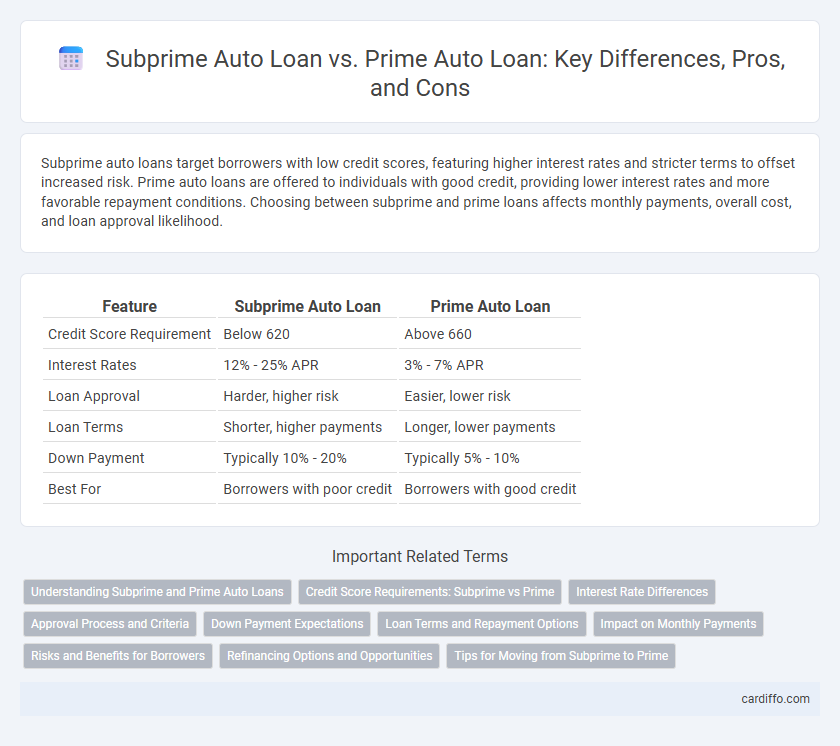

Subprime auto loans target borrowers with low credit scores, featuring higher interest rates and stricter terms to offset increased risk. Prime auto loans are offered to individuals with good credit, providing lower interest rates and more favorable repayment conditions. Choosing between subprime and prime loans affects monthly payments, overall cost, and loan approval likelihood.

Table of Comparison

| Feature | Subprime Auto Loan | Prime Auto Loan |

|---|---|---|

| Credit Score Requirement | Below 620 | Above 660 |

| Interest Rates | 12% - 25% APR | 3% - 7% APR |

| Loan Approval | Harder, higher risk | Easier, lower risk |

| Loan Terms | Shorter, higher payments | Longer, lower payments |

| Down Payment | Typically 10% - 20% | Typically 5% - 10% |

| Best For | Borrowers with poor credit | Borrowers with good credit |

Understanding Subprime and Prime Auto Loans

Subprime auto loans target borrowers with credit scores typically below 620, reflecting higher risk and resulting in elevated interest rates and stricter terms compared to prime auto loans, which cater to individuals with credit scores above 660 and offer more favorable rates and conditions. Understanding the distinction between subprime and prime auto loans is crucial for assessing loan affordability and managing long-term financial commitments. Lenders evaluate creditworthiness using credit history, debt-to-income ratio, and employment stability to classify applicants accurately into subprime or prime categories.

Credit Score Requirements: Subprime vs Prime

Subprime auto loans typically require a credit score below 620, reflecting higher risk borrowers with past credit challenges, while prime auto loans generally demand a credit score of 660 or above, indicating strong creditworthiness. Borrowers with prime credit scores benefit from lower interest rates and more favorable loan terms compared to subprime borrowers who face higher rates due to increased default risk. Lenders use credit score thresholds as a key criterion to differentiate between subprime and prime auto loan eligibility and pricing.

Interest Rate Differences

Subprime auto loans carry significantly higher interest rates than prime auto loans, often ranging from 10% to 25% due to the increased credit risk posed by borrowers with poor credit scores below 620. Prime auto loans typically feature interest rates between 3% and 7%, reflecting the lower default risk associated with borrowers who have credit scores above 700. This interest rate disparity directly impacts the total cost of financing a vehicle, making subprime loans substantially more expensive over the loan term.

Approval Process and Criteria

Subprime auto loans require a more stringent approval process focused on applicants with lower credit scores, often below 620, resulting in higher interest rates and larger down payments to mitigate lender risk. Prime auto loans target borrowers with credit scores above 700, featuring streamlined approval processes and more favorable terms due to the lower default risk. Lenders for prime loans emphasize strong credit history, stable income, and low debt-to-income ratios, while subprime lenders prioritize additional documentation and collateral to approve applicants.

Down Payment Expectations

Subprime auto loans typically require higher down payments, often ranging from 10% to 20% of the vehicle price, reflecting the increased risk lenders face. Prime auto loans generally demand lower down payments, sometimes as low as 5%, due to the borrower's strong credit profile. These down payment differences significantly impact monthly payments and loan approval chances.

Loan Terms and Repayment Options

Subprime auto loans feature higher interest rates and shorter repayment terms compared to prime auto loans, reflecting the increased risk lenders associate with borrowers having lower credit scores. Prime auto loans offer more flexible repayment options, including extended loan terms and lower APRs, which help reduce monthly payments and improve affordability. Borrowers with subprime loans often face stricter repayment schedules and fewer options for refinancing or loan modification.

Impact on Monthly Payments

Subprime auto loans typically result in higher monthly payments due to elevated interest rates reflecting increased lender risk, often exceeding prime loan rates by several percentage points. Prime auto loans offer lower interest rates, translating into more affordable monthly payments and reduced overall cost of financing. Borrowers with strong credit profiles benefit from prime financing, improving payment predictability and budget stability.

Risks and Benefits for Borrowers

Subprime auto loans carry higher interest rates and fees, increasing the overall cost for borrowers with lower credit scores but offer an opportunity to build or rebuild credit through consistent payments. Prime auto loans provide lower interest rates and more favorable terms for borrowers with strong credit histories, reducing financial risk and monthly payments. Borrowers must weigh the cost of higher rates in subprime loans against the benefits of credit improvement, while prime loans prioritize affordability and financial stability.

Refinancing Options and Opportunities

Subprime auto loans typically offer limited refinancing options due to higher interest rates and lower credit scores, making it challenging for borrowers to secure better terms. Prime auto loans provide more refinancing opportunities with lower interest rates and more flexible lender criteria, allowing borrowers to improve their loan conditions as their credit improves. Exploring refinancing options is crucial for subprime borrowers to reduce monthly payments and overall loan costs over time.

Tips for Moving from Subprime to Prime

Improving credit scores through timely bill payments and reducing outstanding debts is essential for transitioning from subprime to prime auto loans. Building a strong credit history with regular monitoring and corrections of credit report errors enhances eligibility for prime loan rates. Establishing stable income and minimizing new credit inquiries also contribute to qualifying for lower interest rates and better loan terms.

Subprime Auto Loan vs Prime Auto Loan Infographic

cardiffo.com

cardiffo.com