A balloon payment loan involves smaller monthly payments with a large lump sum due at the end of the term, offering lower initial costs but requiring significant budgeting for the final payment. In contrast, a standard loan features consistent monthly payments that cover both principal and interest, providing predictable expenses and easier long-term financial planning. Choosing between the two depends on cash flow flexibility and risk tolerance regarding the large final payment.

Table of Comparison

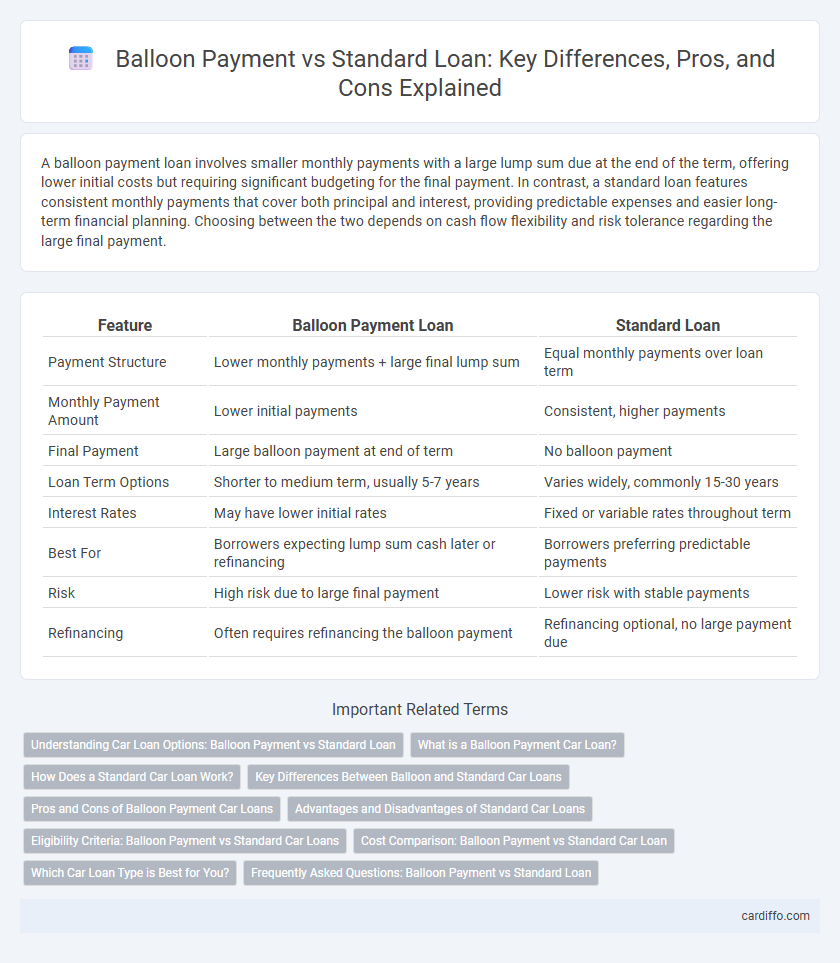

| Feature | Balloon Payment Loan | Standard Loan |

|---|---|---|

| Payment Structure | Lower monthly payments + large final lump sum | Equal monthly payments over loan term |

| Monthly Payment Amount | Lower initial payments | Consistent, higher payments |

| Final Payment | Large balloon payment at end of term | No balloon payment |

| Loan Term Options | Shorter to medium term, usually 5-7 years | Varies widely, commonly 15-30 years |

| Interest Rates | May have lower initial rates | Fixed or variable rates throughout term |

| Best For | Borrowers expecting lump sum cash later or refinancing | Borrowers preferring predictable payments |

| Risk | High risk due to large final payment | Lower risk with stable payments |

| Refinancing | Often requires refinancing the balloon payment | Refinancing optional, no large payment due |

Understanding Car Loan Options: Balloon Payment vs Standard Loan

Balloon payments require lower monthly installments with a large lump sum due at the end, making them suitable for borrowers anticipating higher future income or refinancing options. Standard loans spread payments evenly over the loan term, offering predictable monthly costs and full ownership once paid off. Choosing between these options depends on cash flow flexibility, financial goals, and the ability to manage end-of-term financial obligations.

