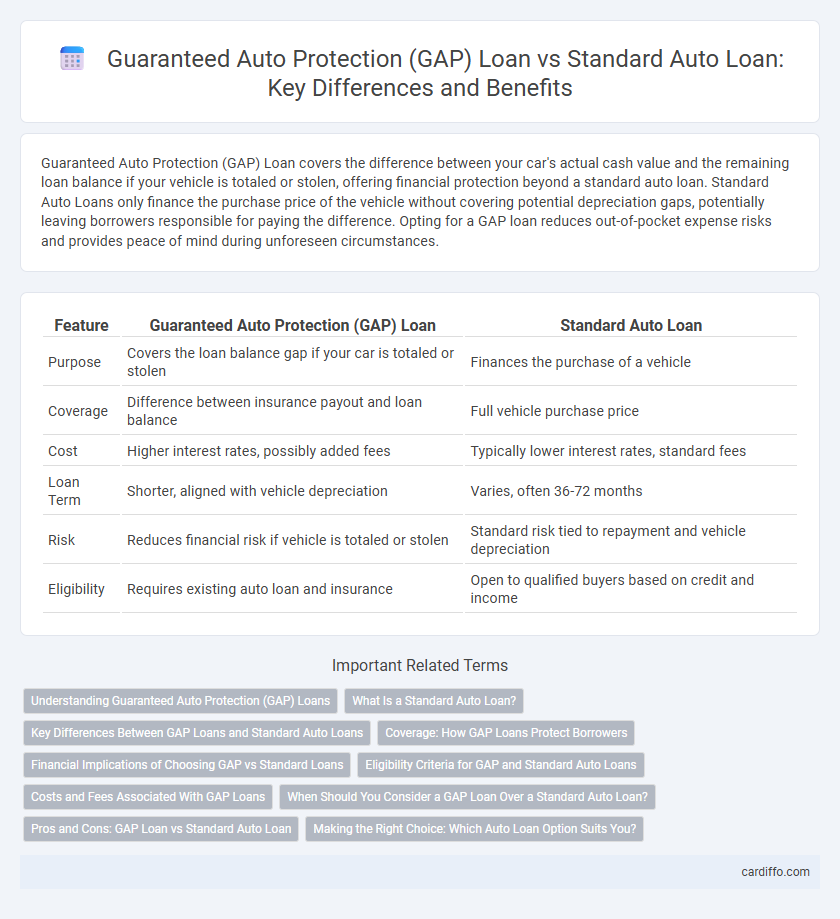

Table of Comparison

| Feature | Guaranteed Auto Protection (GAP) Loan | Standard Auto Loan |

|---|---|---|

| Purpose | Covers the loan balance gap if your car is totaled or stolen | Finances the purchase of a vehicle |

| Coverage | Difference between insurance payout and loan balance | Full vehicle purchase price |

| Cost | Higher interest rates, possibly added fees | Typically lower interest rates, standard fees |

| Loan Term | Shorter, aligned with vehicle depreciation | Varies, often 36-72 months |

| Risk | Reduces financial risk if vehicle is totaled or stolen | Standard risk tied to repayment and vehicle depreciation |

| Eligibility | Requires existing auto loan and insurance | Open to qualified buyers based on credit and income |

Understanding Guaranteed Auto Protection (GAP) Loans

Guaranteed Auto Protection (GAP) loans cover the difference between an auto loan balance and the vehicle's actual cash value in case of total loss or theft, protecting borrowers from significant out-of-pocket expenses. Unlike standard auto loans that only cover the purchase price of the car, GAP loans specifically safeguard against depreciation-related financial gaps. This protection is especially valuable when a vehicle's value depreciates faster than the loan balance decreases.

What Is a Standard Auto Loan?

A Standard Auto Loan is a traditional financing option where the borrower repays the loan amount plus interest over a set term, typically ranging from 36 to 72 months. This loan covers the purchase price of the vehicle, requiring monthly payments based on the principal and applicable interest rate. Unlike Guaranteed Auto Protection (GAP) loans, standard auto loans do not include coverage for the difference between the car's actual cash value and the outstanding loan balance in case of theft or total loss.

