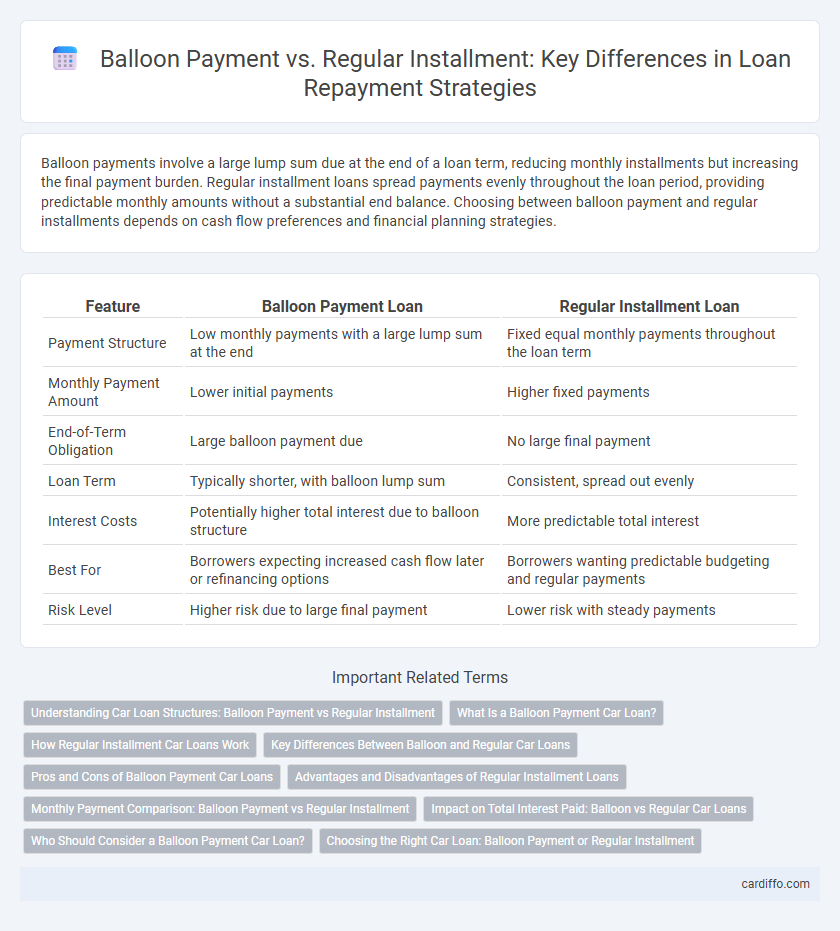

Balloon payments involve a large lump sum due at the end of a loan term, reducing monthly installments but increasing the final payment burden. Regular installment loans spread payments evenly throughout the loan period, providing predictable monthly amounts without a substantial end balance. Choosing between balloon payment and regular installments depends on cash flow preferences and financial planning strategies.

Table of Comparison

| Feature | Balloon Payment Loan | Regular Installment Loan |

|---|---|---|

| Payment Structure | Low monthly payments with a large lump sum at the end | Fixed equal monthly payments throughout the loan term |

| Monthly Payment Amount | Lower initial payments | Higher fixed payments |

| End-of-Term Obligation | Large balloon payment due | No large final payment |

| Loan Term | Typically shorter, with balloon lump sum | Consistent, spread out evenly |

| Interest Costs | Potentially higher total interest due to balloon structure | More predictable total interest |

| Best For | Borrowers expecting increased cash flow later or refinancing options | Borrowers wanting predictable budgeting and regular payments |

| Risk Level | Higher risk due to large final payment | Lower risk with steady payments |

Understanding Car Loan Structures: Balloon Payment vs Regular Installment

Balloon payment car loans feature lower monthly installments with a large lump sum due at the end of the term, allowing buyers to afford more expensive vehicles initially. Regular installment loans distribute payments evenly across the loan period, providing predictable budgeting without a significant final payment. Choosing between these structures depends on cash flow preferences and the borrower's ability to make a substantial payment at loan maturity.

