Lease buyout allows you to purchase your leased vehicle at the end of the term, often with a predetermined price, providing ownership without changing your financing structure. Refinance involves replacing your current auto loan with a new loan, typically to secure better interest rates or terms, which can reduce monthly payments and overall cost. Choosing between a lease buyout and refinance depends on your financial goals, whether you prefer asset ownership or optimizing loan conditions.

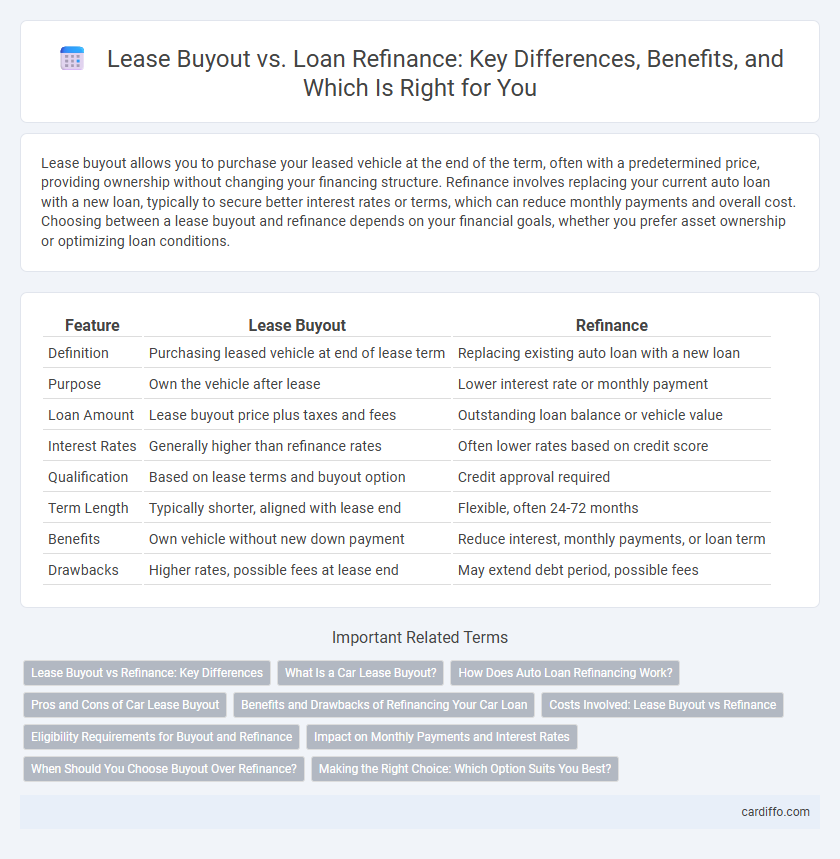

Table of Comparison

| Feature | Lease Buyout | Refinance |

|---|---|---|

| Definition | Purchasing leased vehicle at end of lease term | Replacing existing auto loan with a new loan |

| Purpose | Own the vehicle after lease | Lower interest rate or monthly payment |

| Loan Amount | Lease buyout price plus taxes and fees | Outstanding loan balance or vehicle value |

| Interest Rates | Generally higher than refinance rates | Often lower rates based on credit score |

| Qualification | Based on lease terms and buyout option | Credit approval required |

| Term Length | Typically shorter, aligned with lease end | Flexible, often 24-72 months |

| Benefits | Own vehicle without new down payment | Reduce interest, monthly payments, or loan term |

| Drawbacks | Higher rates, possible fees at lease end | May extend debt period, possible fees |

Lease Buyout vs Refinance: Key Differences

Lease buyout involves purchasing the leased vehicle at the end of the lease term, often with a fixed residual value, while refinancing replaces an existing loan with a new one to achieve better terms or lower interest rates. Lease buyouts typically require a lump-sum payment or new financing based on the buyout price, whereas refinancing adjusts the loan balance and payment schedule without transferring ownership. Understanding the differences helps borrowers decide whether to own the vehicle outright through a lease buyout or improve loan conditions via refinancing.

