Deferred payment loans allow borrowers to postpone repayments for a set period, easing immediate financial pressure while often accruing interest during the deferral period. Immediate payment loans require borrowers to start repaying principal and interest right after disbursement, leading to higher monthly payments but potentially lower overall interest costs. Choosing between these options depends on the borrower's cash flow needs and long-term financial strategy.

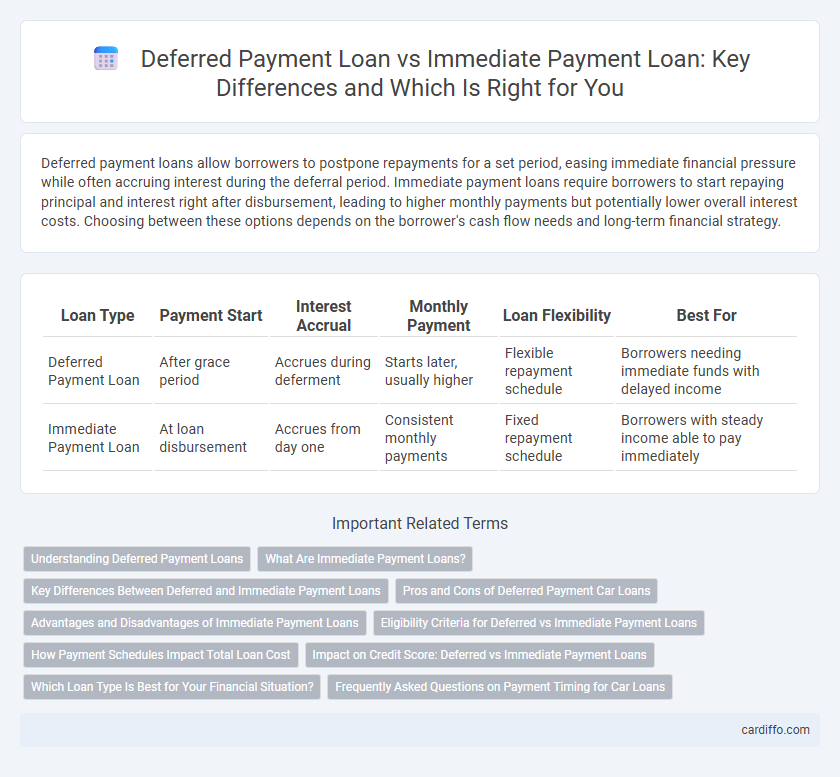

Table of Comparison

| Loan Type | Payment Start | Interest Accrual | Monthly Payment | Loan Flexibility | Best For |

|---|---|---|---|---|---|

| Deferred Payment Loan | After grace period | Accrues during deferment | Starts later, usually higher | Flexible repayment schedule | Borrowers needing immediate funds with delayed income |

| Immediate Payment Loan | At loan disbursement | Accrues from day one | Consistent monthly payments | Fixed repayment schedule | Borrowers with steady income able to pay immediately |

Understanding Deferred Payment Loans

Deferred payment loans allow borrowers to delay repayment of principal and interest until a later date, offering financial relief during cash flow constraints. These loans often feature accruing interest during the deferment period, which increases the total repayment amount compared to immediate payment loans where payments start right after disbursement. Understanding deferred payment loans is crucial for managing long-term financial obligations and avoiding unexpected debt accumulation.

What Are Immediate Payment Loans?

Immediate payment loans require borrowers to start repaying principal and interest shortly after disbursement, typically within 30 days. These loans help improve cash flow management by avoiding interest accumulation during the loan term. Common types include personal installment loans, auto loans, and payday loans, which prioritize quick repayment schedules.

Key Differences Between Deferred and Immediate Payment Loans

Deferred payment loans allow borrowers to postpone principal and interest payments for a specified period, easing initial cash flow but often resulting in higher overall interest costs. Immediate payment loans require borrowers to start repaying principal and interest immediately after disbursement, leading to faster debt reduction and lower total interest paid. Key differences include the timing of payments, impact on borrower's cash flow, and the total interest expense incurred over the loan term.

Pros and Cons of Deferred Payment Car Loans

Deferred payment car loans offer the advantage of reduced initial financial burden by allowing borrowers to delay payments, making vehicle acquisition more accessible. However, these loans often come with higher overall interest costs, increasing the total amount paid over time compared to immediate payment loans. Borrowers should carefully consider their cash flow situation and the potential for increased debt when opting for a deferred payment structure.

Advantages and Disadvantages of Immediate Payment Loans

Immediate payment loans offer borrowers quick access to funds with a clear repayment schedule, enhancing financial predictability and avoiding interest accumulation over time. However, these loans may strain cash flow due to immediate repayment obligations and can lead to higher short-term financial pressure compared to deferred payment options. Borrowers must carefully evaluate their current income stability and ability to meet immediate repayment demands to prevent potential default or financial stress.

Eligibility Criteria for Deferred vs Immediate Payment Loans

Eligibility criteria for Deferred Payment Loans typically require borrowers to demonstrate stable income, a good credit score above 650, and a repayment plan that accommodates delayed payments for a specified period, often favored by borrowers with short-term cash flow constraints. Immediate Payment Loans demand stricter eligibility, including a higher credit score threshold of 700 or above, proof of consistent income, and sometimes collateral, ensuring prompt repayment without deferred schedules. Lenders assess risk differently for both loan types, prioritizing financial stability and creditworthiness to determine suitable eligibility for either deferred or immediate repayment structures.

How Payment Schedules Impact Total Loan Cost

Deferred payment loans postpone principal and interest payments, often increasing the total loan cost due to accumulated interest over the deferment period. Immediate payment loans require regular payments from the start, reducing interest accrual and typically lowering the overall cost of borrowing. Choosing a payment schedule directly influences cash flow management and the total financial burden of the loan.

Impact on Credit Score: Deferred vs Immediate Payment Loans

Deferred payment loans allow borrowers to postpone repayments, which can temporarily lower credit utilization but may increase risk of missed payments if not managed properly. Immediate payment loans require regular, on-time payments that help establish a consistent payment history, positively impacting credit scores. Lenders often view immediate payment loans as less risky, leading to potentially higher credit scores compared to deferred payment options.

Which Loan Type Is Best for Your Financial Situation?

Deferred payment loans offer flexibility by allowing borrowers to postpone repayments, making them suitable for individuals expecting future income or facing short-term financial constraints. Immediate payment loans require prompt repayment, often resulting in lower overall interest costs and benefiting those with stable cash flow who want to minimize interest expenses. Assess your current financial stability, cash flow, and long-term goals to determine whether deferring payments or starting repayments immediately aligns best with your financial situation.

Frequently Asked Questions on Payment Timing for Car Loans

Deferred payment loans allow car buyers to postpone monthly payments for a specified period, easing initial financial pressure but potentially increasing total interest paid over time. Immediate payment loans require borrowers to start repayments right after loan disbursement, helping reduce overall interest costs but demanding quicker cash flow management. Common questions cover when payments begin, impact on interest accrual, and how deferred schedules affect loan payoff timelines.

Deferred Payment Loan vs Immediate Payment Loan Infographic

cardiffo.com

cardiffo.com