Choosing early payoff over standard payoff can significantly reduce the total interest paid on a loan, saving money over time. Early payoff allows borrowers to become debt-free faster, improving financial flexibility and creditworthiness. However, standard payoff schedules provide predictable monthly payments and may include penalties for early repayment, so it's important to review loan terms carefully before deciding.

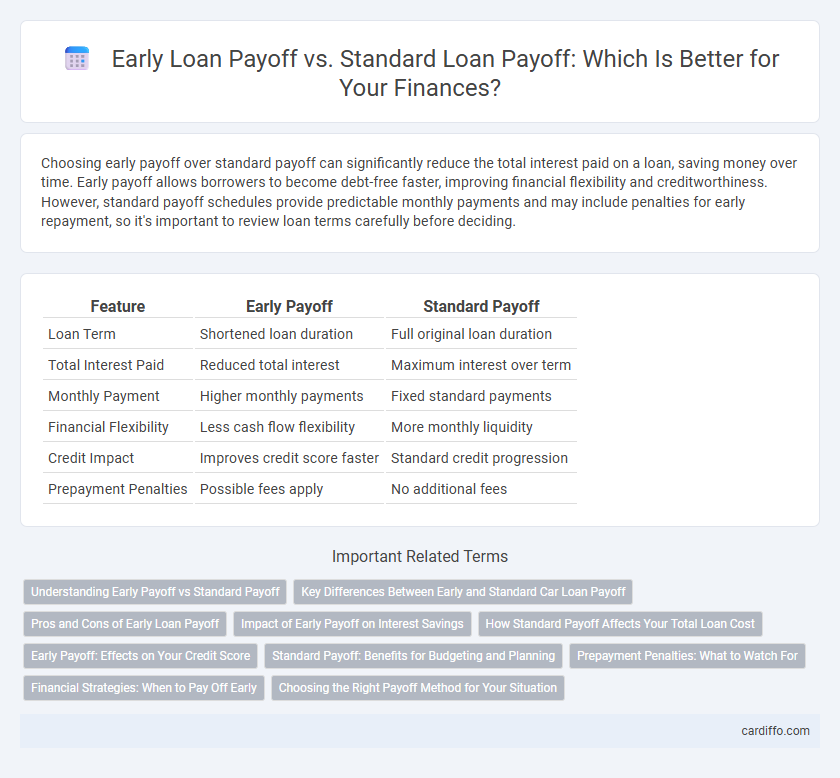

Table of Comparison

| Feature | Early Payoff | Standard Payoff |

|---|---|---|

| Loan Term | Shortened loan duration | Full original loan duration |

| Total Interest Paid | Reduced total interest | Maximum interest over term |

| Monthly Payment | Higher monthly payments | Fixed standard payments |

| Financial Flexibility | Less cash flow flexibility | More monthly liquidity |

| Credit Impact | Improves credit score faster | Standard credit progression |

| Prepayment Penalties | Possible fees apply | No additional fees |

Understanding Early Payoff vs Standard Payoff

Early payoff involves repaying a loan before the agreed term, which can reduce total interest paid and shorten the debt duration. Standard payoff follows the original loan schedule, maintaining consistent monthly payments until the balance reaches zero. Understanding the difference helps borrowers choose strategies that optimize financial benefits and minimize costs.

Key Differences Between Early and Standard Car Loan Payoff

Early car loan payoff reduces total interest paid by shortening the loan term, leading to significant savings over time. Standard payoff follows the scheduled monthly payments until the loan fully matures, resulting in higher interest costs. Early payoff may incur prepayment penalties depending on lender policies, unlike standard payoff which avoids such fees.

Pros and Cons of Early Loan Payoff

Early loan payoff reduces overall interest expenses and frees up monthly cash flow for other financial goals, offering significant long-term savings. However, it can limit liquidity and may include prepayment penalties imposed by some lenders, which could offset financial benefits. Balancing these pros and cons depends on individual financial stability, interest rates, and loan terms.

Impact of Early Payoff on Interest Savings

Early payoff of a loan significantly reduces the total interest paid by decreasing the loan's principal balance faster, which lowers the amount of accrued interest over time. Borrowers who make early payments cut down the loan term and save thousands of dollars in interest compared to following the standard payoff schedule. Interest savings grow larger with loans that have higher interest rates and longer original terms, making early payoff a financially beneficial strategy.

How Standard Payoff Affects Your Total Loan Cost

Standard payoff schedules spread loan payments over the full term, resulting in higher total interest costs compared to early payoff options. By making only the minimum monthly payments, borrowers accrue more interest over time, increasing the overall loan expense. Choosing a standard payoff plan prioritizes cash flow management but typically leads to greater total loan cost.

Early Payoff: Effects on Your Credit Score

Early payoff of a loan can positively impact your credit score by reducing your overall debt-to-credit ratio and demonstrating responsible financial behavior to lenders. Paying off a loan early may result in fewer interest payments and a shorter credit utilization period, which helps improve your credit profile. However, some lenders might report the account as paid off early, potentially affecting the length of your credit history, a factor in credit scoring models.

Standard Payoff: Benefits for Budgeting and Planning

Standard payoff schedules provide predictability in monthly loan payments, making it easier to manage household budgets and avoid unexpected financial strain. Fixed repayment timelines help borrowers develop disciplined saving habits and accurately forecast future expenses. This consistent approach supports long-term financial planning and reduces the risk of late payments or penalties.

Prepayment Penalties: What to Watch For

Prepayment penalties are fees that lenders may charge when borrowers pay off their loans early, impacting overall savings and financial planning. Understanding the specific terms in the loan agreement is crucial, as these penalties can significantly reduce the benefits of early payoff by increasing costs. Borrowers should carefully evaluate the presence and conditions of prepayment penalties to make informed decisions between early payoff and standard payoff strategies.

Financial Strategies: When to Pay Off Early

Early payoff of a loan reduces total interest paid, freeing up cash flow for other investments and improving credit score by lowering debt-to-income ratio. Standard payoff maintains scheduled payments, preserving liquidity and allowing potential investment of extra funds for higher returns than loan interest. Consider financial goals, interest rates, and investment opportunities to determine if early payoff aligns with your long-term strategy.

Choosing the Right Payoff Method for Your Situation

Selecting the appropriate loan payoff method hinges on factors like interest rates, loan terms, and personal financial goals. Early payoff can reduce total interest paid and shorten loan duration, while standard payoff maintains consistent payments and budget stability. Analyzing your cash flow, potential penalties, and long-term savings helps determine the optimal approach for your financial situation.

Early Payoff vs Standard Payoff Infographic

cardiffo.com

cardiffo.com