What is a Balloon Payment Car Loan?

A balloon payment car loan features lower monthly installments by deferring a large lump-sum payment to the end of the loan term, unlike a standard loan where payments are evenly spread throughout. This final balloon payment allows borrowers to reduce initial payment amounts but requires planning for a substantial payoff or refinancing at the loan's conclusion. Balloon loans often appeal to buyers seeking lower short-term costs or expecting increased future income to cover the final payment.

How Does a Standard Car Loan Work?

A standard car loan requires fixed monthly payments over a predetermined term, typically ranging from 36 to 72 months, ensuring predictable budgeting for borrowers. Interest is calculated based on the loan principal, with each payment gradually reducing the outstanding balance until full repayment occurs by the end of the term. Unlike balloon loans, standard loans do not involve a large lump-sum payment at the end, offering steady equity build-up throughout the loan period.

Key Differences Between Balloon and Standard Car Loans

Balloon car loans feature lower monthly payments but require a large lump-sum payment at the end of the term, while standard car loans have consistent monthly payments that fully amortize the vehicle by loan maturity. Balloon loans often appeal to buyers seeking short-term affordability, whereas standard loans provide predictable budgeting without a substantial final payment. The risk of refinancing or selling the car to cover the balloon payment differentiates it significantly from the straightforward payoff structure of standard loans.

Pros and Cons of Balloon Payment Car Loans

Balloon payment car loans offer lower monthly payments by deferring a large lump-sum payment to the end of the loan term, making them attractive for buyers seeking short-term affordability or who plan to refinance. However, the significant final payment poses a financial risk if the borrower cannot secure funds or refinance, potentially leading to repossession or negative equity. Standard loans provide consistent monthly payments, eliminating large end-term balances, but often come with higher monthly costs and less flexibility in managing cash flow.

Advantages and Disadvantages of Standard Car Loans

Standard car loans offer fixed monthly payments and clear repayment schedules, making budgeting easier and providing predictable financial planning. However, they often involve higher monthly payments compared to balloon loans, potentially straining cash flow for some borrowers. While standard loans build equity steadily, they may not offer the flexibility of reduced payments early in the loan term like balloon payment options.

Eligibility Criteria: Balloon Payment vs Standard Car Loans

Balloon payment loans often require higher credit scores and stable income verification due to the significant lump sum due at the end, targeting borrowers with strong financial profiles. Standard car loans generally have more flexible eligibility criteria, making them accessible to a wider range of applicants including those with average credit. Lenders for balloon loans typically assess the borrower's ability to manage the final large payment, while standard loans focus on consistent monthly repayment capacity.

Cost Comparison: Balloon Payment vs Standard Car Loan

Balloon payments typically offer lower monthly installments compared to standard car loans, but they require a large lump sum at the end, increasing overall cost risk. Standard car loans maintain consistent monthly payments and evenly distribute interest, often resulting in higher monthly costs but avoiding large final payments. Borrowers should compare total repayment amounts and interest rates to accurately assess the cost-effectiveness between balloon and standard loans.

Which Car Loan Type is Best for You?

Balloon payment loans offer lower monthly payments with a large sum due at the end, ideal for buyers expecting future cash influx or refinancing options, while standard loans have consistent monthly payments, providing predictable budgeting. Assess your financial stability, expected income changes, and long-term ownership plans to determine which car loan type aligns best with your goals. Choosing the right loan impacts overall cost, cash flow management, and loan payoff strategy.

Frequently Asked Questions: Balloon Payment vs Standard Loan

Balloon payments are large, lump-sum payments due at the end of a loan term, often resulting in lower monthly payments compared to standard loans that have fixed installments throughout the loan period. Borrowers typically choose balloon payment loans to reduce initial monthly expenses, but they must be prepared for the sizable final repayment or refinance options. Standard loans provide predictable repayment schedules and steady equity build-up, making them preferable for those seeking financial stability without large end-of-term obligations.

Balloon Payment vs Standard Loan Infographic

cardiffo.com

cardiffo.com