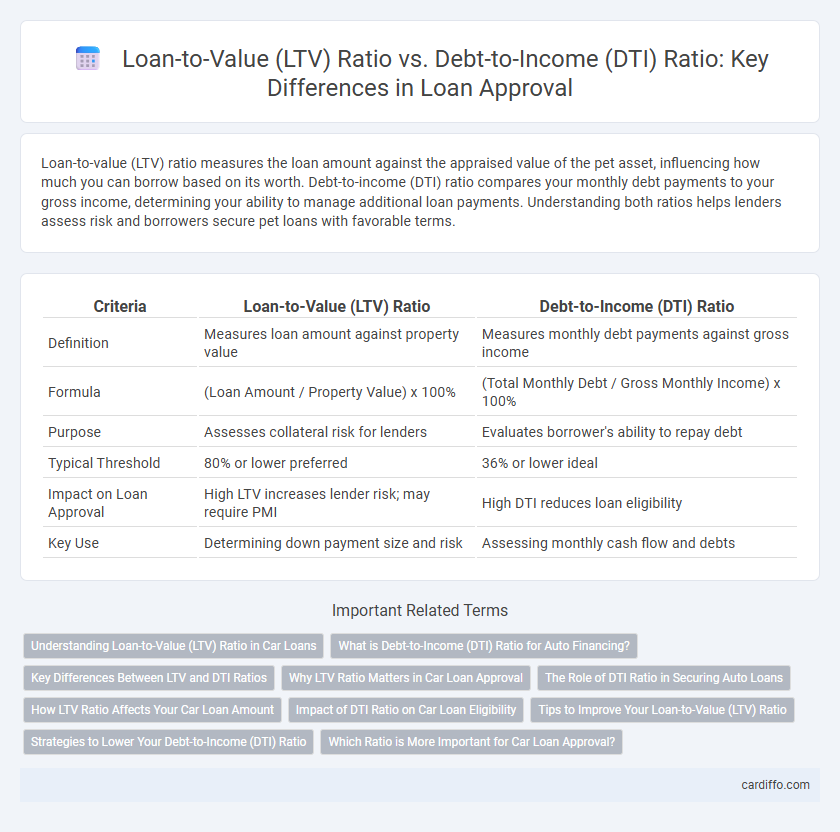

Loan-to-value (LTV) ratio measures the loan amount against the appraised value of the pet asset, influencing how much you can borrow based on its worth. Debt-to-income (DTI) ratio compares your monthly debt payments to your gross income, determining your ability to manage additional loan payments. Understanding both ratios helps lenders assess risk and borrowers secure pet loans with favorable terms.

Table of Comparison

| Criteria | Loan-to-Value (LTV) Ratio | Debt-to-Income (DTI) Ratio |

|---|---|---|

| Definition | Measures loan amount against property value | Measures monthly debt payments against gross income |

| Formula | (Loan Amount / Property Value) x 100% | (Total Monthly Debt / Gross Monthly Income) x 100% |

| Purpose | Assesses collateral risk for lenders | Evaluates borrower's ability to repay debt |

| Typical Threshold | 80% or lower preferred | 36% or lower ideal |

| Impact on Loan Approval | High LTV increases lender risk; may require PMI | High DTI reduces loan eligibility |

| Key Use | Determining down payment size and risk | Assessing monthly cash flow and debts |

Understanding Loan-to-Value (LTV) Ratio in Car Loans

The Loan-to-Value (LTV) ratio in car loans measures the loan amount relative to the vehicle's appraised value or purchase price, indicating the lender's risk exposure. A lower LTV ratio often results in better loan terms and interest rates, as it signals less risk for lenders. Unlike the Debt-to-Income (DTI) ratio, which assesses a borrower's overall financial capacity, LTV specifically evaluates the collateral value against the loan amount in auto financing.

What is Debt-to-Income (DTI) Ratio for Auto Financing?

