Refinancing activity significantly impacts the overall loan landscape by replacing existing loans with new terms, often resulting in lower interest rates or extended repayment periods. This process can reduce the borrower's monthly payments and improve cash flow, contrasting with original loan activity, which involves initiating new borrowing and increasing total debt exposure. Monitoring the balance between refinancing and original loan activity provides insight into borrower behavior and prevailing market conditions.

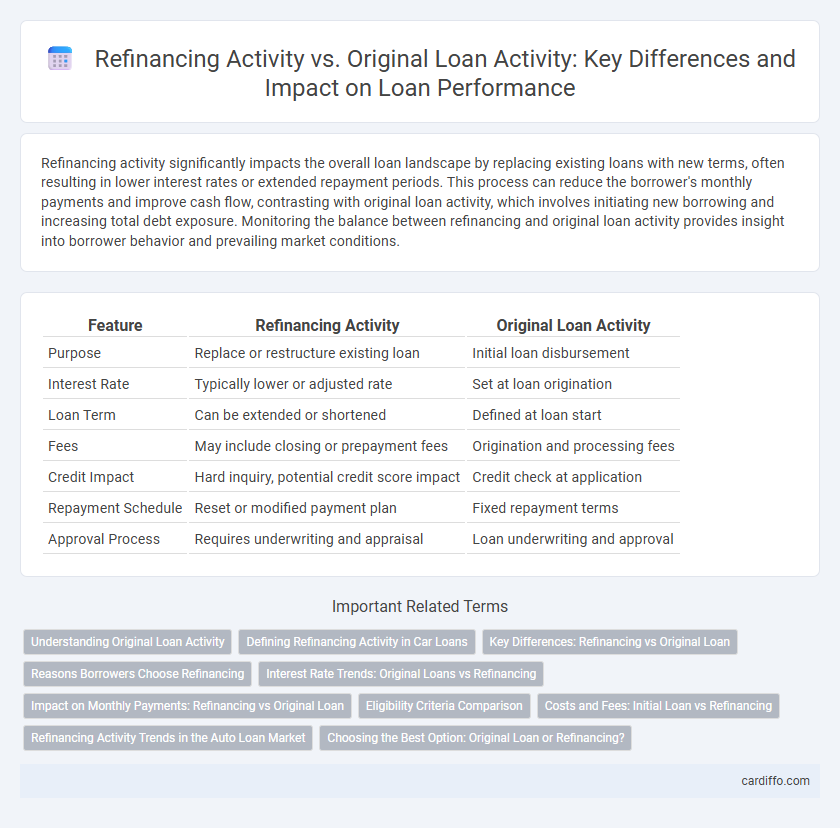

Table of Comparison

| Feature | Refinancing Activity | Original Loan Activity |

|---|---|---|

| Purpose | Replace or restructure existing loan | Initial loan disbursement |

| Interest Rate | Typically lower or adjusted rate | Set at loan origination |

| Loan Term | Can be extended or shortened | Defined at loan start |

| Fees | May include closing or prepayment fees | Origination and processing fees |

| Credit Impact | Hard inquiry, potential credit score impact | Credit check at application |

| Repayment Schedule | Reset or modified payment plan | Fixed repayment terms |

| Approval Process | Requires underwriting and appraisal | Loan underwriting and approval |

Understanding Original Loan Activity

Original loan activity involves the initial disbursement, repayment schedule, and interest terms set at the loan's inception, serving as the baseline for all subsequent financial calculations. Understanding original loan activity is critical for assessing the borrower's initial credit risk, loan performance, and the potential benefits or drawbacks of refinancing options. Detailed analysis of principal amount, interest rate, repayment frequency, and loan tenure helps in accurately comparing subsequent refinancing activity against the original loan terms.

