A balloon payment loan requires a large lump sum payment at the end of the term, resulting in lower monthly installments but a significant final payment, making it ideal for borrowers expecting increased future income or refinancing options. In contrast, a fully amortizing loan spreads payments evenly over the loan term, covering both principal and interest, ensuring the loan is completely paid off by the end without any large outstanding balance. Choosing between these loans depends on cash flow preferences and the borrower's ability to manage substantial end-of-term payments.

Table of Comparison

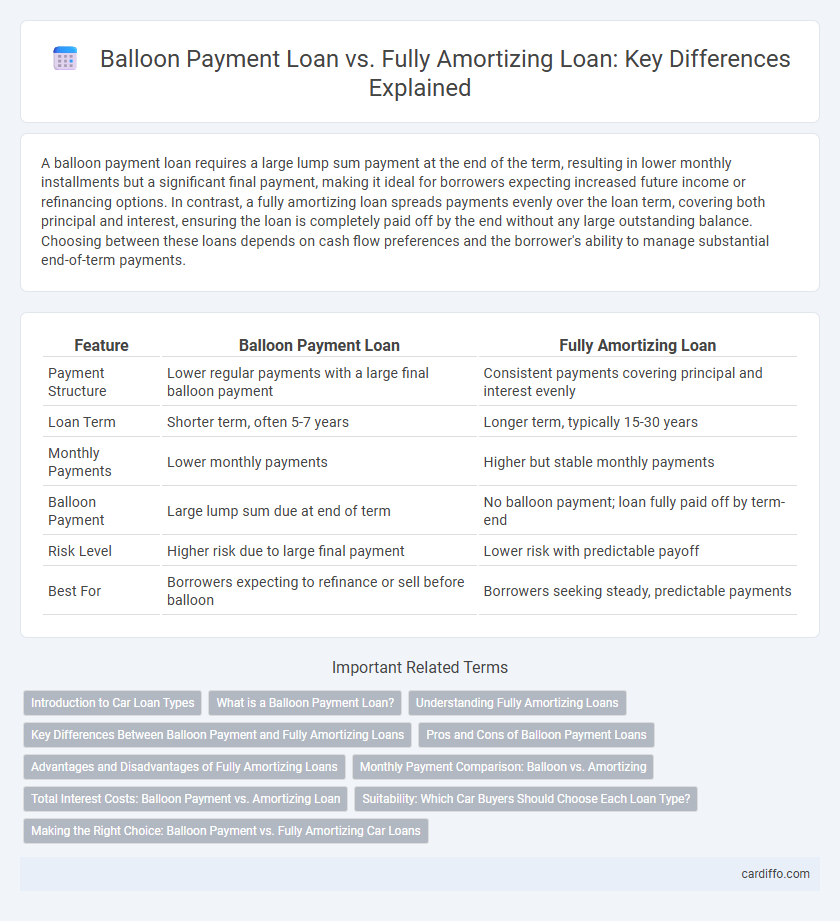

| Feature | Balloon Payment Loan | Fully Amortizing Loan |

|---|---|---|

| Payment Structure | Lower regular payments with a large final balloon payment | Consistent payments covering principal and interest evenly |

| Loan Term | Shorter term, often 5-7 years | Longer term, typically 15-30 years |

| Monthly Payments | Lower monthly payments | Higher but stable monthly payments |

| Balloon Payment | Large lump sum due at end of term | No balloon payment; loan fully paid off by term-end |

| Risk Level | Higher risk due to large final payment | Lower risk with predictable payoff |

| Best For | Borrowers expecting to refinance or sell before balloon | Borrowers seeking steady, predictable payments |

Introduction to Car Loan Types

Car loans typically fall into two main categories: balloon payment loans and fully amortizing loans. Balloon payment loans require lower monthly payments with a large lump sum due at the end of the term, often used for buyers preferring flexibility or lower initial costs. Fully amortizing loans spread the loan balance evenly over the term, resulting in consistent monthly payments that cover both principal and interest, providing predictable budgeting for car buyers.

What is a Balloon Payment Loan?

