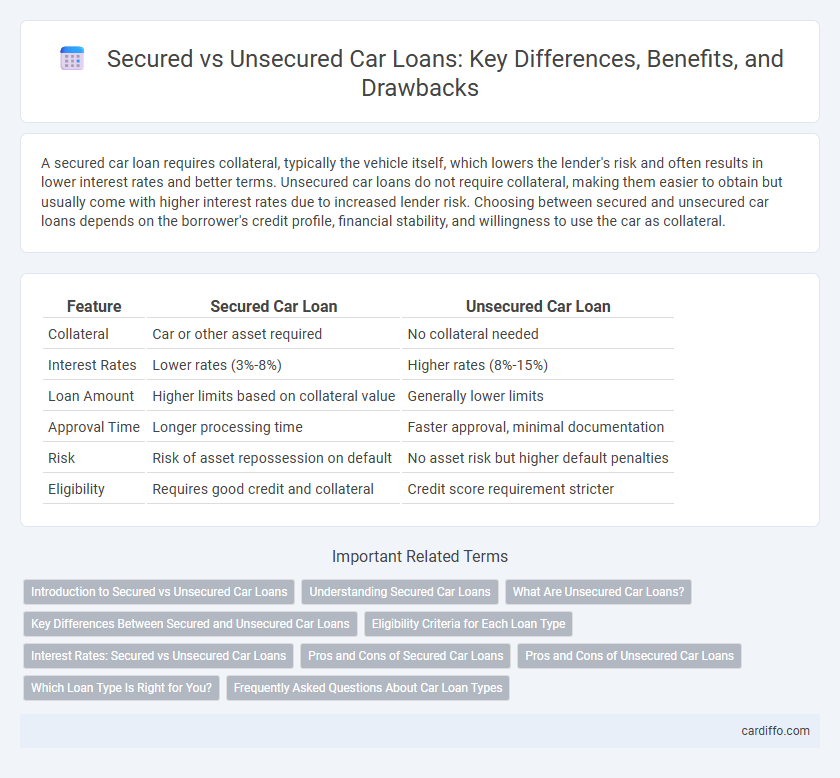

A secured car loan requires collateral, typically the vehicle itself, which lowers the lender's risk and often results in lower interest rates and better terms. Unsecured car loans do not require collateral, making them easier to obtain but usually come with higher interest rates due to increased lender risk. Choosing between secured and unsecured car loans depends on the borrower's credit profile, financial stability, and willingness to use the car as collateral.

Table of Comparison

| Feature | Secured Car Loan | Unsecured Car Loan |

|---|---|---|

| Collateral | Car or other asset required | No collateral needed |

| Interest Rates | Lower rates (3%-8%) | Higher rates (8%-15%) |

| Loan Amount | Higher limits based on collateral value | Generally lower limits |

| Approval Time | Longer processing time | Faster approval, minimal documentation |

| Risk | Risk of asset repossession on default | No asset risk but higher default penalties |

| Eligibility | Requires good credit and collateral | Credit score requirement stricter |

Introduction to Secured vs Unsecured Car Loans

Secured car loans require collateral, typically the vehicle itself, reducing lender risk and often resulting in lower interest rates and higher loan amounts. Unsecured car loans do not require collateral, leading to higher interest rates due to increased lender risk and generally stricter eligibility criteria. Choosing between secured and unsecured car loans depends on credit score, loan amount, and willingness to provide collateral.

Understanding Secured Car Loans

Secured car loans require collateral, usually the vehicle itself, which lowers the lender's risk and often results in lower interest rates and more favorable repayment terms. These loans typically have higher approval rates due to the reduced credit risk and allow borrowers to access larger loan amounts compared to unsecured options. If the borrower defaults, the lender can repossess the car to recover unpaid debt, providing financial security for the lender.

What Are Unsecured Car Loans?

Unsecured car loans require no collateral, making them riskier for lenders and often resulting in higher interest rates compared to secured car loans. Borrowers qualify based on creditworthiness, income stability, and financial history rather than vehicle value. These loans offer flexibility but may come with stricter eligibility criteria and limited loan amounts.

Key Differences Between Secured and Unsecured Car Loans

Secured car loans require collateral, typically the vehicle itself, which reduces lender risk and often results in lower interest rates and higher loan amounts. Unsecured car loans do not require collateral but usually come with higher interest rates and stricter eligibility criteria due to increased lender risk. Repayment terms for secured loans tend to be longer, providing more flexibility, while unsecured loans generally have shorter terms and higher monthly payments.

Eligibility Criteria for Each Loan Type

Secured car loans typically require the borrower to have a stable income, a good credit score, and the vehicle as collateral, which reduces the lender's risk. Unsecured car loans demand stricter eligibility, including higher creditworthiness and proof of consistent income, since no collateral is involved. Lenders may also impose lower loan amounts and shorter terms on unsecured loans due to the increased risk.

Interest Rates: Secured vs Unsecured Car Loans

Secured car loans typically offer lower interest rates because the vehicle acts as collateral, reducing the lender's risk. Unsecured car loans carry higher interest rates since they lack collateral, leading to increased risk for lenders. Borrowers with strong credit profiles may secure competitive rates on both types, but secured loans generally remain more cost-effective over time.

Pros and Cons of Secured Car Loans

Secured car loans require collateral, typically the vehicle itself, which often results in lower interest rates and higher borrowing limits due to reduced lender risk. Borrowers benefit from easier approval even with lower credit scores, but face the risk of vehicle repossession if repayments are missed. However, these loans may involve longer processing times and additional fees related to collateral management.

Pros and Cons of Unsecured Car Loans

Unsecured car loans do not require collateral, allowing borrowers to acquire funds without risking their vehicle or other assets, which is advantageous for those with limited property ownership. However, these loans often come with higher interest rates and stricter credit requirements due to increased lending risk for lenders. The lack of security increases the cost of borrowing and can limit loan amounts, making them less favorable for buyers seeking lower overall financing expenses.

Which Loan Type Is Right for You?

Evaluate your credit score, down payment capacity, and risk tolerance when choosing between a secured car loan and an unsecured car loan. Secured car loans often provide lower interest rates due to collateral requirements, typically the vehicle itself, while unsecured loans offer faster approval but at higher rates and stricter credit criteria. Assess your financial stability and long-term budget to determine whether the security of collateral outweighs the flexibility of unsecured borrowing.

Frequently Asked Questions About Car Loan Types

Secured car loans require collateral, typically the vehicle itself, which lowers interest rates due to reduced lender risk. Unsecured car loans do not need collateral but usually come with higher interest rates and stricter eligibility criteria. Borrowers often inquire about credit score impact, loan tenure, and approval speed when comparing these car loan types.

Secured Car Loan vs Unsecured Car Loan Infographic

cardiffo.com

cardiffo.com