Early repayment of a loan pet reduces interest costs by shortening the loan term, allowing borrowers to save money and regain financial flexibility sooner. Deferred payment options provide temporary relief by postponing installments but may increase the overall loan cost due to accrued interest over the deferred period. Choosing between early repayment and deferred payment depends on the borrower's current financial situation and long-term budget planning.

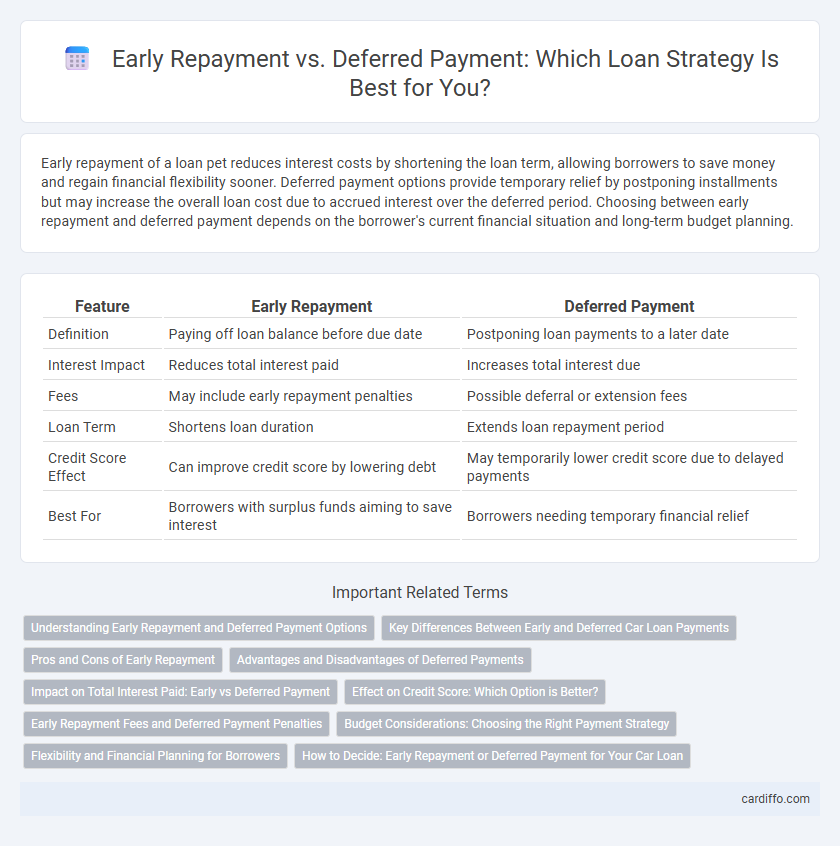

Table of Comparison

| Feature | Early Repayment | Deferred Payment |

|---|---|---|

| Definition | Paying off loan balance before due date | Postponing loan payments to a later date |

| Interest Impact | Reduces total interest paid | Increases total interest due |

| Fees | May include early repayment penalties | Possible deferral or extension fees |

| Loan Term | Shortens loan duration | Extends loan repayment period |

| Credit Score Effect | Can improve credit score by lowering debt | May temporarily lower credit score due to delayed payments |

| Best For | Borrowers with surplus funds aiming to save interest | Borrowers needing temporary financial relief |

Understanding Early Repayment and Deferred Payment Options

Early repayment allows borrowers to pay off their loan balance ahead of schedule, reducing interest costs and overall debt duration. Deferred payment options enable temporary suspension or delay of payments without defaulting, providing financial flexibility during hardship. Understanding the terms, potential fees, and impact on credit is crucial for optimizing loan management strategies.

Key Differences Between Early and Deferred Car Loan Payments

Early repayment of a car loan involves paying off the outstanding balance before the scheduled end date, often reducing overall interest costs and shortening the loan term. Deferred payment allows borrowers to temporarily postpone monthly payments, typically extending the loan term and potentially increasing total interest paid. Key differences include the timing of payment adjustments and the impact on the loan's total cost and duration, with early repayment saving money and deferred payment providing short-term financial relief.

Pros and Cons of Early Repayment

Early repayment of a loan reduces total interest paid, enabling significant savings over the loan term and improving creditworthiness through decreased debt levels. However, some lenders impose prepayment penalties or fees, which can offset the benefits and increase upfront costs. Deferred payment postpones debt obligation but often leads to higher overall interest costs and longer loan duration, making early repayment a financially advantageous choice when penalties are minimal.

Advantages and Disadvantages of Deferred Payments

Deferred payments offer borrowers increased cash flow flexibility by postponing loan repayments, making short-term financial management easier during income fluctuations. However, this option often results in higher overall interest costs and extended loan terms, increasing the total repayment burden. Borrowers must assess their ability to manage long-term debt versus the immediate relief gained from delaying payments.

Impact on Total Interest Paid: Early vs Deferred Payment

Early repayment significantly reduces the total interest paid on a loan by decreasing the principal balance faster, which lowers the accruing interest over time. Deferred payment extends the loan term, causing interest to accumulate for a longer period and increasing the overall interest burden. Borrowers aiming to minimize total interest costs benefit more from early repayment strategies compared to deferred payment options.

Effect on Credit Score: Which Option is Better?

Early repayment of a loan often positively impacts credit scores by reducing overall debt and demonstrating strong financial management. Deferred payment may delay the reduction of debt but can help maintain timely payments, preventing negative marks on credit reports. Evaluating individual financial situations and lender policies reveals early repayment generally benefits credit scores more than deferred payments.

Early Repayment Fees and Deferred Payment Penalties

Early repayment fees typically apply when borrowers pay off their loan balance ahead of schedule, serving as a compensation to lenders for lost interest income. Deferred payment penalties occur if payments are postponed beyond the agreed terms, potentially increasing the total loan cost through added charges or higher interest rates. Understanding the specific fees in loan agreements is crucial to avoid unexpected financial consequences and optimize repayment strategies.

Budget Considerations: Choosing the Right Payment Strategy

Early repayment of a loan reduces total interest paid and shortens the loan term, which benefits borrowers with extra funds available in their budget. Deferred payment allows for temporary relief from immediate financial obligations, prioritizing cash flow management during tight budget periods. Evaluating current income stability and future financial goals is crucial to selecting between early repayment and deferred payment strategies.

Flexibility and Financial Planning for Borrowers

Early repayment offers borrowers the flexibility to reduce interest costs by settling the loan ahead of schedule, supporting proactive financial planning and debt management. Deferred payment allows temporary payment postponement, providing short-term cash flow relief while potentially increasing overall loan costs. Borrowers must weigh early repayment's cost savings against deferred payment's immediate financial ease to optimize their loan strategy.

How to Decide: Early Repayment or Deferred Payment for Your Car Loan

Evaluate your current financial stability, interest rates, and future cash flow to decide between early repayment and deferred payment for your car loan. Early repayment reduces overall interest costs and shortens the loan term, ideal if you have surplus funds and want to save money. Deferred payment allows temporary financial relief by postponing installments but may increase total interest; choose this if you expect fluctuating income or short-term financial strain.

Early Repayment vs Deferred Payment Infographic

cardiffo.com

cardiffo.com