Buy Here Pay Here dealerships offer in-house financing, allowing buyers with poor credit to purchase vehicles without going through banks, but often at higher interest rates and limited vehicle selection. Traditional auto loans typically provide lower interest rates, longer terms, and a wider range of car choices, requiring credit checks and more stringent approval processes. Evaluating individual financial situations and credit profiles helps determine the best loan option for vehicle purchase.

Table of Comparison

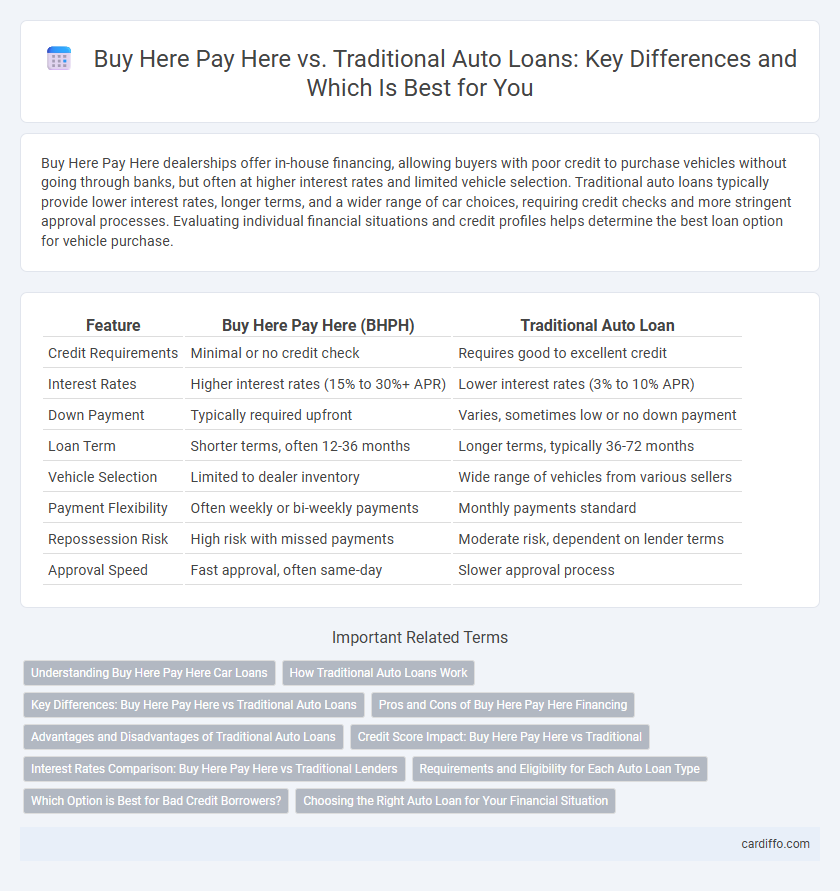

| Feature | Buy Here Pay Here (BHPH) | Traditional Auto Loan |

|---|---|---|

| Credit Requirements | Minimal or no credit check | Requires good to excellent credit |

| Interest Rates | Higher interest rates (15% to 30%+ APR) | Lower interest rates (3% to 10% APR) |

| Down Payment | Typically required upfront | Varies, sometimes low or no down payment |

| Loan Term | Shorter terms, often 12-36 months | Longer terms, typically 36-72 months |

| Vehicle Selection | Limited to dealer inventory | Wide range of vehicles from various sellers |

| Payment Flexibility | Often weekly or bi-weekly payments | Monthly payments standard |

| Repossession Risk | High risk with missed payments | Moderate risk, dependent on lender terms |

| Approval Speed | Fast approval, often same-day | Slower approval process |

Understanding Buy Here Pay Here Car Loans

Buy Here Pay Here (BHPH) car loans offer direct financing through the dealership, bypassing traditional lenders and catering to buyers with poor credit or no credit history. BHPH loans often require larger down payments and higher interest rates compared to traditional auto loans, but they provide flexible approval processes and in-house payment options. Understanding the terms, interest rates, and potential fees of BHPH loans is crucial to avoid higher overall costs and repossession risks.

