Direct loans are funded directly by the lender to the borrower, often resulting in lower fees and more transparent terms, enhancing borrower control over the loan process. Indirect loans involve a third party, such as a car dealership or broker, who arranges financing through a lender, which may increase costs due to additional fees or markups. Understanding the differences between direct and indirect loans helps borrowers make informed decisions to secure the most cost-effective and suitable financing option.

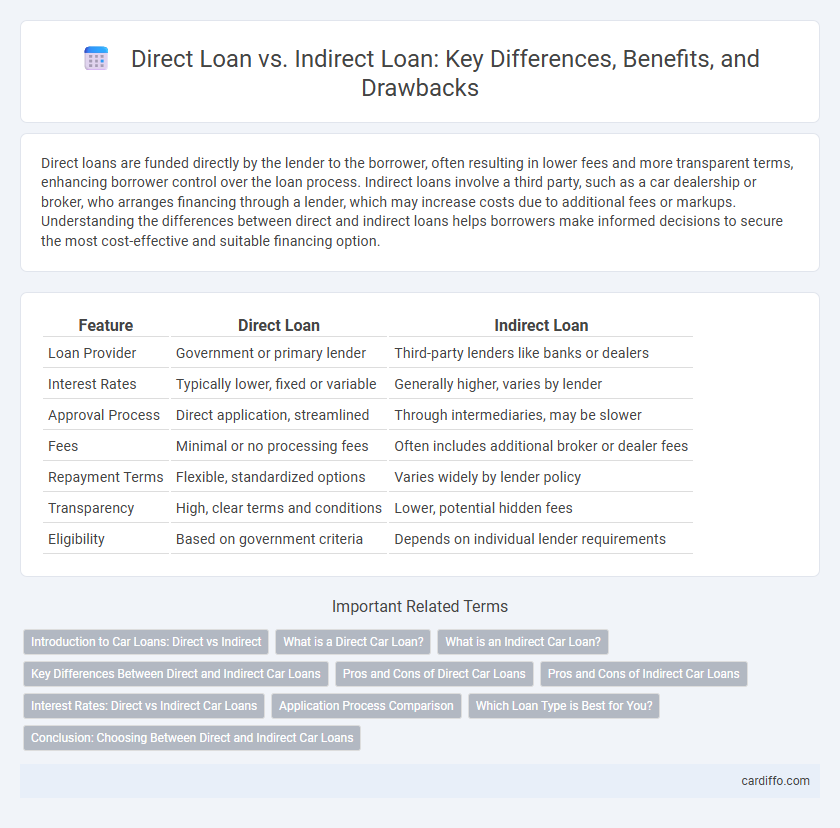

Table of Comparison

| Feature | Direct Loan | Indirect Loan |

|---|---|---|

| Loan Provider | Government or primary lender | Third-party lenders like banks or dealers |

| Interest Rates | Typically lower, fixed or variable | Generally higher, varies by lender |

| Approval Process | Direct application, streamlined | Through intermediaries, may be slower |

| Fees | Minimal or no processing fees | Often includes additional broker or dealer fees |

| Repayment Terms | Flexible, standardized options | Varies widely by lender policy |

| Transparency | High, clear terms and conditions | Lower, potential hidden fees |

| Eligibility | Based on government criteria | Depends on individual lender requirements |

Introduction to Car Loans: Direct vs Indirect

Direct car loans involve borrowing funds straight from a lender, such as a bank or credit union, allowing for potentially lower interest rates and clearer terms. Indirect loans are arranged through a car dealership, where the dealer acts as an intermediary between the borrower and the lender, often resulting in higher rates due to added fees. Understanding the differences in these loan types helps buyers make informed decisions based on cost, convenience, and lender relationships.

What is a Direct Car Loan?

A direct car loan is a type of financing obtained directly from a lender such as a bank, credit union, or online financial institution, allowing buyers to negotiate terms without dealer involvement. This loan offers competitive interest rates and flexible repayment schedules tailored to the borrower's credit profile and financial needs. Direct loans provide transparency in fees and terms, enabling borrowers to make informed decisions when purchasing a vehicle.

What is an Indirect Car Loan?

An indirect car loan is a financing option where the borrower obtains the loan through a dealership that works with various lenders on their behalf. The dealer acts as an intermediary, facilitating the loan process and often presenting multiple financing offers from different financial institutions. This type of loan can simplify borrowing but may include higher interest rates compared to direct loans, due to dealer markups and fees.

Key Differences Between Direct and Indirect Car Loans

Direct car loans involve borrowing funds directly from a bank, credit union, or online lender, offering lower interest rates and greater transparency. Indirect car loans are arranged through the dealership, often including higher interest rates due to dealer markup and less negotiation flexibility. Key differences also include control over loan terms, with direct loans providing borrowers the ability to shop around, while indirect loans simplify the process by bundling financing with the vehicle purchase.

Pros and Cons of Direct Car Loans

Direct car loans offer lower interest rates and simplified approval processes by financing through lenders such as banks or credit unions, resulting in cost savings for borrowers. However, they may require more effort from the buyer to negotiate terms and lack the immediate convenience of dealership financing. Borrowers benefit from greater transparency and potential for better loan terms but might face longer approval times compared to indirect loans.

Pros and Cons of Indirect Car Loans

Indirect car loans offer the convenience of financing through the dealership, often simplifying the purchasing process and providing promotional rates. However, they may carry higher interest rates compared to direct loans from banks or credit unions, increasing the overall cost of the vehicle. Borrowers should carefully compare loan terms and total repayment amounts to avoid potentially costly indirect financing options.

Interest Rates: Direct vs Indirect Car Loans

Direct car loans typically offer lower interest rates as they involve borrowing funds directly from banks or credit unions, eliminating intermediaries and reducing overhead costs. Indirect car loans, obtained through car dealerships, often carry higher interest rates due to added dealer markups and lender fees embedded in the loan agreement. Comparing APRs from both sources reveals that direct loans usually provide more favorable financing terms and potential savings over the loan term.

Application Process Comparison

Direct loans typically involve applying directly through a financial institution or government agency, resulting in a streamlined application process with fewer intermediaries and faster approval times. Indirect loans require coordination with a third party, such as a dealership or broker, which can introduce additional steps, increased paperwork, and potential delays due to the involvement of multiple parties. Comparing application processes, direct loans provide more transparency and control for borrowers, while indirect loans may offer convenience but often involve more complex approval procedures.

Which Loan Type is Best for You?

Choosing between a direct loan and an indirect loan depends on factors like interest rates, lender flexibility, and convenience. Direct loans, offered directly by financial institutions, often provide lower interest rates and transparent terms, while indirect loans, arranged through intermediaries like dealerships or brokers, may offer easier qualification but higher costs. Evaluating your credit score, repayment capacity, and loan purpose helps determine the best loan type tailored to your financial needs.

Conclusion: Choosing Between Direct and Indirect Car Loans

Direct loans often provide lower interest rates and faster approval by eliminating intermediaries, making them ideal for borrowers seeking cost efficiency and transparency. Indirect loans, offered through dealerships, can provide convenience and promotional incentives but may involve higher interest rates and less flexible terms. Choosing between direct and indirect car loans depends on your priority for cost savings versus ease of process and immediate accessibility.

Direct Loan vs Indirect Loan Infographic

cardiffo.com

cardiffo.com