Subprime loans carry higher interest rates and stricter terms due to borrowers' lower credit scores and increased risk, contrasting with prime loans that offer competitive rates and favorable conditions to individuals with strong credit histories. Lenders assess factors like credit score, income stability, and debt-to-income ratio to determine eligibility for prime or subprime loans, impacting overall borrowing costs. Understanding these distinctions helps borrowers make informed decisions and manage financial commitments more effectively.

Table of Comparison

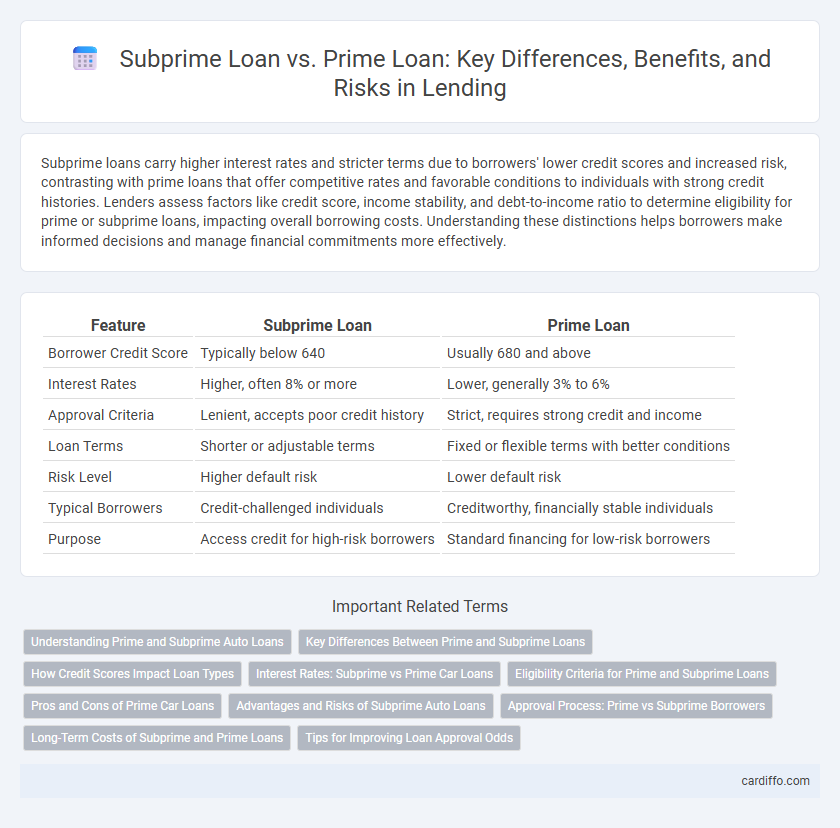

| Feature | Subprime Loan | Prime Loan |

|---|---|---|

| Borrower Credit Score | Typically below 640 | Usually 680 and above |

| Interest Rates | Higher, often 8% or more | Lower, generally 3% to 6% |

| Approval Criteria | Lenient, accepts poor credit history | Strict, requires strong credit and income |

| Loan Terms | Shorter or adjustable terms | Fixed or flexible terms with better conditions |

| Risk Level | Higher default risk | Lower default risk |

| Typical Borrowers | Credit-challenged individuals | Creditworthy, financially stable individuals |

| Purpose | Access credit for high-risk borrowers | Standard financing for low-risk borrowers |

Understanding Prime and Subprime Auto Loans

Prime auto loans target borrowers with strong credit scores, typically above 700, offering lower interest rates and favorable terms that reduce overall borrowing costs. Subprime auto loans serve individuals with credit scores below 620, often resulting in higher interest rates and stricter lending conditions to offset increased default risk. Understanding the distinction between prime and subprime auto loans helps consumers select financing options aligned with their credit profiles and financial goals.

Key Differences Between Prime and Subprime Loans

Prime loans typically offer lower interest rates and better terms due to borrowers' strong credit history and financial stability, whereas subprime loans have higher interest rates reflecting increased risk from borrowers with poor credit scores. Subprime loans often include more stringent repayment terms and higher fees to offset the lender's risk, while prime loans provide more favorable conditions and easier approval processes. The key differences lie in borrower creditworthiness, interest costs, loan terms, and the associated risk profile for lenders.

How Credit Scores Impact Loan Types

Credit scores critically determine whether borrowers qualify for subprime or prime loans, with scores above 700 typically attracting prime loan offers featuring lower interest rates and favorable terms. Subprime loans target individuals with credit scores below 650, resulting in higher interest rates and increased fees due to elevated default risk. Lenders utilize credit score thresholds to assess risk and customize loan products, directly impacting borrowing costs and approval chances.

Interest Rates: Subprime vs Prime Car Loans

Subprime car loans typically carry significantly higher interest rates compared to prime car loans, reflecting the increased risk lenders associate with borrowers who have lower credit scores. Interest rates on subprime loans can exceed 15% or more, whereas prime auto loans often have rates below 6%, promoting more affordable monthly payments. Lenders use these differentiated interest rates to manage default risk while providing access to financing for varying credit profiles.

Eligibility Criteria for Prime and Subprime Loans

Prime loans require borrowers to have strong credit scores typically above 670, stable income, and low debt-to-income ratios, reflecting a reliable repayment capacity. Subprime loans target borrowers with credit scores below 670, often including those with past delinquencies, bankruptcies, or limited credit history, resulting in higher risk for lenders. Eligibility for prime loans favors financial stability and creditworthiness, while subprime loans accommodate higher risk profiles, usually accompanied by higher interest rates.

Pros and Cons of Prime Car Loans

Prime car loans offer lower interest rates and better loan terms due to higher creditworthiness requirements, making them more affordable and accessible for borrowers with strong credit scores. These loans typically have fewer fees and longer repayment periods, reducing monthly payments and financial stress. However, prime car loans may be inaccessible to individuals with poor or limited credit history, limiting options for some buyers.

Advantages and Risks of Subprime Auto Loans

Subprime auto loans offer access to vehicle financing for borrowers with lower credit scores, enabling car ownership despite limited credit history. These loans typically come with higher interest rates and fees, reflecting the increased risk lenders assume, which can lead to higher monthly payments and potential difficulty in repayment. Borrowers should carefully evaluate the loan terms to avoid the risk of default and repossession associated with subprime lending.

Approval Process: Prime vs Subprime Borrowers

Prime loan approval processes prioritize borrowers with strong credit scores, stable income, and low debt-to-income ratios, leading to faster approvals and lower interest rates. Subprime loan approval involves higher scrutiny of financial history, often requiring additional documentation and resulting in longer processing times and higher interest rates. Lenders mitigate risks for subprime borrowers by imposing stricter terms and more rigorous eligibility criteria compared to prime loans.

Long-Term Costs of Subprime and Prime Loans

Subprime loans typically carry higher interest rates and fees compared to prime loans, resulting in substantially greater long-term costs for borrowers. Over the life of the loan, these elevated rates increase the total repayment amount, often exceeding the initial principal by a significant margin. Prime loans offer lower interest rates and better terms, minimizing overall financial burden and enabling more affordable repayment plans.

Tips for Improving Loan Approval Odds

Maintaining a strong credit score above 700 significantly boosts approval chances for prime loans with lower interest rates and better terms. Reducing existing debt-to-income ratio below 36% demonstrates financial stability favored by lenders for both prime and subprime loans. Consistently verifying accurate credit reports and addressing errors can improve creditworthiness, increasing the likelihood of loan approval.

Subprime Loan vs Prime Loan Infographic

cardiffo.com

cardiffo.com