How Traditional Auto Loans Work

Traditional auto loans involve borrowing a fixed amount from banks, credit unions, or online lenders to purchase a vehicle, with repayment over a set term typically ranging from 36 to 72 months. These loans require a good to excellent credit score to qualify for competitive interest rates, which are determined based on creditworthiness, loan amount, and loan duration. Monthly payments consist of principal and interest, and borrowers may face penalties for prepayment or late payments, ensuring lenders manage risk effectively.

Key Differences: Buy Here Pay Here vs Traditional Auto Loans

Buy Here Pay Here (BHPH) loans provide in-house financing directly through the dealership, often catering to buyers with poor credit by offering easier approval but higher interest rates. Traditional auto loans require approval through banks or credit unions, typically offering lower interest rates and more flexible repayment terms due to more rigorous credit evaluations. BHPH loans usually involve smaller loan amounts with higher risk, while traditional loans support a wider range of vehicle prices and borrower credit profiles.

Pros and Cons of Buy Here Pay Here Financing

Buy Here Pay Here (BHPH) financing offers easier approval for buyers with poor credit by allowing in-house loan servicing, but it typically comes with higher interest rates and limited vehicle selection compared to traditional auto loans. BHPH dealerships often require larger down payments and shorter repayment terms, increasing monthly costs and risk of repossession. While BHPH provides convenience and accessibility, traditional auto loans tend to offer better interest rates, flexible terms, and greater consumer protections.

Advantages and Disadvantages of Traditional Auto Loans

Traditional auto loans offer lower interest rates and longer repayment terms compared to Buy Here Pay Here financing, making them more affordable for buyers with good credit. Borrowers benefit from flexible lender options, including banks and credit unions, which often provide competitive rates and better customer service. However, traditional auto loans require stronger credit approval, involve extensive credit checks, and may have stricter documentation requirements, making them less accessible to individuals with poor credit or limited financial history.

Credit Score Impact: Buy Here Pay Here vs Traditional

Buy Here Pay Here dealerships often approve auto loans with minimal credit checks, which means they have less impact on credit scores initially compared to traditional auto loans that require thorough credit evaluations. Traditional loans typically report payment histories to major credit bureaus, positively influencing credit scores when payments are made on time, whereas Buy Here Pay Here loans may not always report to credit bureaus, limiting credit-building opportunities. Choosing a traditional auto loan generally provides better potential for credit score improvement through consistent, documented payments.

Interest Rates Comparison: Buy Here Pay Here vs Traditional Lenders

Interest rates for Buy Here Pay Here (BHPH) loans typically range between 15% and 30%, significantly higher than traditional auto loans, which average around 4% to 8% for borrowers with good credit. BHPH dealerships offer in-house financing, often targeting buyers with poor credit or no credit history, which explains the elevated interest rates to offset higher risk. Traditional lenders, including banks and credit unions, provide more competitive rates due to stricter qualification criteria and lower default risk.

Requirements and Eligibility for Each Auto Loan Type

Buy Here Pay Here (BHPH) loans typically require minimal credit checks and proof of income, making them accessible to borrowers with poor or no credit history, while Traditional Auto Loans demand a good credit score, stable income, and thorough financial documentation. BHPH dealerships often require a down payment and proof of residence, whereas Traditional lenders assess debt-to-income ratio and creditworthiness more rigorously. Eligibility for Traditional Auto Loans improves with higher credit scores, steady employment, and verified assets, contrasting with the more flexible but higher-interest terms common in BHPH financing.

Which Option is Best for Bad Credit Borrowers?

Buy Here Pay Here (BHPH) dealerships cater to bad credit borrowers by offering in-house financing with flexible approval criteria, avoiding credit checks that traditional auto lenders require. Traditional auto loans generally provide lower interest rates and better terms but often reject applicants with poor credit scores below 600. Bad credit borrowers seeking faster approval and less stringent credit requirements may benefit more from BHPH, while those aiming for lower overall costs should work on improving their credit to qualify for traditional auto loans.

Choosing the Right Auto Loan for Your Financial Situation

Buy Here Pay Here dealerships offer in-house financing that suits buyers with poor credit or limited credit history, providing flexible terms directly through the seller. Traditional auto loans through banks or credit unions typically offer lower interest rates and longer repayment periods, benefiting those with good credit scores and stable income. Evaluating credit standing, interest rates, down payment capacity, and repayment flexibility helps determine the best auto loan option for your financial situation.

Buy Here Pay Here vs Traditional Auto Loan Infographic

cardiffo.com

cardiffo.com