A buyout loan enables borrowers to finance the full purchase price of a leased asset, converting it into ownership at the lease's end, often with favorable interest rates. Lease assumption involves taking over the remaining lease payments and terms from the original lessee, which can reduce upfront costs but may limit flexibility compared to outright ownership. Understanding the differences helps individuals and businesses choose between immediate asset control with a buyout loan or less financial commitment with lease assumption.

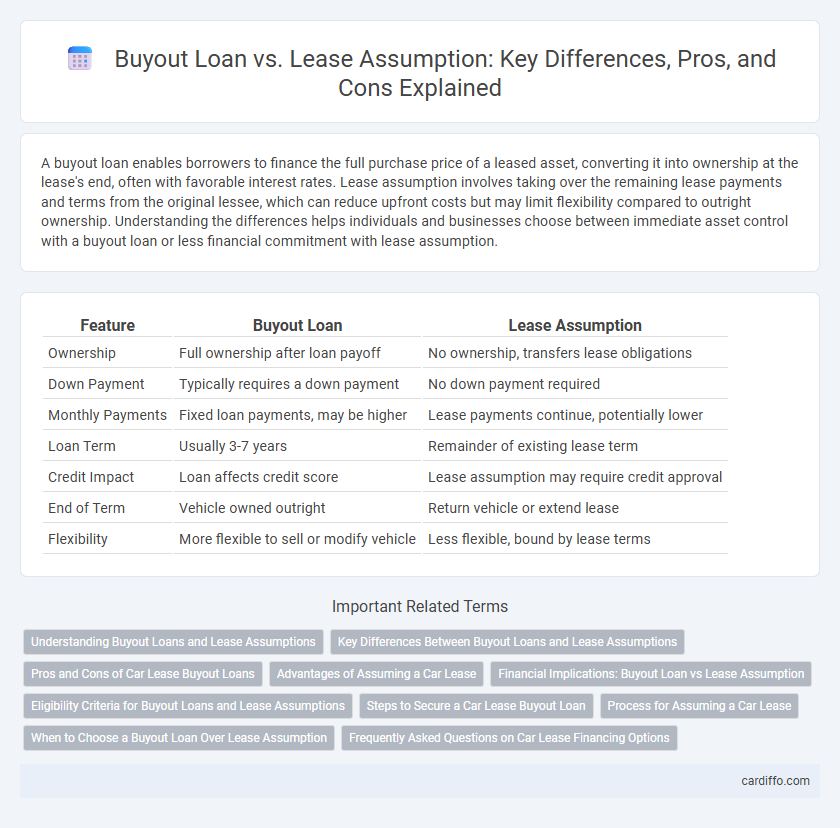

Table of Comparison

| Feature | Buyout Loan | Lease Assumption |

|---|---|---|

| Ownership | Full ownership after loan payoff | No ownership, transfers lease obligations |

| Down Payment | Typically requires a down payment | No down payment required |

| Monthly Payments | Fixed loan payments, may be higher | Lease payments continue, potentially lower |

| Loan Term | Usually 3-7 years | Remainder of existing lease term |

| Credit Impact | Loan affects credit score | Lease assumption may require credit approval |

| End of Term | Vehicle owned outright | Return vehicle or extend lease |

| Flexibility | More flexible to sell or modify vehicle | Less flexible, bound by lease terms |

Understanding Buyout Loans and Lease Assumptions

Buyout loans enable borrowers to purchase an asset outright at the end of a lease or loan term, providing full ownership and potential equity growth. Lease assumptions involve taking over the remaining terms of an existing lease agreement, often with lower upfront costs but without transferring ownership. Understanding the differences helps borrowers decide between long-term asset acquisition through a buyout loan or short-term commitment via lease assumption.

Key Differences Between Buyout Loans and Lease Assumptions

Buyout loans involve financing the purchase of a leased asset at the end of the lease term, converting it into ownership, whereas lease assumptions transfer the remaining lease obligations to a new lessee without ownership transfer. Buyout loans typically require credit approval and may include interest rates based on the borrower's credit profile, while lease assumptions depend on approval by the leasing company and often involve assuming the original lease terms and payments. The key differences lie in ownership transfer, financing mechanisms, and responsibility for ongoing payments.

Pros and Cons of Car Lease Buyout Loans

Car lease buyout loans allow borrowers to purchase their leased vehicle by financing the residual value, offering an opportunity to own a familiar car without the hassle of searching for a new one. These loans provide flexibility in ownership and potential equity gains if the vehicle's market value exceeds the lease-end buyout price. However, drawbacks include potentially higher interest rates than traditional auto loans and the risk of inheriting maintenance costs or unfavorable lease terms that may not align with ownership benefits.

Advantages of Assuming a Car Lease

Assuming a car lease offers lower upfront costs compared to a buyout loan, making it an affordable option for gaining immediate vehicle use without a large down payment. It often includes the remaining warranty and maintenance coverage, reducing unexpected expenses during the lease term. Lease assumption avoids the need for new credit checks, benefiting those with less-than-perfect credit scores.

Financial Implications: Buyout Loan vs Lease Assumption

Buyout loans require securing financing to purchase the asset outright, often leading to higher monthly payments but full ownership and potential equity buildup. Lease assumption typically involves taking over remaining lease payments without ownership, resulting in lower immediate costs but no asset equity. Evaluating total financial outlay, interest rates, and long-term asset value is crucial when comparing buyout loans to lease assumptions.

Eligibility Criteria for Buyout Loans and Lease Assumptions

Buyout loans typically require borrowers to have a strong credit score, stable income, and sufficient equity in the asset to qualify, ensuring the ability to repay the loan. Lease assumptions often have less stringent eligibility criteria, mainly requiring the original lessee's consent and the new party's creditworthiness to take over existing lease terms. Financial institutions evaluate debt-to-income ratios and employment history for buyout loans, while lease assumptions prioritize approval from the leasing company and adherence to original lease conditions.

Steps to Secure a Car Lease Buyout Loan

To secure a car lease buyout loan, first review the lease contract to confirm the buyout price and any applicable fees. Next, research lenders specializing in auto loans and compare interest rates, loan terms, and eligibility criteria. Finally, gather required documents, submit a loan application, and obtain approval to pay off the lease balance and transfer ownership.

Process for Assuming a Car Lease

The process for assuming a car lease involves transferring the remaining lease term and payments from the original lessee to the new party, requiring approval from the leasing company. The new lessee typically submits a credit application, and upon approval, signs the lease transfer agreement to take over the vehicle's obligations. Unlike buyout loans, lease assumptions avoid depreciation risk but may include transfer fees and mileage restrictions.

When to Choose a Buyout Loan Over Lease Assumption

Choose a buyout loan over lease assumption when ownership and long-term asset control are priorities, especially if the remaining lease term is short or lease-end costs are high. Buyout loans provide the opportunity to build equity and avoid mileage limits or wear-and-tear fees associated with leases. This option benefits customers looking to finance the remaining value of the vehicle with fixed payments and eventual ownership.

Frequently Asked Questions on Car Lease Financing Options

Buyout loans enable lessees to purchase their leased vehicles at the end of the lease term by financing the residual value, often with competitive interest rates and flexible repayment options. Lease assumption allows a new lessee to take over the remaining lease payments, providing an alternative to traditional financing without the need for a large down payment or a new credit check. Understanding differences in credit requirements, monthly payments, and ownership transfer processes can help consumers choose the optimal car lease financing option for their budget and long-term goals.

Buyout Loan vs Lease Assumption Infographic

cardiffo.com

cardiffo.com