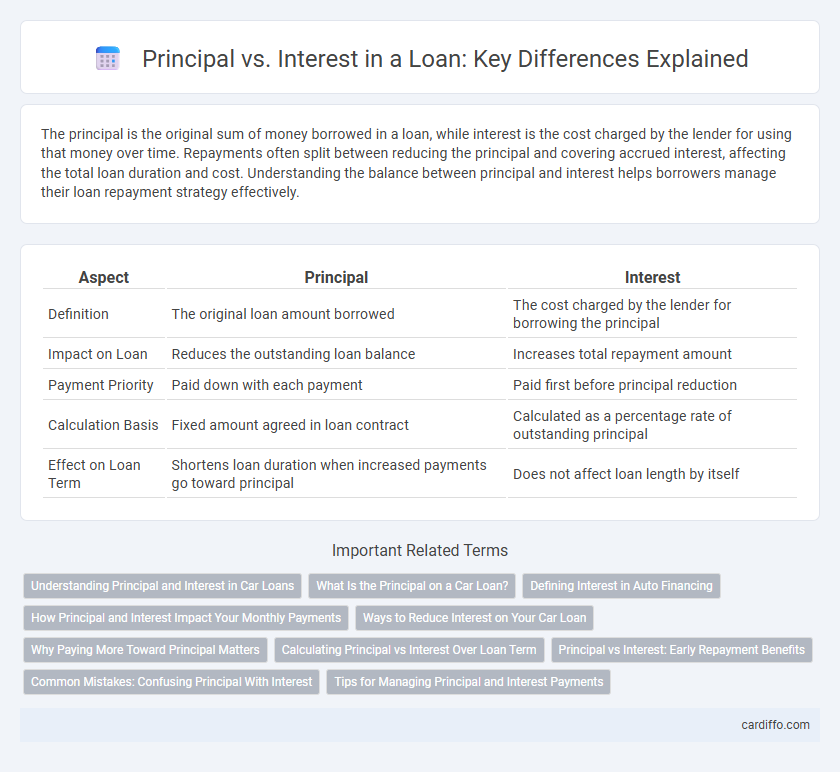

The principal is the original sum of money borrowed in a loan, while interest is the cost charged by the lender for using that money over time. Repayments often split between reducing the principal and covering accrued interest, affecting the total loan duration and cost. Understanding the balance between principal and interest helps borrowers manage their loan repayment strategy effectively.

Table of Comparison

| Aspect | Principal | Interest |

|---|---|---|

| Definition | The original loan amount borrowed | The cost charged by the lender for borrowing the principal |

| Impact on Loan | Reduces the outstanding loan balance | Increases total repayment amount |

| Payment Priority | Paid down with each payment | Paid first before principal reduction |

| Calculation Basis | Fixed amount agreed in loan contract | Calculated as a percentage rate of outstanding principal |

| Effect on Loan Term | Shortens loan duration when increased payments go toward principal | Does not affect loan length by itself |

Understanding Principal and Interest in Car Loans

Understanding the principal and interest in car loans is essential for managing repayment effectively. The principal represents the original loan amount borrowed to purchase the vehicle, while interest is the cost charged by the lender for borrowing the principal. Focusing on paying down the principal early can reduce the total interest paid over the life of the car loan, lowering overall financing costs.

What Is the Principal on a Car Loan?

The principal on a car loan is the original amount of money borrowed from the lender to purchase the vehicle, excluding any interest or fees. It represents the core debt that the borrower must repay before interest accrual affects the balance. Understanding the principal helps borrowers track how much of their monthly payments reduce the loan balance versus the interest cost.

Defining Interest in Auto Financing

Interest in auto financing represents the cost a borrower pays to the lender for the use of the loan amount, expressed as a percentage of the principal. It accrues over the loan term and directly affects the total repayment cost, making it crucial to understand the interest rate and how it impacts monthly payments. Principal refers to the original loan amount borrowed, while interest is the extra charge calculated on this principal balance.

How Principal and Interest Impact Your Monthly Payments

The principal amount directly determines the base loan balance that must be repaid, while the interest rate affects the cost of borrowing over time. Higher principal leads to larger monthly payments, whereas higher interest rates increase the portion of each payment allocated to interest rather than reducing the principal. Understanding the balance between principal and interest enables better management of monthly loan payments and overall borrowing costs.

Ways to Reduce Interest on Your Car Loan

Lowering the interest on your car loan can significantly reduce the total repayment amount and shorten the loan term. Strategies include making a larger down payment to decrease the principal balance, opting for a shorter loan tenure with higher monthly payments, and improving credit scores to secure lower interest rates. Refinancing at a lower rate and making extra payments directly toward the principal are effective tactics to minimize interest accrual over time.

Why Paying More Toward Principal Matters

Paying more toward the principal of a loan reduces the outstanding balance faster, lowering total interest charges over the life of the loan. This strategy shortens the loan term, allowing borrowers to become debt-free sooner and improve their credit utilization ratio. Reducing principal early can save thousands of dollars by minimizing cumulative interest payments.

Calculating Principal vs Interest Over Loan Term

Calculating principal versus interest over a loan term involves understanding that each payment partly reduces the loan's outstanding principal while covering interest on the remaining balance. Early in the loan, interest payments are higher due to the larger principal amount, but as repayments continue, the principal portion increases and interest decreases. Using amortization schedules or loan calculators helps accurately determine these shifting amounts for effective financial planning.

Principal vs Interest: Early Repayment Benefits

Paying down the principal early reduces the overall interest accrued on a loan by decreasing the outstanding balance faster. Early repayment minimizes the total loan term and can substantially cut the total interest costs, resulting in significant savings. Focusing on principal payments first accelerates debt elimination and improves financial flexibility.

Common Mistakes: Confusing Principal With Interest

Confusing principal with interest is a common mistake that can lead to miscalculations in loan payments and overall debt management. Principal represents the original loan amount borrowed, while interest is the cost charged by the lender for borrowing that money, calculated as a percentage of the principal. Misunderstanding these key components often results in borrowers paying more interest over time or failing to accurately track how much of their payment reduces the loan balance.

Tips for Managing Principal and Interest Payments

Prioritize extra payments toward the principal balance to reduce the overall interest paid and shorten the loan term. Set up automatic payments to ensure timely interest coverage and avoid late fees that can increase total loan costs. Regularly review your loan statements to track how much goes toward principal versus interest and adjust your payment strategy accordingly.

Principal vs Interest Infographic

cardiffo.com

cardiffo.com