GAP insurance loans offer crucial protection by covering the difference between your car's actual cash value and the outstanding loan balance in case of total loss, preventing unexpected financial strain. Without GAP insurance, borrowers remain liable for any loan balance exceeding the vehicle's depreciated value, which can lead to significant out-of-pocket expenses. Choosing a GAP insurance loan ensures peace of mind and financial security during unforeseen accidents or theft.

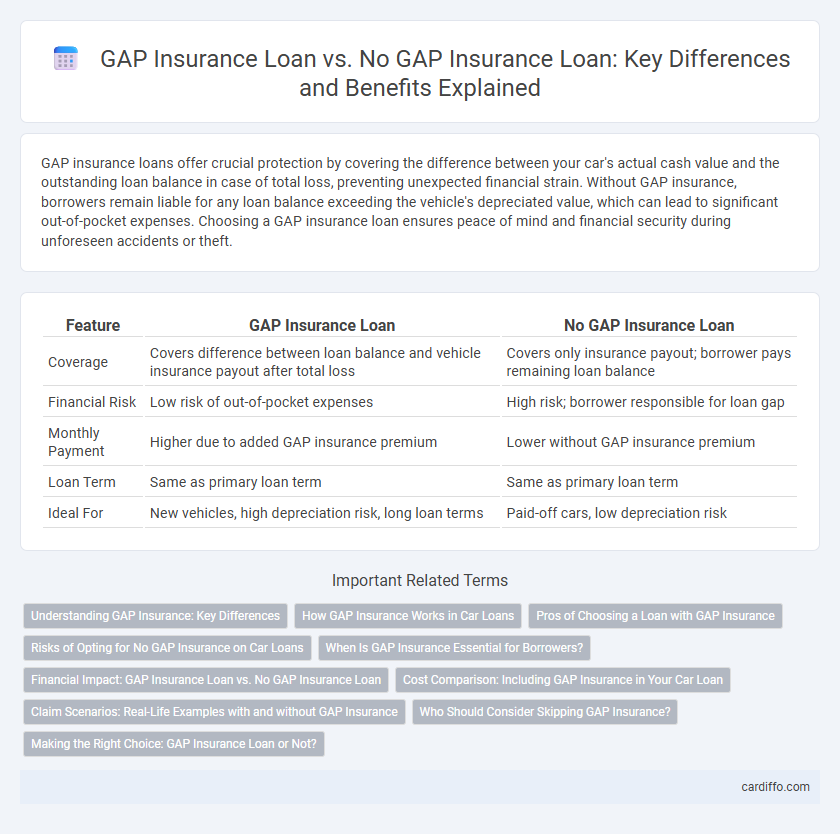

Table of Comparison

| Feature | GAP Insurance Loan | No GAP Insurance Loan |

|---|---|---|

| Coverage | Covers difference between loan balance and vehicle insurance payout after total loss | Covers only insurance payout; borrower pays remaining loan balance |

| Financial Risk | Low risk of out-of-pocket expenses | High risk; borrower responsible for loan gap |

| Monthly Payment | Higher due to added GAP insurance premium | Lower without GAP insurance premium |

| Loan Term | Same as primary loan term | Same as primary loan term |

| Ideal For | New vehicles, high depreciation risk, long loan terms | Paid-off cars, low depreciation risk |

Understanding GAP Insurance: Key Differences

GAP insurance covers the difference between the outstanding loan balance and the vehicle's actual cash value in case of total loss or theft, protecting borrowers from owing more than the car is worth. Loans with GAP insurance typically offer better financial security, reducing the risk of a significant financial burden after an accident. In contrast, loans without GAP insurance leave borrowers responsible for the full loan balance, potentially resulting in higher out-of-pocket expenses.

How GAP Insurance Works in Car Loans

GAP insurance covers the difference between a car loan balance and the vehicle's actual cash value if the car is totaled or stolen, protecting borrowers from owing more than the car's worth. Loans with GAP insurance typically result in lower financial risk for borrowers by covering the "gap" that standard auto insurance does not. In contrast, loans without GAP insurance leave borrowers responsible for paying the remaining loan balance out of pocket if total loss occurs.

