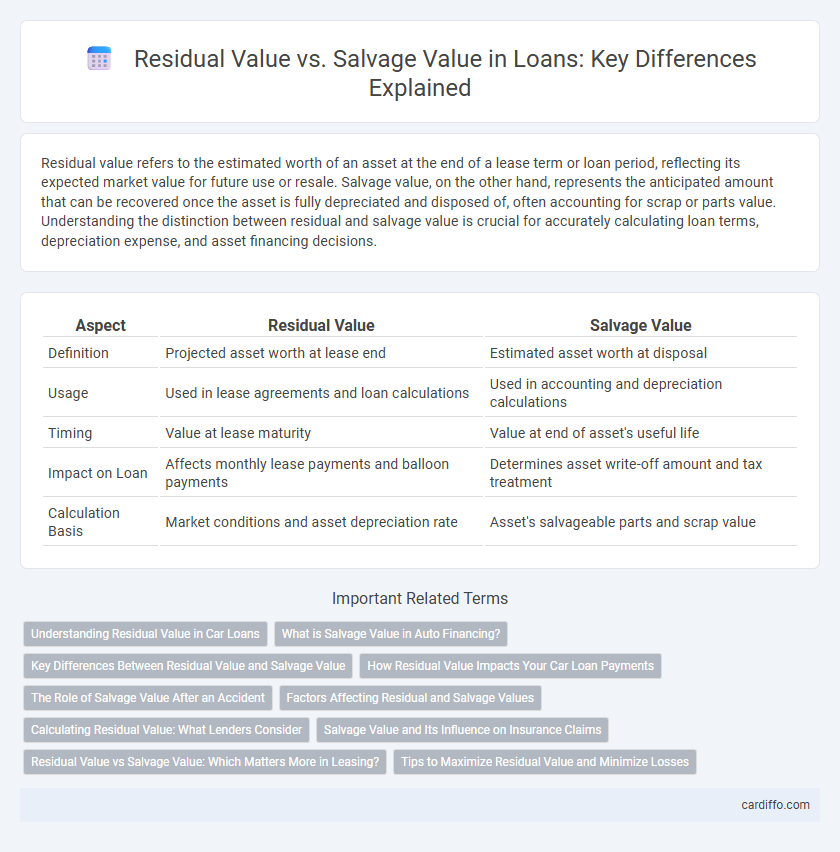

Residual value refers to the estimated worth of an asset at the end of a lease term or loan period, reflecting its expected market value for future use or resale. Salvage value, on the other hand, represents the anticipated amount that can be recovered once the asset is fully depreciated and disposed of, often accounting for scrap or parts value. Understanding the distinction between residual and salvage value is crucial for accurately calculating loan terms, depreciation expense, and asset financing decisions.

Table of Comparison

| Aspect | Residual Value | Salvage Value |

|---|---|---|

| Definition | Projected asset worth at lease end | Estimated asset worth at disposal |

| Usage | Used in lease agreements and loan calculations | Used in accounting and depreciation calculations |

| Timing | Value at lease maturity | Value at end of asset's useful life |

| Impact on Loan | Affects monthly lease payments and balloon payments | Determines asset write-off amount and tax treatment |

| Calculation Basis | Market conditions and asset depreciation rate | Asset's salvageable parts and scrap value |

Understanding Residual Value in Car Loans

Residual value in car loans represents the estimated worth of a vehicle at the end of the lease period, directly impacting monthly payment calculations. This value is essential for lessees and lenders because it determines the depreciation cost factored into the lease agreement. Understanding the residual value helps borrowers make informed decisions about lease terms, buyout options, and total loan costs.

What is Salvage Value in Auto Financing?

Salvage value in auto financing refers to the estimated resale or trade-in value of a vehicle at the end of a loan or lease term, representing the expected worth after depreciation. Lenders use salvage value to calculate loan amounts and monthly payments, ensuring the borrower's residual risk is minimized. This value plays a crucial role in determining lease-end charges and buyout options for financed vehicles.

Key Differences Between Residual Value and Salvage Value

Residual value represents the estimated worth of an asset at the end of a lease term, influencing lease payments and buyout options. Salvage value refers to the expected resale or scrap value of an asset after its useful life for depreciation calculations. The key difference lies in residual value's role in lease agreements versus salvage value's function in accounting and asset disposal.

How Residual Value Impacts Your Car Loan Payments

Residual value directly affects your car loan payments by determining the depreciation amount lenders use to calculate monthly installments. A higher residual value lowers the financed amount, resulting in reduced monthly payments and less interest paid over the loan term. Understanding residual value can help borrowers choose lease or loan options that minimize total financing costs and improve affordability.

The Role of Salvage Value After an Accident

Salvage value refers to the estimated worth of a loaned asset after it has been damaged in an accident and deemed a total loss, influencing the lender's recovery amount. Residual value represents the anticipated asset worth at the end of a loan term under normal conditions, but salvage value specifically accounts for asset depreciation due to accident impact. Understanding salvage value is crucial for calculating loan balances, insurance claims, and determining the financial responsibility of borrowers post-accident.

Factors Affecting Residual and Salvage Values

Residual value and salvage value are influenced by factors such as asset age, condition, and market demand. Economic conditions, technological advancements, and depreciation methods also play critical roles in determining these values. Understanding these variables helps lenders and borrowers accurately assess loan security and asset worth.

Calculating Residual Value: What Lenders Consider

Lenders calculate residual value by estimating the expected market value of an asset at the end of a loan term, factoring in depreciation rates and projected usage. This residual value influences loan terms, as it impacts the borrower's monthly payments and the lender's risk exposure. Accurate assessment includes examining asset type, condition, and industry-specific depreciation trends to determine realistic residual values.

Salvage Value and Its Influence on Insurance Claims

Salvage value represents the estimated resale or scrap value of an asset at the end of its useful life, directly influencing insurance claim settlements by determining the recoverable amount post-loss. Insurers often factor the salvage value into claim payouts, reducing the compensation based on the residual worth of damaged or totaled collateral. Accurately assessing salvage value is essential for lenders and policyholders to ensure fair reimbursement and mitigate financial losses in loan agreements involving asset financing.

Residual Value vs Salvage Value: Which Matters More in Leasing?

Residual value represents the estimated worth of a leased asset at lease end, directly impacting monthly lease payments and total lease cost. Salvage value refers to the asset's expected resale value after its useful life, primarily used in accounting and depreciation calculations. In leasing, residual value matters more because it determines lease terms and influences lessee savings, while salvage value has less immediate effect on lease structure.

Tips to Maximize Residual Value and Minimize Losses

Maximizing residual value in loan agreements involves maintaining the asset's condition through regular upkeep and timely repairs to preserve its market appeal. Understanding market trends and choosing assets with strong demand helps minimize depreciation and increases end-of-lease buyout options. Negotiating favorable terms based on accurate residual value projections reduces financial losses and improves overall loan profitability.

Residual Value vs Salvage Value Infographic

cardiffo.com

cardiffo.com