What Is a Car Lease Buyout?

A car lease buyout allows the lessee to purchase the vehicle at the end of the lease term for a predetermined price, often specified in the lease agreement as the residual value. This option provides a straightforward path to ownership without the need for a new loan application or credit check, unlike refinancing. Lease buyouts can be financially advantageous when the car's market value exceeds the residual buyout price, offering equity to the lessee.

How Does Auto Loan Refinancing Work?

Auto loan refinancing involves replacing your existing car loan with a new one, typically offering a lower interest rate or better terms to reduce monthly payments or overall loan cost. The process requires applying with a lender who evaluates your credit, vehicle value, and loan balance to approve a new loan that pays off the original lender. Refinancing can improve cash flow, lower total interest paid, and adjust loan duration based on updated financial goals.

Pros and Cons of Car Lease Buyout

Car lease buyout allows drivers to purchase their leased vehicle at the end of the contract, offering the advantage of avoiding the hassle of searching for a new car and potentially saving money on lease-end fees. However, the buyout price can be higher than the car's current market value, leading to a less favorable financial outcome. Buyers must consider factors like vehicle condition, residual value, and available financing options before deciding on a lease buyout.

Benefits and Drawbacks of Refinancing Your Car Loan

Refinancing your car loan can lower monthly payments and reduce interest rates, improving cash flow and saving money over time. However, it may extend the loan term, resulting in higher total interest paid and potential fees, which could negate short-term savings. Evaluating credit scores and lender offers is essential to ensure refinancing aligns with financial goals and provides genuine benefits.

Costs Involved: Lease Buyout vs Refinance

Lease buyout costs typically include a predetermined residual value, purchase option fees, taxes, and potential repair charges, making the upfront expense higher compared to refinancing. Refinancing usually involves interest rates, loan origination fees, and closing costs, which can be spread out over the loan term to reduce immediate financial burden. Understanding the total cost of ownership, including interest accumulation for refinancing versus lump-sum payments for lease buyouts, is crucial for informed financial decisions.

Eligibility Requirements for Buyout and Refinance

Eligibility requirements for a lease buyout typically include the lessee having fulfilled all lease payments and maintaining the vehicle in good condition, with no outstanding penalties or fees. Refinance eligibility generally requires a strong credit score, proof of stable income, and a current loan balance that justifies refinancing costs. Both options often demand thorough financial documentation, but refinance may offer more flexibility in terms and interest rates compared to lease buyout.

Impact on Monthly Payments and Interest Rates

Lease buyout typically results in higher monthly payments compared to refinancing, as it converts remaining lease obligations into a loan with less favorable interest rates. Refinancing offers the opportunity to secure lower interest rates, thereby reducing monthly payments and overall loan costs. Borrowers aiming to minimize monthly expenses and interest rates should consider refinancing over a lease buyout for better financial terms.

When Should You Choose Buyout Over Refinance?

Choosing a lease buyout over refinance makes sense when the vehicle's lease is near its end, and you want to avoid potential lease termination fees or mileage penalties. A buyout is advantageous if the buyout price is lower than the car's current market value, allowing you to gain equity rather than extending debt. Opt for refinancing if you seek lower monthly payments across a longer loan term or better interest rates while keeping ownership flexible.

Making the Right Choice: Which Option Suits You Best?

Choosing between a lease buyout and refinancing depends on your financial goals and vehicle ownership preferences. Lease buyout offers full ownership by paying the residual value, ideal if you plan to keep the vehicle long-term with no monthly payments after purchase. Refinancing reduces monthly loan payments or interest rates on an existing car loan, suitable for those wanting to maintain ownership but improve cash flow and loan terms.

Lease Buyout vs Refinance Infographic

cardiffo.com

cardiffo.com