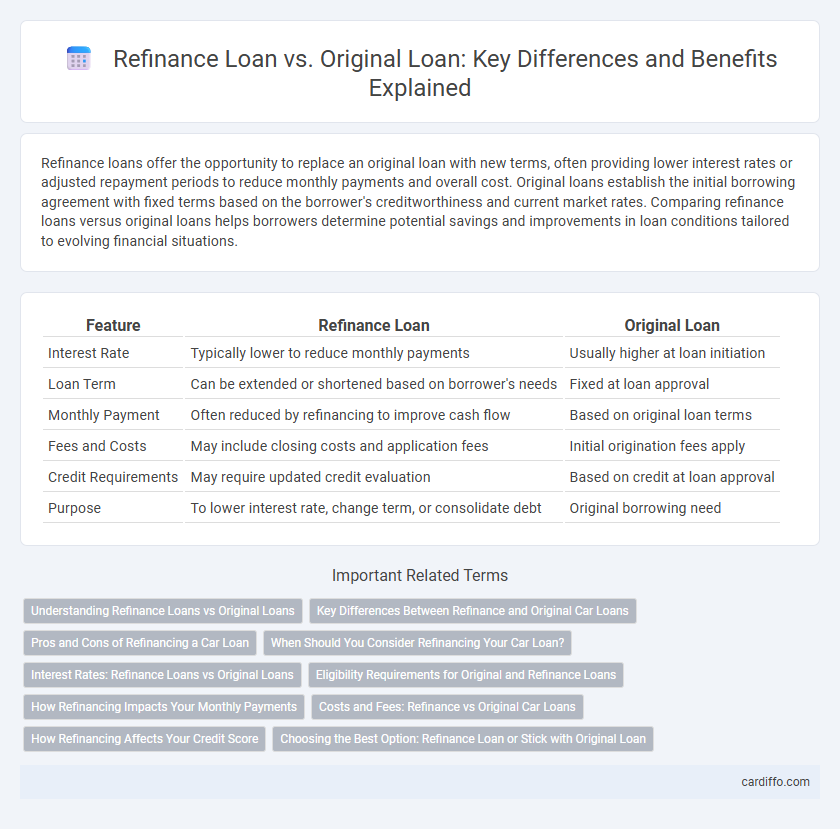

Refinance loans offer the opportunity to replace an original loan with new terms, often providing lower interest rates or adjusted repayment periods to reduce monthly payments and overall cost. Original loans establish the initial borrowing agreement with fixed terms based on the borrower's creditworthiness and current market rates. Comparing refinance loans versus original loans helps borrowers determine potential savings and improvements in loan conditions tailored to evolving financial situations.

Table of Comparison

| Feature | Refinance Loan | Original Loan |

|---|---|---|

| Interest Rate | Typically lower to reduce monthly payments | Usually higher at loan initiation |

| Loan Term | Can be extended or shortened based on borrower's needs | Fixed at loan approval |

| Monthly Payment | Often reduced by refinancing to improve cash flow | Based on original loan terms |

| Fees and Costs | May include closing costs and application fees | Initial origination fees apply |

| Credit Requirements | May require updated credit evaluation | Based on credit at loan approval |

| Purpose | To lower interest rate, change term, or consolidate debt | Original borrowing need |

Understanding Refinance Loans vs Original Loans

Refinance loans replace existing original loans with new terms, often featuring lower interest rates or extended repayment periods to reduce monthly payments. Original loans are the initial borrowed amounts with predetermined interest rates and fixed repayment schedules set at loan inception. Understanding these differences helps borrowers manage debt more effectively by comparing potential cost savings and loan flexibility.

Key Differences Between Refinance and Original Car Loans

Refinance loans involve replacing an existing car loan with a new one, often to secure lower interest rates or better terms, while original car loans are initial financing agreements for purchasing a vehicle. Key differences include changes in interest rates, loan duration, and monthly payment amounts, where refinancing can lead to reduced monthly costs or adjusted loan periods. Credit score, current market rates, and remaining loan balance significantly impact refinancing eligibility and benefits compared to the original loan.

Pros and Cons of Refinancing a Car Loan

Refinancing a car loan can lower interest rates, reduce monthly payments, or shorten the loan term, offering potential savings and improved cash flow. However, refinancing may involve fees, extend the loan duration, or impact credit scores due to hard inquiries, which could offset the benefits. Careful comparison of the original loan terms versus the new refinance offer is crucial to ensure overall financial advantage.

When Should You Consider Refinancing Your Car Loan?

Refinancing your car loan is beneficial when interest rates drop significantly below your original loan rate or when your credit score improves, enabling better loan terms. It's also ideal if your financial situation has changed, allowing for lower monthly payments or a shorter loan term to save on interest. Evaluating the total cost of refinancing, including fees, ensures it results in meaningful financial advantages over your original loan.

Interest Rates: Refinance Loans vs Original Loans

Refinance loans often offer lower interest rates compared to original loans, enabling borrowers to reduce monthly payments and overall interest costs. Original loan interest rates are typically higher due to the initial risk assessment and lender fees, while refinancing leverages improved credit scores or market conditions for better terms. Choosing to refinance depends on current interest rate trends, creditworthiness, and the remaining loan balance.

Eligibility Requirements for Original and Refinance Loans

Eligibility requirements for original loans typically include proof of income, credit score assessment, debt-to-income ratio, and employment verification to determine borrower reliability. Refinance loan eligibility often requires the borrower to have a specific minimum credit score, sufficient home equity or asset value, current loan status, and sometimes proof of improved financial stability since the original loan was obtained. Both loan types demand thorough documentation, but refinance loans prioritize existing loan performance and property appraisal for approval.

How Refinancing Impacts Your Monthly Payments

Refinancing a loan typically lowers monthly payments by securing a reduced interest rate or extending the loan term, easing financial strain. However, stretching the repayment period may increase total interest paid over time despite smaller monthly installments. Evaluating interest rates, loan terms, and fees is crucial to determine if refinancing improves overall loan affordability.

Costs and Fees: Refinance vs Original Car Loans

Refinance car loans often involve lower interest rates and can reduce monthly payments, but they may include fees such as application, title transfer, and prepayment penalties that impact overall cost. Original car loans typically have upfront costs like origination fees and higher interest rates, which can increase total loan expenses. Comparing the total cost of ownership, including fees and interest over the loan term, helps determine whether refinancing offers significant financial benefits.

How Refinancing Affects Your Credit Score

Refinancing a loan involves replacing an existing debt with a new loan, often to secure better interest rates or terms, which can temporarily impact your credit score due to hard inquiries and new account openings. While the initial credit score may dip, consistent on-time payments on the refinanced loan can improve your credit profile over time by lowering your credit utilization ratio and diversifying your credit mix. Monitoring credit reports regularly helps identify changes caused by refinancing, ensuring you maintain a strong credit standing throughout the loan transition.

Choosing the Best Option: Refinance Loan or Stick with Original Loan

Evaluating refinance loans versus sticking with the original loan hinges on interest rates, loan terms, and overall financial goals. Refinancing may lower monthly payments or reduce loan duration by securing a better interest rate, but potential fees and credit impact must be considered. Analyzing current market rates and personal financial stability ensures selecting the most cost-effective and manageable loan option.

Refinance Loan vs Original Loan Infographic

cardiffo.com

cardiffo.com