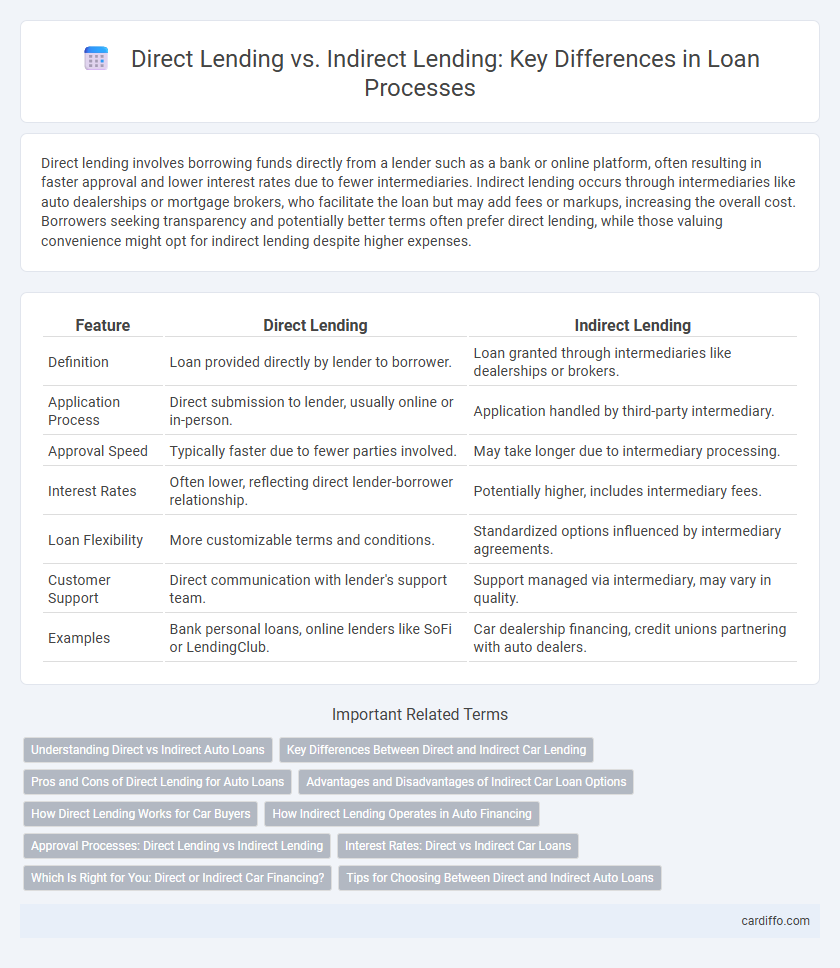

Direct lending involves borrowing funds directly from a lender such as a bank or online platform, often resulting in faster approval and lower interest rates due to fewer intermediaries. Indirect lending occurs through intermediaries like auto dealerships or mortgage brokers, who facilitate the loan but may add fees or markups, increasing the overall cost. Borrowers seeking transparency and potentially better terms often prefer direct lending, while those valuing convenience might opt for indirect lending despite higher expenses.

Table of Comparison

| Feature | Direct Lending | Indirect Lending |

|---|---|---|

| Definition | Loan provided directly by lender to borrower. | Loan granted through intermediaries like dealerships or brokers. |

| Application Process | Direct submission to lender, usually online or in-person. | Application handled by third-party intermediary. |

| Approval Speed | Typically faster due to fewer parties involved. | May take longer due to intermediary processing. |

| Interest Rates | Often lower, reflecting direct lender-borrower relationship. | Potentially higher, includes intermediary fees. |

| Loan Flexibility | More customizable terms and conditions. | Standardized options influenced by intermediary agreements. |

| Customer Support | Direct communication with lender's support team. | Support managed via intermediary, may vary in quality. |

| Examples | Bank personal loans, online lenders like SoFi or LendingClub. | Car dealership financing, credit unions partnering with auto dealers. |

Understanding Direct vs Indirect Auto Loans

Direct auto loans involve borrowers obtaining financing directly from banks, credit unions, or online lenders, allowing for more competitive interest rates and greater control over loan terms. Indirect auto loans are arranged through dealerships, where the lender works behind the scenes, often resulting in higher interest rates and less transparency. Understanding the differences in rates, lender relationships, and payment structures is crucial for borrowers to secure the most cost-effective auto loan option.