What Is a Balloon Payment Car Loan?

A balloon payment car loan requires borrowers to pay lower monthly installments with a large lump sum due at the end of the loan term, typically covering a significant portion of the vehicle's price. This financing option helps reduce monthly cash flow but increases the risk of a hefty final payment that must be refinanced or paid outright. Balloon payments contrast with regular installment loans, where fixed monthly payments amortize the entire loan balance evenly over the loan period.

How Regular Installment Car Loans Work

Regular installment car loans involve fixed monthly payments that cover both principal and interest over a predetermined loan term, providing predictable budgeting for borrowers. Each payment gradually reduces the loan balance, resulting in full repayment by the end of the loan period without a large final payment. This structured approach contrasts with balloon payment loans, which require a substantial lump sum at the conclusion of the term.

Key Differences Between Balloon and Regular Car Loans

Balloon payments are large, lump-sum amounts due at the end of a loan term, significantly reducing monthly installments compared to regular car loans, which consist of fixed, consistent payments spread evenly over the loan period. Balloon loans typically have lower initial payments but require borrowers to plan for a substantial final payment or refinance, while regular installment loans offer predictable budgeting without a large payoff at the end. The key differentiation lies in payment structure, financial planning demands, and overall interest cost, with balloon loans potentially carrying higher long-term costs despite lower monthly payments.

Pros and Cons of Balloon Payment Car Loans

Balloon payment car loans feature lower monthly installments and a large lump sum due at the end, making them attractive for buyers seeking short-term affordability. The major advantage is reduced monthly financial strain, while the principal risk involves a substantial final payment that can lead to refinancing challenges or asset repossession. Borrowers must evaluate their future cash flow and exit strategy carefully to avoid the financial stress associated with balloon repayments.

Advantages and Disadvantages of Regular Installment Loans

Regular installment loans offer consistent monthly payments that simplify budgeting and provide predictable cash flow management, making them ideal for borrowers seeking financial stability. These loans reduce the risk of a large lump-sum payment at the end, minimizing default risk and improving long-term creditworthiness. However, regular installment loans often have higher total interest costs compared to balloon payment loans due to longer repayment periods and continuous amortization.

Monthly Payment Comparison: Balloon Payment vs Regular Installment

Balloon payments typically result in lower monthly payments compared to regular installment loans because the borrower pays smaller amounts throughout the loan term with a large lump sum due at the end. Regular installment loans distribute the total principal and interest evenly over the loan period, leading to consistent, higher monthly payments. Borrowers must consider cash flow needs and the ability to handle the final balloon payment when comparing these loan structures.

Impact on Total Interest Paid: Balloon vs Regular Car Loans

Balloon payments in car loans reduce monthly installments but increase the total interest paid over the loan term due to deferred principal repayment. Regular installment loans maintain consistent payments, leading to faster principal reduction and lower total interest costs. Borrowers choosing balloon payment plans should consider the higher financial burden at loan maturity compared to regular amortized loans.

Who Should Consider a Balloon Payment Car Loan?

Borrowers expecting a significant cash inflow, such as a bonus or inheritance, should consider a balloon payment car loan to manage lower monthly installments during the loan term. This loan type suits individuals seeking short-term affordability with a large lump sum payment at the end, often benefiting those anticipating vehicle trade-ins before the final balloon payment. Balloon payment car loans also attract buyers looking for flexibility in budgeting but who have a clear repayment strategy for the large terminal payment.

Choosing the Right Car Loan: Balloon Payment or Regular Installment

Choosing the right car loan depends on your financial situation and repayment preferences, with balloon payment loans offering lower monthly installments but a large lump sum at the end, while regular installment loans provide consistent, equal payments throughout the loan term. Balloon payments can be beneficial for borrowers expecting higher future income or planning to refinance, whereas regular installments suit those seeking predictable budgeting without a substantial final payment. Evaluating interest rates, loan terms, and cash flow helps determine whether balloon payment or regular installment financing aligns better with your car ownership goals.

Balloon Payment vs Regular Installment Infographic

cardiffo.com

cardiffo.com