Underwater loans occur when the outstanding mortgage balance exceeds the property's current market value, causing negative equity. Positive equity loans happen when the home's value surpasses the loan amount, offering homeowners more financial flexibility and better refinancing options. Navigating these loan types requires understanding their impact on loan terms, interest rates, and potential refinancing strategies.

Table of Comparison

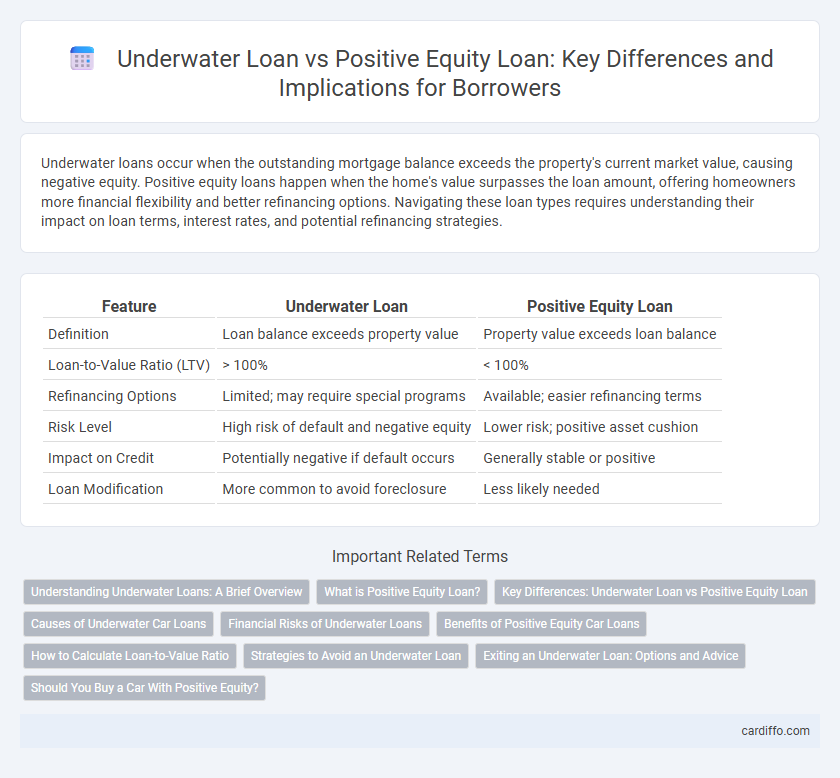

| Feature | Underwater Loan | Positive Equity Loan |

|---|---|---|

| Definition | Loan balance exceeds property value | Property value exceeds loan balance |

| Loan-to-Value Ratio (LTV) | > 100% | < 100% |

| Refinancing Options | Limited; may require special programs | Available; easier refinancing terms |

| Risk Level | High risk of default and negative equity | Lower risk; positive asset cushion |

| Impact on Credit | Potentially negative if default occurs | Generally stable or positive |

| Loan Modification | More common to avoid foreclosure | Less likely needed |

Understanding Underwater Loans: A Brief Overview

An underwater loan occurs when the outstanding mortgage balance exceeds the property's current market value, leading to negative equity for the borrower. Positive equity loans reflect a situation where the property's market value surpasses the remaining loan balance, offering better financial flexibility. Understanding underwater loans is crucial for assessing risks such as difficulty refinancing or selling the property without incurring losses.

What is Positive Equity Loan?

A Positive Equity Loan occurs when the current market value of a property exceeds the outstanding mortgage balance, allowing homeowners to access the difference as available equity. This equity can be utilized for home improvements, debt consolidation, or other financial needs, offering greater financial flexibility. Understanding the key distinction between Positive Equity Loans and Underwater Loans, where the mortgage surpasses the property value, is crucial for making informed lending decisions.

Key Differences: Underwater Loan vs Positive Equity Loan

Underwater loans occur when the outstanding mortgage balance exceeds the current market value of the property, resulting in negative equity. Positive equity loans exist when the property's market value surpasses the mortgage balance, allowing homeowners to potentially access home equity for refinancing or borrowing purposes. Key differences include financial risk exposure, refinancing options, and the impact on a homeowner's ability to sell or leverage the property.

Causes of Underwater Car Loans

Underwater car loans occur when the outstanding loan balance exceeds the vehicle's current market value, often caused by rapid depreciation, negative equity from trade-ins, or low down payments. High-interest rates and extended loan terms amplify the risk of owing more than the car is worth. Market fluctuations and poor credit can further deepen underwater loan situations, impacting borrowers' financial stability.

Financial Risks of Underwater Loans

Underwater loans occur when the outstanding mortgage balance exceeds the current market value of the property, leading to negative equity and increased financial vulnerability. Homeowners with underwater loans face higher risks of default and foreclosure due to limited options for refinancing or selling without incurring a loss. This negative equity situation can exacerbate financial instability, affecting credit scores and long-term wealth accumulation.

Benefits of Positive Equity Car Loans

Positive equity car loans offer lower interest rates and improved approval chances compared to underwater loans, as the vehicle's market value exceeds the remaining loan balance. Borrowers benefit from increased equity, which provides greater financial flexibility, easier refinancing options, and the potential to trade or sell the car without rolling negative equity into a new loan. These advantages reduce the risk of default and support better credit management throughout the loan term.

How to Calculate Loan-to-Value Ratio

Loan-to-Value (LTV) ratio is calculated by dividing the outstanding loan balance by the current market value of the property and multiplying by 100 to express it as a percentage. An underwater loan occurs when the LTV ratio exceeds 100%, indicating the loan amount is greater than the property's market value, whereas a positive equity loan has an LTV ratio below 100%, meaning the property value is higher than the loan balance. Accurately determining LTV ratio requires up-to-date property appraisals and precise loan balance figures.

Strategies to Avoid an Underwater Loan

Homeowners can avoid underwater loans by consistently making extra principal payments to reduce the loan balance faster than the depreciation of the property value. Refinancing when interest rates drop or property values stabilize also helps maintain positive equity. Regularly monitoring local real estate market trends enables proactive adjustments to loan terms and prevents negative equity situations.

Exiting an Underwater Loan: Options and Advice

Exiting an underwater loan, where the mortgage balance exceeds the property's market value, requires strategic options such as loan modification, refinancing through a government program, or a short sale to mitigate financial loss. Positive equity loans, by contrast, offer more flexibility for refinancing or selling due to the home's value exceeding the loan amount, often reducing default risk. Borrowers should consult with financial advisors to evaluate eligibility for relief programs and to understand the long-term impact on credit and equity.

Should You Buy a Car With Positive Equity?

Buying a car with positive equity provides financial advantages such as easier loan approval and lower interest rates compared to underwater loans where the vehicle's value is less than the owed loan amount. Positive equity loans reduce the risk of owing more than the car's worth, making it a safer investment and potentially allowing for trade-ins or refinancing options. Ensuring your loan remains in positive equity improves long-term financial stability and asset management.

Underwater Loan vs Positive Equity Loan Infographic

cardiffo.com

cardiffo.com