Recourse loans allow lenders to claim the borrower's other assets if the collateral does not cover the outstanding debt, increasing the borrower's personal liability. Non-recourse loans limit the lender's recovery strictly to the collateral, offering borrowers protection from further financial obligation beyond the secured asset. Understanding the differences in risk and liability between recourse and non-recourse loans is crucial for making informed borrowing decisions.

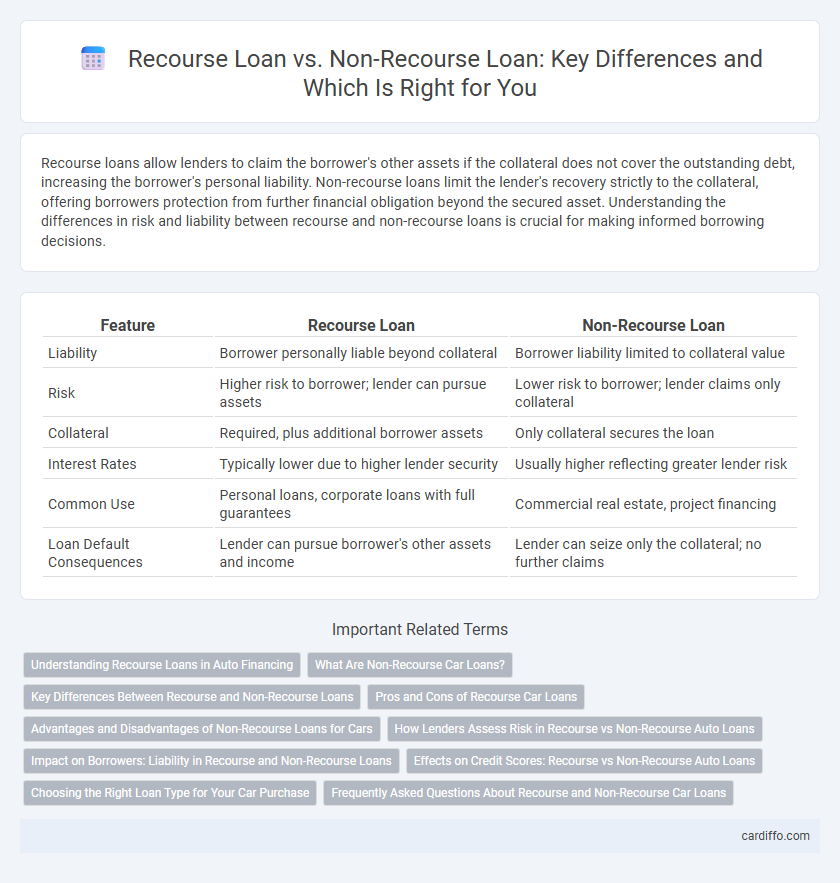

Table of Comparison

| Feature | Recourse Loan | Non-Recourse Loan |

|---|---|---|

| Liability | Borrower personally liable beyond collateral | Borrower liability limited to collateral value |

| Risk | Higher risk to borrower; lender can pursue assets | Lower risk to borrower; lender claims only collateral |

| Collateral | Required, plus additional borrower assets | Only collateral secures the loan |

| Interest Rates | Typically lower due to higher lender security | Usually higher reflecting greater lender risk |

| Common Use | Personal loans, corporate loans with full guarantees | Commercial real estate, project financing |

| Loan Default Consequences | Lender can pursue borrower's other assets and income | Lender can seize only the collateral; no further claims |

Understanding Recourse Loans in Auto Financing

Recourse loans in auto financing allow lenders to pursue the borrower's other assets if the vehicle's value does not cover the outstanding loan balance after repossession. This type of loan shifts more risk to the borrower, as they remain personally liable for the full debt amount beyond the collateral. Understanding recourse loans helps borrowers evaluate the financial obligations and potential consequences of defaulting on an auto loan.

What Are Non-Recourse Car Loans?

