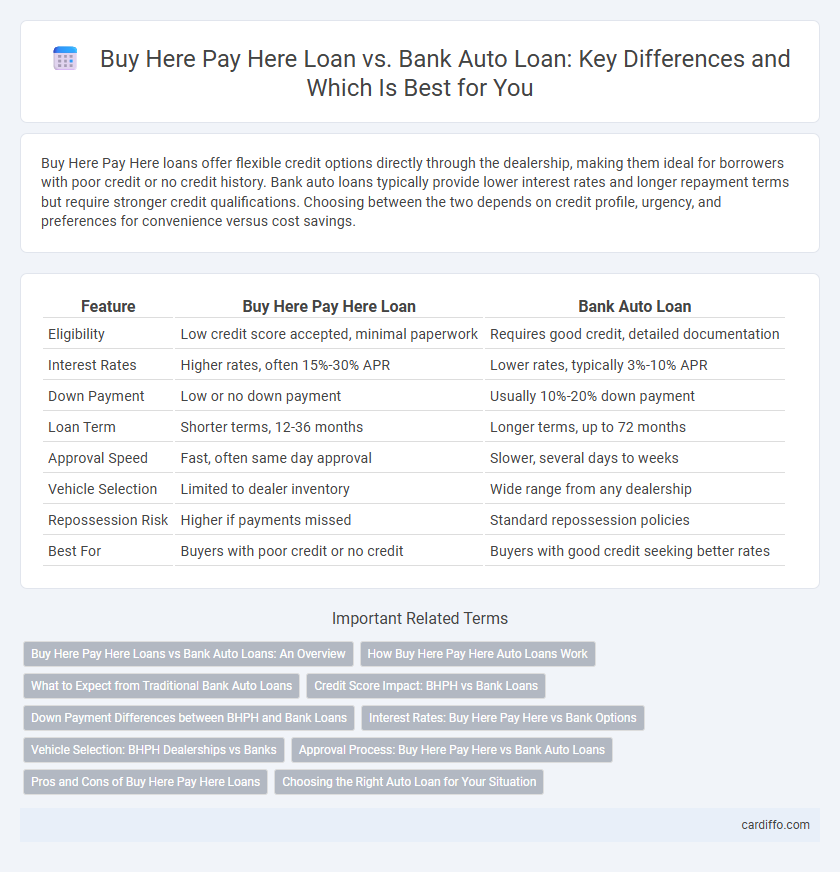

Buy Here Pay Here loans offer flexible credit options directly through the dealership, making them ideal for borrowers with poor credit or no credit history. Bank auto loans typically provide lower interest rates and longer repayment terms but require stronger credit qualifications. Choosing between the two depends on credit profile, urgency, and preferences for convenience versus cost savings.

Table of Comparison

| Feature | Buy Here Pay Here Loan | Bank Auto Loan |

|---|---|---|

| Eligibility | Low credit score accepted, minimal paperwork | Requires good credit, detailed documentation |

| Interest Rates | Higher rates, often 15%-30% APR | Lower rates, typically 3%-10% APR |

| Down Payment | Low or no down payment | Usually 10%-20% down payment |

| Loan Term | Shorter terms, 12-36 months | Longer terms, up to 72 months |

| Approval Speed | Fast, often same day approval | Slower, several days to weeks |

| Vehicle Selection | Limited to dealer inventory | Wide range from any dealership |

| Repossession Risk | Higher if payments missed | Standard repossession policies |

| Best For | Buyers with poor credit or no credit | Buyers with good credit seeking better rates |

Buy Here Pay Here Loans vs Bank Auto Loans: An Overview

Buy Here Pay Here (BHPH) loans typically cater to borrowers with poor credit by offering in-house financing directly through dealerships, often requiring a higher interest rate and shorter repayment terms. In contrast, bank auto loans usually provide lower interest rates and longer terms but require good credit scores and thorough application processes. Understanding the differences in credit requirements, interest rates, and repayment flexibility is crucial when choosing between BHPH loans and traditional bank auto loans.