Pros of Choosing a Loan with GAP Insurance

Choosing a loan with GAP insurance provides critical financial protection by covering the difference between the vehicle's actual cash value and the outstanding loan balance in case of total loss or theft. This insurance minimizes out-of-pocket expenses, reducing the risk of owing money on a car loan for a vehicle no longer in use. GAP insurance loans enhance peace of mind by safeguarding borrowers against depreciation and unforeseen accidents that standard auto insurance might not fully cover.

Risks of Opting for No GAP Insurance on Car Loans

Opting for a no GAP insurance loan exposes borrowers to significant financial risks in the event of a total car loss, as standard auto insurance often covers only the current market value, which may be significantly less than the outstanding loan balance. Without GAP insurance, the borrower is responsible for paying the difference between the insurance payout and the remaining auto loan debt, potentially leading to substantial out-of-pocket expenses. This risk is particularly high during the early years of a car loan when depreciation rates cause loan balances to exceed vehicle value.

When Is GAP Insurance Essential for Borrowers?

GAP insurance is essential for borrowers who finance or lease vehicles with high depreciation rates or minimal down payments, as it covers the difference between the car's actual cash value and the loan balance in case of total loss. Borrowers with long loan terms or negative equity benefit significantly from GAP insurance, protecting them from costly out-of-pocket expenses after insurance claims. Those with large down payments or short-term loans might not require GAP insurance, making it crucial to assess individual loan terms and vehicle value depreciation before opting in.

Financial Impact: GAP Insurance Loan vs. No GAP Insurance Loan

GAP insurance loans significantly reduce financial exposure by covering the difference between the loan balance and the vehicle's actual cash value in case of total loss, minimizing out-of-pocket expenses. Without GAP insurance, borrowers risk owing the full remaining loan balance even if the car's market value is lower, leading to potential financial hardship. Studies show that GAP insurance can save borrowers thousands of dollars in depreciation-related losses following accidents or theft.

Cost Comparison: Including GAP Insurance in Your Car Loan

Including GAP insurance in your car loan increases the overall loan cost but provides crucial protection by covering the difference between your car's actual cash value and the loan balance in case of total loss. Without GAP insurance, borrowers may face significant out-of-pocket expenses if their vehicle is totaled or stolen, as standard auto insurance typically covers only the depreciated value. Comparing the total loan cost with and without GAP insurance, the additional premium often proves cost-effective by mitigating potential financial risk and unexpected debt.

Claim Scenarios: Real-Life Examples with and without GAP Insurance

GAP insurance covers the difference between a car's actual cash value and the outstanding loan balance in case of total loss, preventing significant out-of-pocket expenses in accident claims. Without GAP insurance, borrowers often face paying the remaining loan amount despite the insurance payout being lower than the loan balance, as seen when a vehicle is totaled shortly after purchase. Real-life examples highlight instances where drivers with GAP insurance avoided financial strain, while those without struggled to cover the loan gap after accidents resulting in total vehicle loss.

Who Should Consider Skipping GAP Insurance?

Borrowers with a low loan-to-value ratio or those financing vehicles with slow depreciation may consider skipping GAP insurance since the risk of owing more than the vehicle's worth is minimal. Individuals who plan to pay off their auto loans quickly or have comprehensive insurance coverage that includes gap protection might not need additional GAP insurance. However, borrowers with high-interest loans or those purchasing new vehicles with significant depreciation should carefully evaluate the benefits of GAP insurance to avoid potential financial loss.

Making the Right Choice: GAP Insurance Loan or Not?

GAP insurance loans cover the difference between your car's actual cash value and the outstanding loan balance, protecting you from financial loss in case of total vehicle theft or accident. Choosing a GAP insurance loan is ideal for borrowers with low down payments or longer loan terms, where depreciation exceeds loan balances quickly. Opting out may save on upfront costs but risks significant out-of-pocket expenses if the car is totaled before the loan is paid off.

GAP Insurance Loan vs No GAP Insurance Loan Infographic

cardiffo.com

cardiffo.com