Defining Refinancing Activity in Car Loans

Refinancing activity in car loans involves replacing an existing loan with a new one under different terms, often to secure a lower interest rate or reduce monthly payments. This process differs from original loan activity, which initiates the initial financing to purchase the vehicle. Refinancing primarily targets improved loan conditions and financial flexibility without acquiring new principal amounts.

Key Differences: Refinancing vs Original Loan

Refinancing replaces an existing loan with a new one, often to secure lower interest rates or better terms, whereas an original loan is the initial borrowing agreement between lender and borrower. Refinancing typically involves closing costs and fees that are not present in original loan disbursement, affecting overall financial outcomes. The loan purpose also diverges: original loans fund new purchases or investments, while refinancing aims to restructure existing debt for improved cash flow or savings.

Reasons Borrowers Choose Refinancing

Borrowers choose refinancing primarily to secure lower interest rates, reducing monthly payments and overall loan costs. Refinancing also allows access to improved loan terms, such as extended repayment periods or switching from variable to fixed rates. Many borrowers refinance to consolidate debt or tap into home equity for cash-out options, optimizing their financial strategies.

Interest Rate Trends: Original Loans vs Refinancing

Refinancing activity often spikes when interest rates on new loans fall below the rates of original loans, as borrowers seek to reduce their monthly payments or overall interest costs. Original loan activity tends to stabilize or decline in periods of lower rates, while refinancing surges, reflecting borrowers' responsiveness to attractive refinancing terms. Tracking interest rate trends reveals a clear inverse relationship: as rates drop, refinancing volumes increase, contrasting with steadier origination levels during stable or rising rates.

Impact on Monthly Payments: Refinancing vs Original Loan

Refinancing activity typically lowers monthly payments by securing a reduced interest rate or extending the loan term compared to the original loan. This adjustment can result in immediate cash flow relief for borrowers, unlike the often higher initial payments of the original loan structure. However, refinancing may also increase the total loan duration, impacting long-term interest costs despite monthly payment reductions.

Eligibility Criteria Comparison

Refinancing activity requires borrowers to meet updated eligibility criteria that often include improved credit scores, current debt-to-income ratios, and property valuation assessments, contrasting with original loan activity which primarily focuses on initial creditworthiness and income verification. Lenders typically impose stricter conditions during refinancing to mitigate risk, such as higher reserve requirements and proof of consistent payment history on the original loan. Comparing both processes reveals that refinancing eligibility emphasizes financial stability and loan performance post-origination, whereas original loan eligibility centers on borrower qualification at the point of loan inception.

Costs and Fees: Initial Loan vs Refinancing

Refinancing a loan often involves lower upfront costs and fees compared to the original loan due to reduced origination fees and lower interest rates negotiated at refinancing. The initial loan typically includes higher fees such as application, underwriting, and closing costs, which contribute to overall borrowing expenses. Borrowers benefit from refinancing by minimizing these costs, leading to potential long-term savings despite some associated refinancing fees like prepayment penalties or appraisal charges.

Refinancing Activity Trends in the Auto Loan Market

Refinancing activity in the auto loan market has surged significantly, driven by declining interest rates and improved borrower credit profiles, enabling consumers to reduce monthly payments or loan terms. Recent data indicate a growing preference for refinancing among subprime and prime borrowers, highlighting increased market fluidity and competition among lenders. This trend contrasts with original loan activity, where stricter underwriting standards and higher vehicle prices have constrained new loan origination growth.

Choosing the Best Option: Original Loan or Refinancing?

Assessing refinancing activity compared to the original loan activity requires analyzing interest rates, loan terms, and total repayment costs to determine which option yields greater financial benefits. Refinancing can lower monthly payments and reduce interest expenses when market rates have dropped since the original loan was secured, but origination fees and extended loan periods may offset savings. Borrowers should calculate the break-even point and consider credit score impact before deciding between maintaining the original loan or pursuing refinancing.

Refinancing Activity vs Original Loan Activity Infographic

cardiffo.com

cardiffo.com