Key Differences Between GAP Loans and Standard Auto Loans

Guaranteed Auto Protection (GAP) loans cover the difference between an auto loan balance and the vehicle's actual cash value in case of total loss, whereas standard auto loans only finance the vehicle purchase amount without such protection. GAP loans typically involve higher fees or interest rates due to the added insurance coverage embedded in the loan structure. Unlike standard auto loans, GAP loans reduce financial risk for borrowers by mitigating potential out-of-pocket expenses resulting from depreciation or loan balance exceeding vehicle worth.

Coverage: How GAP Loans Protect Borrowers

Guaranteed Auto Protection (GAP) loans provide coverage that pays the difference between the actual cash value of a vehicle and the remaining auto loan balance if the car is totaled or stolen, ensuring borrowers are not left with a significant financial gap. Standard auto loans cover the vehicle purchase but do not protect against depreciation or negative equity, potentially leaving borrowers responsible for paying off a loan on a vehicle they no longer possess. GAP loans safeguard borrowers by minimizing out-of-pocket expenses and reducing financial risk when insurance settlements fall short.

Financial Implications of Choosing GAP vs Standard Loans

Guaranteed Auto Protection (GAP) loans cover the difference between the car's actual cash value and the outstanding loan balance in case of total loss, reducing the risk of financial loss. Standard auto loans typically require borrowers to cover this gap out-of-pocket, potentially leading to higher personal expenses after an accident or theft. Choosing a GAP loan often results in higher initial monthly payments but offers significant financial security by safeguarding against depreciation-related loan deficits.

Eligibility Criteria for GAP and Standard Auto Loans

Guaranteed Auto Protection (GAP) loans typically require borrowers to have standard auto loan eligibility, including a good credit score, stable income, and proof of insurance, with an additional focus on the loan-to-value ratio of the vehicle to cover potential depreciation gaps. Standard auto loans prioritize creditworthiness, income verification, and debt-to-income ratio without the specific need to address depreciation or loan coverage gaps. Lenders may impose stricter conditions on GAP loans due to their supplementary nature and risk mitigation features compared to conventional auto financing options.

Costs and Fees Associated With GAP Loans

Guaranteed Auto Protection (GAP) loans typically incur higher upfront costs compared to standard auto loans due to the added coverage that protects borrowers from owing more than the vehicle's depreciated value in case of theft or total loss. GAP loan fees often include a one-time premium or an increased interest rate, which can raise the overall cost of financing. Standard auto loans generally have lower fees and interest rates but lack the financial protection GAP coverage provides in high-risk scenarios.

When Should You Consider a GAP Loan Over a Standard Auto Loan?

Consider a Guaranteed Auto Protection (GAP) loan when buying a new or leased vehicle that rapidly depreciates, as it covers the difference between your car's actual cash value and the remaining loan balance if totaled or stolen. Standard auto loans only cover the vehicle purchase price, potentially leaving you responsible for a significant financial gap in the event of total loss. GAP loans are especially beneficial for drivers with low down payments, long loan terms, or high depreciation schedules.

Pros and Cons: GAP Loan vs Standard Auto Loan

Guaranteed Auto Protection (GAP) Loans cover the difference between your car's actual value and the outstanding loan balance if the vehicle is totaled, providing financial security but typically coming with higher interest rates and fees. Standard Auto Loans offer lower interest rates and simpler terms but leave borrowers responsible for any depreciation gap, potentially leading to out-of-pocket expenses after total loss or theft. Borrowers seeking comprehensive coverage might prefer GAP Loans despite increased costs, while those prioritizing lower monthly payments may opt for Standard Auto Loans.

Making the Right Choice: Which Auto Loan Option Suits You?

Guaranteed Auto Protection (GAP) loans cover the difference between your car's actual cash value and the remaining loan balance if your vehicle is totaled or stolen, offering enhanced financial security. Standard auto loans typically involve fixed or variable interest rates based on credit score, with repayment terms varying from 36 to 72 months, but lack coverage for total loss gaps. Assess your financial risk tolerance, asset depreciation rate, and budget flexibility to determine whether GAP protection or a traditional auto loan best aligns with your long-term vehicle financing goals.

Guaranteed Auto Protection (GAP) Loan vs Standard Auto Loan Infographic

cardiffo.com

cardiffo.com