Lease buyout loans allow consumers to finance the purchase of their leased vehicle at the end of the lease term, often offering lower interest rates and streamlined approval since the car's value and condition are well-documented. New car loans typically involve higher interest rates and longer loan terms, reflecting the full retail price and potential depreciation risk associated with brand-new vehicles. Choosing between a lease buyout loan and a new car loan depends on factors such as budget, interest rates, and how much you value keeping a familiar, already-driven vehicle versus owning a brand-new model.

Table of Comparison

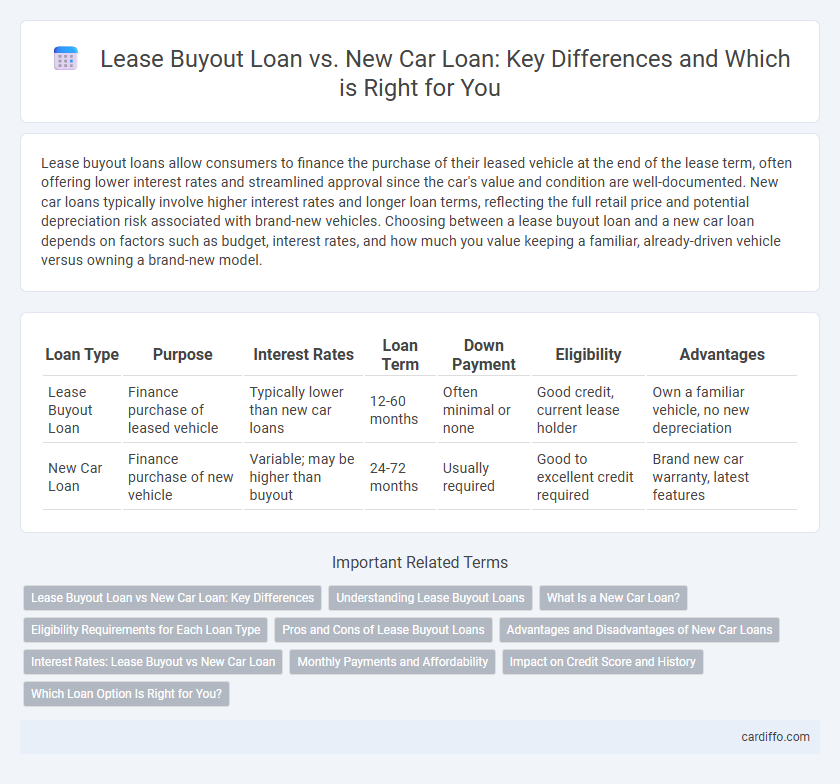

| Loan Type | Purpose | Interest Rates | Loan Term | Down Payment | Eligibility | Advantages |

|---|---|---|---|---|---|---|

| Lease Buyout Loan | Finance purchase of leased vehicle | Typically lower than new car loans | 12-60 months | Often minimal or none | Good credit, current lease holder | Own a familiar vehicle, no new depreciation |

| New Car Loan | Finance purchase of new vehicle | Variable; may be higher than buyout | 24-72 months | Usually required | Good to excellent credit required | Brand new car warranty, latest features |

Lease Buyout Loan vs New Car Loan: Key Differences

Lease buyout loans allow borrowers to purchase their leased vehicle at the end of the lease term, often with lower interest rates and smaller loan amounts compared to new car loans. New car loans finance the purchase of a brand-new vehicle, typically involving higher loan amounts and potentially longer repayment terms. Understanding the differences in interest rates, loan duration, and total cost helps consumers decide between buying out a lease or financing a new car purchase.

Understanding Lease Buyout Loans

Lease buyout loans enable lessees to purchase their leased vehicle at the end of the lease term by financing the residual value, often resulting in lower interest rates compared to new car loans. These loans provide an alternative to vehicle replacement, allowing owners to keep a known car with potentially lower depreciation costs. Understanding lease buyout loan terms, fees, and eligibility criteria is crucial to making an informed decision between buying out a lease or securing a new car loan.

What Is a New Car Loan?

A new car loan is a type of financing specifically designed to help buyers purchase a brand-new vehicle directly from a dealership. This loan typically offers lower interest rates compared to used car loans due to the car's initial value and manufacturer incentives. Borrowers repay the loan in fixed monthly installments over a term that usually ranges from 36 to 72 months, with the vehicle serving as collateral.

Eligibility Requirements for Each Loan Type

Lease buyout loans typically require the borrower to have a lease agreement with a buyout option, a good to excellent credit score often above 700, and proof of income to demonstrate repayment ability. New car loans generally demand a strong credit history, steady income verification, and may require a down payment depending on the lender's criteria and the vehicle's price. Both loan types commonly require a debt-to-income ratio under 45% to qualify, but lease buyout loans specifically need the physical lease buyout terms and vehicle condition appraisal as part of eligibility.

Pros and Cons of Lease Buyout Loans

Lease buyout loans allow drivers to purchase their leased vehicle at the end of the lease term, often with the benefit of a pre-negotiated buyout price that can be lower than market value, providing financial predictability and potential savings. However, lease buyout loans may come with higher interest rates compared to new car loans, and the vehicle's condition or mileage could impact its residual value, possibly limiting the overall cost-effectiveness. Unlike new car loans that finance a brand-new vehicle with full warranty and latest features, lease buyout loans involve used cars that might lack warranty coverage and could entail higher maintenance costs.

Advantages and Disadvantages of New Car Loans

New car loans offer the advantage of full ownership with flexible financing terms, often featuring lower interest rates due to manufacturer incentives, which helps preserve credit scores and build equity. However, they tend to come with higher monthly payments compared to lease buyout loans and incur accelerated depreciation costs, which reduce the vehicle's resale value over time. Borrowers should consider the trade-off between immediate ownership benefits and long-term financial impacts when choosing new car loans.

Interest Rates: Lease Buyout vs New Car Loan

Lease buyout loans typically offer lower interest rates compared to new car loans due to the vehicle's depreciated value and shorter loan terms. New car loans often come with higher rates influenced by the car's initial price, credit score requirements, and longer repayment periods. Understanding these rate differences can help borrowers optimize financing costs when deciding between buying out a lease or purchasing a new vehicle.

Monthly Payments and Affordability

Lease buyout loans typically offer lower monthly payments compared to new car loans since they finance the remaining value of a used vehicle rather than the full price of a new car. Affordability improves with lease buyout loans due to reduced interest rates and shorter loan terms, making monthly installments more manageable for budget-conscious borrowers. Conversely, new car loans often result in higher monthly payments but provide access to the latest vehicle models with full warranty coverage.

Impact on Credit Score and History

A Lease Buyout Loan allows borrowers to purchase their leased vehicle, which can positively impact credit history by adding a new installment loan and demonstrating consistent payments. New Car Loans also affect credit scores by increasing debt obligations, but timely repayments help build credit history and improve scores over time. Both loan types influence credit utilization and payment history, key factors in credit scoring models used by FICO and VantageScore.

Which Loan Option Is Right for You?

Choosing between a lease buyout loan and a new car loan depends on your financial goals and vehicle preferences. A lease buyout loan lets you purchase the car you've been leasing, often at a lower cost than buying new, while a new car loan finances a brand-new vehicle with full warranties and the latest features. Evaluate factors like monthly payments, interest rates, vehicle condition, and long-term value to determine which loan option aligns best with your budget and driving needs.

Lease Buyout Loan vs New Car Loan Infographic

cardiffo.com

cardiffo.com