Debt-to-Income (DTI) ratio for auto financing measures the percentage of a borrower's gross monthly income allocated to debt payments, including the new auto loan. Lenders use DTI to evaluate the borrower's ability to manage monthly payments and assess credit risk, with acceptable DTI ratios typically below 43%. A low DTI ratio improves the chances of loan approval and may result in better interest rates on auto financing.

Key Differences Between LTV and DTI Ratios

Loan-to-value (LTV) ratio measures the loan amount relative to the appraised value of the property, indicating the risk level for lenders based on collateral value. Debt-to-income (DTI) ratio compares a borrower's total monthly debt payments to their gross monthly income, assessing the borrower's ability to manage monthly payments. LTV focuses on property value risk, while DTI evaluates personal financial capacity, both crucial for loan approval decisions.

Why LTV Ratio Matters in Car Loan Approval

LTV ratio measures the loan amount against the vehicle's appraised value, directly impacting approval odds by indicating lender risk exposure. A lower LTV ratio suggests the borrower has more equity, reducing lender risk and often leading to better interest rates or loan terms. Unlike DTI ratio, which assesses overall borrower debt capacity, LTV focuses specifically on collateral value, making it crucial for car loan underwriting decisions.

The Role of DTI Ratio in Securing Auto Loans

The Debt-to-Income (DTI) ratio is a critical metric lenders use to evaluate a borrower's ability to manage monthly payments relative to income when securing auto loans. A lower DTI ratio typically increases the likelihood of loan approval and favorable interest rates by demonstrating sufficient income to cover new and existing debt obligations. While the Loan-to-Value (LTV) ratio assesses the auto loan amount compared to the vehicle's value, the DTI ratio underscores overall financial health by limiting overextension of debt.

How LTV Ratio Affects Your Car Loan Amount

The Loan-to-Value (LTV) ratio directly impacts the maximum car loan amount you can secure, as lenders use it to determine the loan size relative to the vehicle's value. A lower LTV ratio often results in higher loan approval chances and better interest rates because it indicates less risk for the lender. Unlike the Debt-to-Income (DTI) ratio, which assesses overall debt burden, the LTV ratio specifically influences loan amounts based on the car's market price.

Impact of DTI Ratio on Car Loan Eligibility

The Debt-to-Income (DTI) ratio significantly impacts car loan eligibility by measuring the borrower's ability to manage monthly payments relative to their income. Lenders typically prefer a DTI ratio below 36%, ensuring borrowers can afford new debt without financial strain. A low DTI ratio increases the likelihood of loan approval and may result in more favorable interest rates on the car loan.

Tips to Improve Your Loan-to-Value (LTV) Ratio

Improving your Loan-to-Value (LTV) ratio increases your chances of loan approval and securing better interest rates. Make a larger down payment, reduce the loan amount, and consider increasing your property's value through renovations or upgrades. Maintaining a strong credit score and keeping existing debts low indirectly support a favorable LTV by strengthening your overall financial profile.

Strategies to Lower Your Debt-to-Income (DTI) Ratio

Reducing your Debt-to-Income (DTI) ratio enhances loan approval chances and improves financial health by lowering monthly debt obligations or increasing gross income. Strategies to lower DTI include paying down high-interest credit card balances, consolidating debts into lower-interest loans, and avoiding new debt before applying for a loan. Increasing income through side jobs or bonuses also positively impacts the DTI ratio, making you a more favorable candidate for lenders compared to solely focusing on the Loan-to-Value (LTV) ratio.

Which Ratio is More Important for Car Loan Approval?

The Loan-to-Value (LTV) ratio is more crucial for car loan approval as it directly measures the loan amount against the vehicle's value, influencing lender risk exposure. While the Debt-to-Income (DTI) ratio assesses a borrower's overall ability to manage monthly payments, lenders prioritize LTV to determine the collateral value and potential loss in default. A lower LTV ratio often results in better loan terms and higher approval chances for auto financing.

Loan-to-value (LTV) ratio vs Debt-to-income (DTI) ratio Infographic

cardiffo.com

cardiffo.com