Key Differences Between Direct and Indirect Car Lending

Direct car lending involves borrowers securing loans directly from lenders such as banks or credit unions, resulting in lower interest rates and more transparent terms. Indirect lending occurs through dealerships that arrange financing with third-party lenders, often leading to higher costs due to added fees and markups. Key differences include interest rate variability, approval speed, and long-term cost implications for borrowers.

Pros and Cons of Direct Lending for Auto Loans

Direct lending for auto loans offers lower interest rates and faster approval times due to the removal of intermediaries, enabling borrowers to secure financing more efficiently. However, it may limit the availability of loan options and reduce competitive offers compared to indirect lending through dealerships. Borrowers benefit from greater transparency and control over loan terms but face the potential downside of fewer incentives or discounts commonly provided by dealers.

Advantages and Disadvantages of Indirect Car Loan Options

Indirect car loans offer convenience by allowing borrowers to secure financing directly through dealerships, often streamlining the purchasing process. However, interest rates may be higher compared to direct lending due to dealer markups and added fees, potentially increasing the total loan cost. Limited negotiation flexibility and the possibility of less favorable loan terms are common disadvantages of indirect lending options.

How Direct Lending Works for Car Buyers

Direct lending for car buyers involves obtaining a loan directly from a financial institution such as a bank, credit union, or online lender without dealership involvement. Borrowers apply and get approved independently, often benefiting from pre-approved rates and clearer loan terms. This process can provide more control over financing options and potentially lower interest rates compared to indirect lending through dealership-arranged loans.

How Indirect Lending Operates in Auto Financing

Indirect lending in auto financing involves third-party intermediaries, such as car dealerships, facilitating loans between borrowers and financial institutions. Dealers submit loan applications on behalf of buyers, often offering multiple financing options tailored to the buyer's credit profile. This method streamlines the approval process and provides convenient, on-the-spot financing solutions for vehicle purchases.

Approval Processes: Direct Lending vs Indirect Lending

Direct lending approval processes involve direct interaction between borrowers and lenders, allowing for streamlined application reviews and quicker decisions based on comprehensive borrower data. Indirect lending approval relies on intermediary channels such as auto dealerships or brokers, which can introduce additional layers of verification and potentially longer processing times. The presence of third parties in indirect lending often results in varying approval criteria and reduced transparency compared to the direct lending model.

Interest Rates: Direct vs Indirect Car Loans

Direct car loans typically offer lower interest rates compared to indirect loans due to fewer intermediaries and reduced administrative costs. Indirect lending involves dealership financing, which may include markups on the base interest rate set by lenders, resulting in higher overall borrowing costs. Borrowers seeking competitive rates should consider pre-approval through banks or credit unions to secure more favorable terms in direct lending.

Which Is Right for You: Direct or Indirect Car Financing?

Direct lending offers car buyers the advantage of negotiating loan terms directly with lenders, often resulting in lower interest rates and more flexible repayment options. Indirect lending simplifies the process by allowing dealers to handle financing through their network of lenders, providing convenience and faster approval but potentially higher rates. Choosing the right option depends on your preference for control over loan terms versus ease of access and speed in securing car financing.

Tips for Choosing Between Direct and Indirect Auto Loans

Evaluate interest rates carefully when choosing between direct and indirect auto loans, as direct lenders often provide lower rates due to fewer intermediaries. Assess your credit score and loan terms, since indirect loans through dealerships might offer convenience but at higher total costs. Prioritize transparency and read all fees and conditions to ensure the loan aligns with your financial goals and budget.

Direct Lending vs Indirect Lending Infographic

cardiffo.com

cardiffo.com