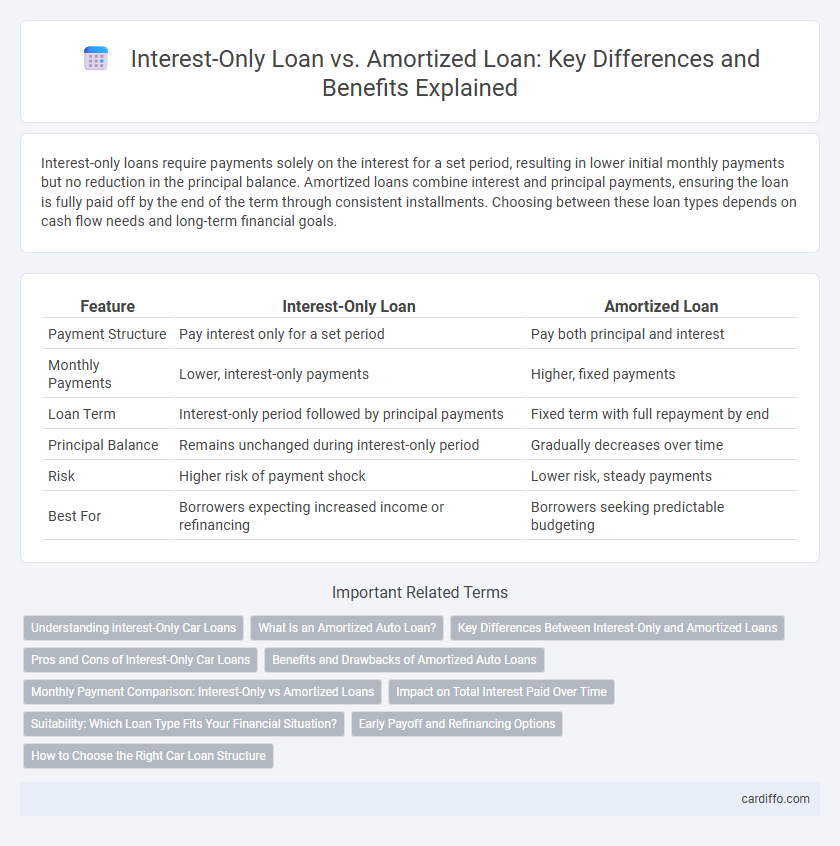

Interest-only loans require payments solely on the interest for a set period, resulting in lower initial monthly payments but no reduction in the principal balance. Amortized loans combine interest and principal payments, ensuring the loan is fully paid off by the end of the term through consistent installments. Choosing between these loan types depends on cash flow needs and long-term financial goals.

Table of Comparison

| Feature | Interest-Only Loan | Amortized Loan |

|---|---|---|

| Payment Structure | Pay interest only for a set period | Pay both principal and interest |

| Monthly Payments | Lower, interest-only payments | Higher, fixed payments |

| Loan Term | Interest-only period followed by principal payments | Fixed term with full repayment by end |

| Principal Balance | Remains unchanged during interest-only period | Gradually decreases over time |

| Risk | Higher risk of payment shock | Lower risk, steady payments |

| Best For | Borrowers expecting increased income or refinancing | Borrowers seeking predictable budgeting |

Understanding Interest-Only Car Loans

Interest-only car loans require borrowers to pay only the interest component for a set period, typically 3 to 5 years, resulting in lower monthly payments initially. After the interest-only period ends, payments increase significantly as the principal repayment begins, often leading to higher overall costs compared to amortized loans. Amortized loans spread principal and interest payments evenly over the loan term, ensuring consistent payments and gradual equity buildup in the vehicle.

What Is an Amortized Auto Loan?

An amortized auto loan requires monthly payments that cover both principal and interest, ensuring the loan balance decreases over time until fully paid off by the end of the term. This structured repayment schedule provides predictable installments, making budgeting easier for borrowers. Unlike interest-only loans, amortized loans build equity in the vehicle with each payment.

Key Differences Between Interest-Only and Amortized Loans

Interest-only loans require payments solely on the interest for a set period, resulting in lower initial monthly payments but no principal reduction during that time. Amortized loans combine interest and principal payments throughout the loan term, ensuring the loan balance decreases with each payment until fully paid off. The key difference lies in principal repayment timing, affecting overall cost, loan duration, and payment stability.

Pros and Cons of Interest-Only Car Loans

Interest-only car loans offer lower initial monthly payments, improving short-term cash flow and affordability for borrowers who anticipate increased income later. However, these loans do not reduce the principal balance during the interest-only period, leading to higher payments once the amortization phase begins and potentially increased overall interest costs. Borrowers risk owing more than the car's value if the vehicle depreciates faster than expected, making interest-only loans less suitable for long-term financing or those seeking equity buildup.

Benefits and Drawbacks of Amortized Auto Loans

Amortized auto loans provide predictable monthly payments that cover both principal and interest, helping borrowers build equity steadily over the loan term. These loans typically have higher initial payments than interest-only options but reduce total interest paid over time, lowering overall borrowing costs. However, the higher monthly commitment may strain budgets compared to interest-only loans, which offer lower payments initially but risk larger equity gaps later.

Monthly Payment Comparison: Interest-Only vs Amortized Loans

Interest-only loans feature lower initial monthly payments since borrowers pay only the interest, avoiding principal reduction during the interest-only period. Amortized loans require higher monthly payments that combine principal and interest, gradually reducing the loan balance over time. Comparing monthly payments, interest-only loans offer short-term affordability, whereas amortized loans ensure steady equity buildup and predictable repayment schedules.

Impact on Total Interest Paid Over Time

Interest-only loans require payments only on the interest for a set period, resulting in lower initial monthly costs but often leading to higher total interest paid over the life of the loan. Amortized loans combine principal and interest payments from the start, gradually reducing the principal balance, which minimizes total interest paid and accelerates equity buildup. Borrowers seeking long-term cost efficiency typically benefit more from amortized loans due to their structured reduction of both interest and principal.

Suitability: Which Loan Type Fits Your Financial Situation?

Interest-only loans suit borrowers with fluctuating income or those expecting increased earnings, offering lower initial payments and cash flow flexibility. Amortized loans fit individuals seeking predictable monthly payments and gradual principal reduction, providing equity buildup and long-term financial stability. Assess income consistency, financial goals, and risk tolerance to determine the optimal loan type for your financial situation.

Early Payoff and Refinancing Options

Interest-only loans offer lower initial payments by requiring borrowers to pay only interest for a set period, which can simplify early payoff but may result in higher principal balances if not managed carefully. Amortized loans combine principal and interest payments, reducing the loan balance over time and making early payoff more straightforward without a balloon payment. Refinancing options are typically more flexible with amortized loans due to the steady reduction in principal, while interest-only loans may face stricter refinancing criteria depending on the remaining principal and market conditions.

How to Choose the Right Car Loan Structure

Choosing the right car loan structure depends on your financial goals and cash flow stability. Interest-only loans offer lower initial payments, making them suitable for short-term budgeting flexibility, while amortized loans build equity steadily through combined principal and interest payments. Assess your ability to manage monthly payments and long-term costs to determine which loan aligns best with your financial situation and vehicle ownership plans.

Interest-Only Loan vs Amortized Loan Infographic

cardiffo.com

cardiffo.com