Non-recourse car loans allow borrowers to finance a vehicle without personal liability beyond the collateral, meaning the lender's sole remedy in case of default is repossessing the car. These loans protect the borrower's assets from deficiency judgments, limiting risk to the value of the vehicle. Typically, non-recourse loans come with higher interest rates or stricter qualifications due to increased lender risk.

Key Differences Between Recourse and Non-Recourse Loans

Recourse loans hold borrowers personally liable, allowing lenders to pursue additional assets beyond the collateral if the loan defaults. Non-recourse loans limit lender claims strictly to the collateral, protecting borrowers' other assets from seizure. The key difference lies in creditor recovery rights, influencing risk exposure and borrower liability.

Pros and Cons of Recourse Car Loans

Recourse car loans allow lenders to pursue the borrower's other assets if the collateral does not cover the outstanding debt, providing greater security for lenders and often resulting in lower interest rates for borrowers. Borrowers benefit from potentially better loan terms but face the risk of losing additional personal assets beyond the vehicle in case of default. However, this increased risk can create financial strain, making recourse loans less attractive for those with limited assets or uncertain financial stability.

Advantages and Disadvantages of Non-Recourse Loans for Cars

Non-recourse loans for cars limit the borrower's liability to the vehicle itself, protecting personal assets from repossession beyond the car in case of default. These loans often have higher interest rates and stricter qualification criteria due to increased lender risk. Borrowers benefit from reduced financial exposure, but may face less favorable loan terms compared to recourse loans.

How Lenders Assess Risk in Recourse vs Non-Recourse Auto Loans

Lenders assess risk in recourse auto loans by considering the borrower's overall creditworthiness, as they can pursue other assets if the loan balance exceeds the vehicle's value after repossession. In non-recourse auto loans, lenders focus primarily on the collateral's market value since their recovery is limited to the repossessed vehicle, increasing exposure to depreciation and resale risks. Risk assessment models for recourse loans heavily weigh debt-to-income ratios and credit scores, while non-recourse evaluations emphasize collateral appraisal and residual values.

Impact on Borrowers: Liability in Recourse and Non-Recourse Loans

Recourse loans hold borrowers personally liable, allowing lenders to pursue other assets beyond the collateral if the loan defaults, increasing financial risk. Non-recourse loans limit the lender's claim strictly to the collateral pledged, protecting the borrower's other assets from seizure. This distinct liability difference influences borrower risk management and loan approval criteria.

Effects on Credit Scores: Recourse vs Non-Recourse Auto Loans

Recourse auto loans allow lenders to pursue the borrower's other assets if the collateral is insufficient, which increases the risk of adverse credit score impacts if payments are missed. Non-recourse auto loans limit lender recovery strictly to the collateral, typically protecting the borrower's credit score from additional damage beyond repossession. Understanding these differences is crucial for borrowers aiming to manage credit risk and maintain a favorable credit history.

Choosing the Right Loan Type for Your Car Purchase

Recourse loans require borrowers to be personally liable, meaning the lender can pursue other assets if the car's value doesn't cover the debt, offering lower interest rates but higher risk. Non-recourse loans limit the lender's claim to the car itself, providing protection to borrowers but often with higher interest rates and stricter qualification criteria. Evaluating your financial stability, risk tolerance, and long-term plans helps determine whether a recourse or non-recourse car loan aligns best with your purchase goals.

Frequently Asked Questions About Recourse and Non-Recourse Car Loans

Recourse car loans allow lenders to pursue the borrower's other assets if the collateral's value does not cover the outstanding debt, while non-recourse car loans limit the lender's recovery strictly to the vehicle used as collateral. Common FAQs involve understanding which type offers better protection, the implications of default, and how each impacts credit scores and financial liability. Borrowers should assess their risk tolerance and financial situation when choosing between recourse and non-recourse car loans, as terms and consequences differ significantly.

Recourse Loan vs Non-Recourse Loan Infographic

cardiffo.com

cardiffo.com