A balloon payment loan is a type of loan where the borrower makes smaller regular payments over the loan term, followed by a large lump-sum payment at the end, known as the balloon payment. This structure allows for lower monthly payments compared to fully amortizing loans but requires the borrower to refinance, sell the property, or make the large final payment to avoid default. Balloon payment loans are common in mortgages and commercial financing, often benefiting borrowers with short-term cash flow needs or expecting increased income before the balloon payment is due.

Understanding Fully Amortizing Loans

Fully amortizing loans require consistent monthly payments that cover both principal and interest, ensuring the loan balance reaches zero by the end of the term. These loans provide predictable payment schedules, reducing the risk of a large lump-sum payment at maturity. Understanding the amortization schedule helps borrowers manage cash flow and plan long-term financial obligations effectively.

Key Differences Between Balloon Payment and Fully Amortizing Loans

Balloon payment loans feature lower monthly payments with a large lump sum due at the end of the term, affecting cash flow and interest accumulation. Fully amortizing loans require equal monthly payments that cover both principal and interest, ensuring the loan is paid off by the maturity date. Key differences include payment structure, total interest cost, and risk exposure related to the final payment amount.

Pros and Cons of Balloon Payment Loans

Balloon payment loans offer lower monthly payments by deferring a large lump sum payment until the end of the term, which can improve short-term cash flow for borrowers. However, the significant final balloon payment poses a risk of refinancing challenges or large financial strain if the borrower cannot secure funds at maturity. Unlike fully amortizing loans that gradually eliminate the principal and interest through consistent payments, balloon loans require careful planning to manage the end-of-term payment obligations.

Advantages and Disadvantages of Fully Amortizing Loans

Fully amortizing loans offer the advantage of predictable monthly payments that cover both principal and interest, ensuring the loan is paid off within the agreed term without a large final payment. This structure reduces the risk of refinancing at potentially higher interest rates, providing financial stability and easier budgeting for borrowers. However, these loans typically have higher monthly payments than balloon payment loans, which may limit affordability for some borrowers.

Monthly Payment Comparison: Balloon vs. Amortizing

Monthly payments for balloon payment loans are typically lower than fully amortizing loans because borrowers only pay interest or a small portion of principal during the term, with a large lump sum due at maturity. Fully amortizing loans feature higher monthly payments that cover both principal and interest, fully paying off the loan by the end of the term. This results in predictable monthly costs for amortizing loans, while balloon loans may pose payment challenges when the balloon amount becomes due.

Total Interest Costs: Balloon Payment vs. Amortizing Loan

Balloon payment loans often result in higher total interest costs compared to fully amortizing loans due to the large lump-sum payment at the end, which may accrue significant interest over the loan term. Fully amortizing loans distribute principal and interest evenly across monthly payments, reducing overall interest expense by steadily lowering the outstanding principal balance. Borrowers seeking to minimize long-term interest typically benefit from fully amortizing loans, while balloon loans may initially offer lower payments but increase total interest risk.

Suitability: Which Car Buyers Should Choose Each Loan Type?

Balloon payment loans suit car buyers seeking lower monthly payments and planning to sell or refinance before the balloon payment is due, often appealing to those with short-term ownership plans or fluctuating income. Fully amortizing loans fit buyers preferring predictable monthly payments and full ownership of the vehicle by the loan's end, ideal for long-term owners aiming to avoid large lump-sum payments. Choosing between these depends on financial stability, ownership duration, and the borrower's ability to manage a significant payment at the loan term's conclusion.

Making the Right Choice: Balloon Payment vs. Fully Amortizing Car Loans

Choosing between balloon payment loans and fully amortizing car loans hinges on your financial goals and cash flow management. Balloon loans offer lower monthly payments with a large lump sum due at the end, ideal for buyers expecting a future cash influx or refinancing options. Fully amortizing loans spread payments evenly over the loan term, eliminating large final payments and providing predictable budgeting for long-term financial stability.

Balloon Payment Loan vs Fully Amortizing Loan Infographic

cardiffo.com

cardiffo.com