How Buy Here Pay Here Auto Loans Work

Buy Here Pay Here (BHPH) auto loans allow buyers to purchase a vehicle directly from the dealership and make payments to the dealer instead of a traditional bank. These loans typically require lower credit scores and provide in-house financing, with weekly or biweekly payment schedules tailored to the buyer's budget. BHPH loans generally have higher interest rates and shorter terms compared to conventional bank auto loans, reflecting the increased risk assumed by the dealer.

What to Expect from Traditional Bank Auto Loans

Traditional bank auto loans typically offer lower interest rates and longer repayment terms compared to Buy Here Pay Here loans, making them more cost-effective for borrowers with good credit. Banks require thorough credit checks, proof of income, and vehicle appraisal, ensuring borrowers meet strict eligibility criteria. Expect a streamlined approval process with standardized documentation but less flexibility in payment options than Buy Here Pay Here lenders.

Credit Score Impact: BHPH vs Bank Loans

Buy Here Pay Here (BHPH) loans typically have a minimal impact on credit scores since they are rarely reported to major credit bureaus, making them accessible for borrowers with poor credit but less effective for credit building. Bank auto loans usually require a good credit score for approval, and timely payments can help improve credit history through regular reporting to credit agencies. Borrowers seeking to enhance their credit profiles should consider bank loans for positive credit score impact, whereas BHPH loans cater more to immediate financing despite limited credit benefits.

Down Payment Differences between BHPH and Bank Loans

Buy Here Pay Here (BHPH) loans typically require a lower down payment, often ranging from 0% to 10%, compared to bank auto loans which usually demand 10% to 20% down. BHPH dealerships finance directly, making them more flexible but with higher interest rates and shorter loan terms. Bank auto loans offer better interest rates and longer repayment periods but impose stricter credit requirements and larger initial down payments.

Interest Rates: Buy Here Pay Here vs Bank Options

Buy Here Pay Here loans typically have higher interest rates compared to traditional bank auto loans due to the increased risk lenders assume. Bank auto loans often offer lower interest rates, especially for borrowers with strong credit scores, making them more cost-effective in the long term. Evaluating interest rates alongside credit qualifications helps determine the most affordable financing option for purchasing a vehicle.

Vehicle Selection: BHPH Dealerships vs Banks

Buy Here Pay Here (BHPH) dealerships typically offer a limited selection of used vehicles with varying conditions, catering to borrowers with lower credit scores or limited financing options. Banks provide a broader range of new and certified pre-owned vehicles with detailed histories and warranties due to their partnerships with established dealerships. Consumers seeking reliable inventory and more vehicle options generally find banks more advantageous, while BHPH dealerships prioritize accessible financing over diverse vehicle selection.

Approval Process: Buy Here Pay Here vs Bank Auto Loans

Buy Here Pay Here (BHPH) loans offer faster and more flexible approval processes, often tailored for customers with poor credit or no credit history by approving loans directly through the dealership. Bank auto loans require a more stringent approval process involving credit checks, income verification, and lengthy documentation, favoring applicants with strong credit profiles. The BHPH approval prioritizes immediate vehicle access over traditional credit standards, while banks emphasize financial stability and risk assessment before loan approval.

Pros and Cons of Buy Here Pay Here Loans

Buy Here Pay Here (BHPH) loans offer easier approval for buyers with poor credit by financing directly through the dealership, enabling quicker vehicle acquisition without traditional credit checks. However, BHPH loans often come with higher interest rates and shorter repayment terms, increasing overall costs compared to bank auto loans that typically offer lower rates and more flexible terms but require stronger creditworthiness. Buyers should weigh the convenience and accessibility of BHPH loans against the potential financial drawbacks in interest and vehicle selection.

Choosing the Right Auto Loan for Your Situation

Buy Here Pay Here loans offer flexible credit requirements and faster approval, ideal for buyers with poor credit or no credit history. Bank auto loans provide lower interest rates and longer repayment terms but require strong credit scores and income verification. Assessing your credit profile, budget, and urgency helps determine whether a Buy Here Pay Here option or a traditional bank auto loan best suits your financial situation.

Buy Here Pay Here Loan vs Bank Auto Loan Infographic

cardiffo.com

cardiffo.com