Online lenders provide faster approval and more flexible terms compared to traditional lenders, making them ideal for borrowers seeking quick access to funds. Traditional lenders often offer lower interest rates and more personalized service due to their established reputation and regulatory oversight. Choosing the right lender depends on the borrower's priorities regarding speed, cost, and customer experience.

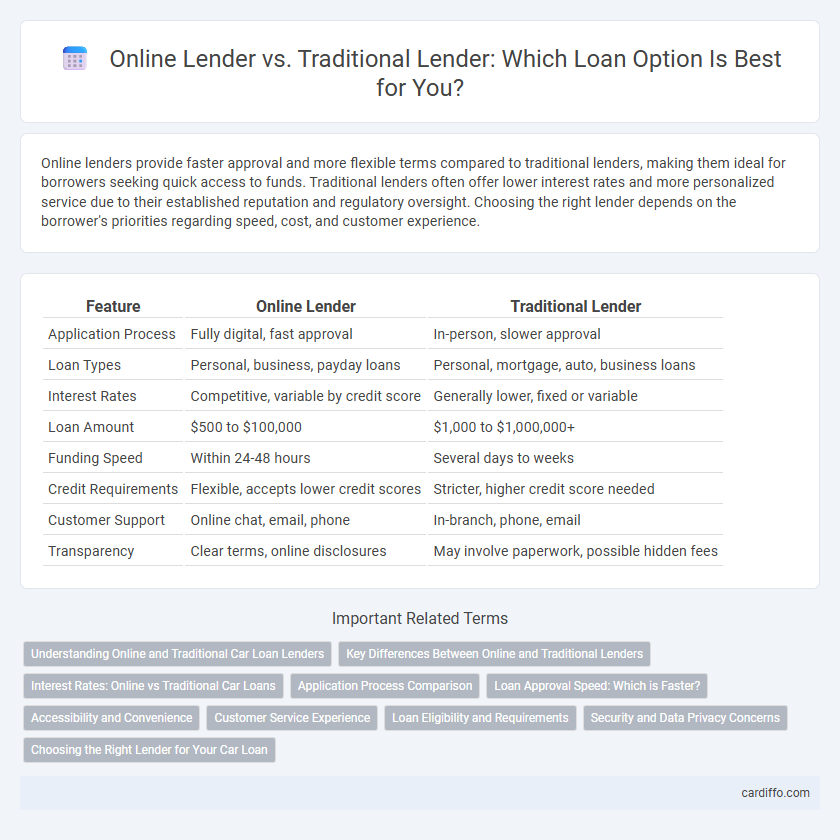

Table of Comparison

| Feature | Online Lender | Traditional Lender |

|---|---|---|

| Application Process | Fully digital, fast approval | In-person, slower approval |

| Loan Types | Personal, business, payday loans | Personal, mortgage, auto, business loans |

| Interest Rates | Competitive, variable by credit score | Generally lower, fixed or variable |

| Loan Amount | $500 to $100,000 | $1,000 to $1,000,000+ |

| Funding Speed | Within 24-48 hours | Several days to weeks |

| Credit Requirements | Flexible, accepts lower credit scores | Stricter, higher credit score needed |

| Customer Support | Online chat, email, phone | In-branch, phone, email |

| Transparency | Clear terms, online disclosures | May involve paperwork, possible hidden fees |

Understanding Online and Traditional Car Loan Lenders

Online car loan lenders offer fast approval processes, competitive interest rates, and convenient digital applications, making them ideal for tech-savvy borrowers seeking quick financing solutions. Traditional lenders, such as banks and credit unions, provide personalized service, potentially lower interest rates for well-qualified borrowers, and face-to-face consultations that help build long-term financial relationships. Comparing factors like loan terms, customer service, and eligibility criteria is essential to determine the best choice between online and traditional car loan lenders.

Key Differences Between Online and Traditional Lenders

Online lenders offer faster loan approvals and disbursements through automated digital platforms, while traditional lenders typically require in-person visits and longer processing times. Interest rates for online lenders can be more competitive due to lower overhead costs, whereas traditional lenders often provide personalized service and access to a wider range of loan products. Online lenders emphasize convenience and flexibility, whereas traditional lenders prioritize face-to-face interactions and established credit assessment practices.

Interest Rates: Online vs Traditional Car Loans

Online lenders often offer lower interest rates on car loans compared to traditional lenders due to reduced overhead costs and streamlined application processes. Traditional lenders may have higher rates but provide personalized service and established trust, which can affect a borrower's decision. Interest rates for online car loans typically range from 3% to 7%, whereas traditional lenders often charge between 4% and 9%, depending on credit score and loan terms.

Application Process Comparison

Online lenders offer a streamlined loan application process with fully digital forms, instant pre-approvals, and automated document submission, reducing the waiting time significantly compared to traditional lenders. Traditional lenders often require in-person visits, paper documentation, and manual credit evaluations, extending the approval duration from several days to weeks. The convenience and speed of online lenders make them a preferred choice for borrowers seeking quick access to funds.

Loan Approval Speed: Which is Faster?

Online lenders typically offer faster loan approval speeds, often providing decisions within minutes to a few hours due to automated underwriting and digital application processes. Traditional lenders usually take several days to weeks as they rely on manual reviews and extensive documentation verification. Faster approval from online lenders benefits borrowers needing quick access to funds, while traditional lenders may offer more personalized service despite longer wait times.

Accessibility and Convenience

Online lenders offer unparalleled accessibility and convenience by enabling borrowers to apply for loans anytime and anywhere using digital platforms, eliminating the need for physical branch visits. Traditional lenders often require in-person meetings and extensive paperwork, which can delay the loan approval process and limit access for individuals in remote areas. Digital tools provided by online lenders expedite approvals and funding, making them a preferred choice for borrowers seeking quick and easy loan access.

Customer Service Experience

Online lenders offer 24/7 customer service through live chat, email, and phone support, providing quick responses and easy access to account information. Traditional lenders typically provide in-person consultations and personalized assistance, fostering stronger relationships and clearer communication. Customer service preferences depend on the borrower's need for convenience versus personalized support.

Loan Eligibility and Requirements

Online lenders typically offer more flexible loan eligibility criteria, often requiring minimal documentation and faster application processes compared to traditional lenders. Traditional lenders generally have stricter credit score requirements, detailed income verification, and longer approval times due to extensive underwriting practices. Borrowers with lower credit scores or irregular income sources may find online lenders more accessible, while those seeking larger loan amounts or favorable interest rates might prefer traditional institutions.

Security and Data Privacy Concerns

Online lenders implement advanced encryption protocols and multi-factor authentication to protect borrower data, but concerns about data breaches and third-party data sharing persist. Traditional lenders often have established security frameworks and regulatory compliance histories, offering borrowers a perceived higher level of data protection. Both types of lenders must navigate evolving cybersecurity threats and privacy regulations to maintain trust and safeguard sensitive financial information.

Choosing the Right Lender for Your Car Loan

Online lenders offer faster approval processes and competitive interest rates for car loans, making them ideal for borrowers seeking convenience and efficiency. Traditional lenders, such as banks and credit unions, provide personalized service and may offer lower rates to borrowers with strong credit profiles. Evaluating factors like loan terms, fees, customer service, and your credit score helps determine the best lender for your specific car loan needs.

Online Lender vs Traditional Lender Infographic

cardiffo.com

cardiffo.com