Balloon payment loans feature lower monthly installments with a large lump sum due at the end, appealing to borrowers seeking short-term affordability but risking a significant final payment. Standard auto loans offer consistent monthly payments over the loan term, providing predictable budgeting without a substantial payoff at the conclusion. Choosing between these options depends on cash flow preferences and the borrower's ability to manage a large final payment versus steady installments.

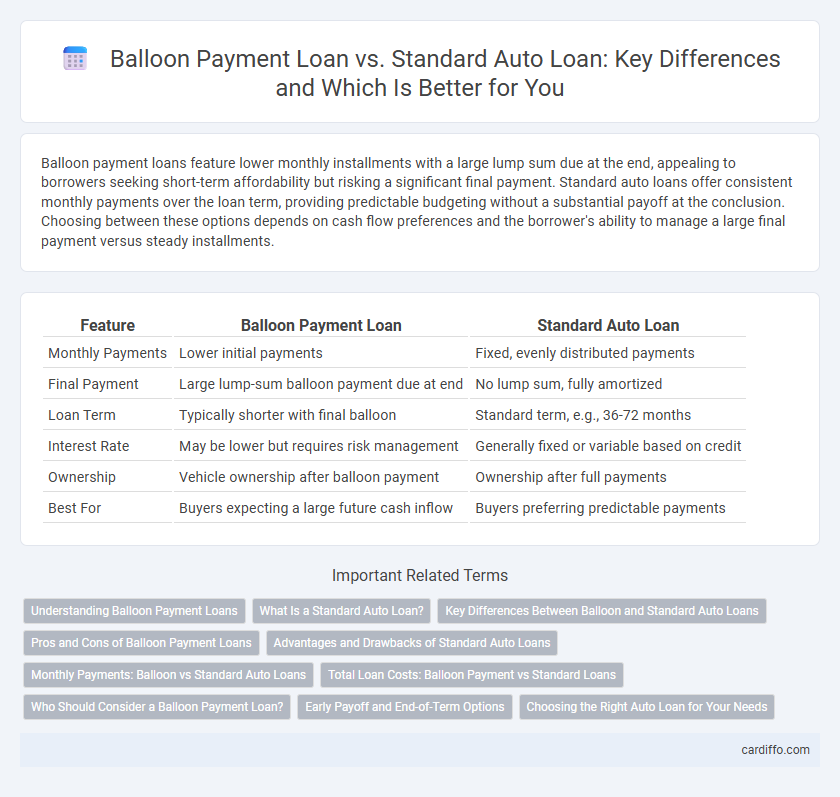

Table of Comparison

| Feature | Balloon Payment Loan | Standard Auto Loan |

|---|---|---|

| Monthly Payments | Lower initial payments | Fixed, evenly distributed payments |

| Final Payment | Large lump-sum balloon payment due at end | No lump sum, fully amortized |

| Loan Term | Typically shorter with final balloon | Standard term, e.g., 36-72 months |

| Interest Rate | May be lower but requires risk management | Generally fixed or variable based on credit |

| Ownership | Vehicle ownership after balloon payment | Ownership after full payments |

| Best For | Buyers expecting a large future cash inflow | Buyers preferring predictable payments |

Understanding Balloon Payment Loans

Balloon payment loans require a large lump-sum payment at the end of the term, contrasting with standard auto loans that have fixed monthly payments throughout the loan period. This structure typically results in lower monthly payments initially but demands careful financial planning to manage the final balloon payment, which can be substantial. Borrowers should evaluate their ability to refinance or pay off the balloon amount to avoid default, making balloon payment loans suitable for those expecting increased future cash flow or vehicle sale before loan maturity.

What Is a Standard Auto Loan?

A standard auto loan is a fixed-term financing agreement where the borrower repays the principal and interest in equal monthly installments until the loan is fully paid off. Unlike balloon payment loans, standard auto loans do not require a large lump-sum payment at the end of the term, providing predictable and consistent monthly payments. These loans typically range from 36 to 72 months, with interest rates based on the borrower's credit profile and market conditions.

Key Differences Between Balloon and Standard Auto Loans

Balloon payment loans require a large lump-sum payment at the end of the term, significantly reducing monthly payments compared to standard auto loans, which have consistent installments throughout. Standard auto loans typically spread costs evenly over a fixed term, offering predictable budgeting without a substantial final payment. Balloon loans may result in lower initial monthly payments but pose higher financial risk at term-end, while standard loans provide steady amortization and full vehicle ownership upon completion.

Pros and Cons of Balloon Payment Loans

Balloon payment loans offer lower monthly payments compared to standard auto loans, making them attractive for buyers seeking short-term cash flow flexibility. However, the large lump-sum payment due at the end can pose a financial risk if the borrower is unprepared or unable to refinance. Borrowers benefit from initial affordability but must plan carefully to avoid default or the need to sell the vehicle to cover the balloon amount.

Advantages and Drawbacks of Standard Auto Loans

Standard auto loans offer fixed monthly payments, providing predictable budgeting over the loan term and full vehicle ownership at the end. They typically have lower interest rates compared to balloon payment loans, reducing the overall cost of financing. However, higher monthly payments can strain cash flow, and early repayment penalties or less flexibility may limit financial maneuverability.

Monthly Payments: Balloon vs Standard Auto Loans

Balloon payment loans typically feature lower monthly payments compared to standard auto loans due to a large lump sum payment required at the end of the term. Standard auto loans spread the total cost evenly across monthly payments, resulting in consistently higher installments but no substantial final payment. Borrowers must evaluate their cash flow and risk tolerance when choosing between manageable monthly payments with a balloon loan and steady payments without a large end balance in a standard auto loan.

Total Loan Costs: Balloon Payment vs Standard Loans

Balloon payment loans typically have lower monthly payments but result in higher total loan costs due to the large lump-sum payment at the end of the term. Standard auto loans feature consistent monthly payments that spread the cost evenly over the loan period, often leading to lower total interest paid. Borrowers should carefully compare the total interest and principal amounts to determine which loan structure aligns best with their financial goals.

Who Should Consider a Balloon Payment Loan?

Borrowers seeking lower monthly payments and planning to sell or refinance their vehicle before the balloon payment is due should consider a balloon payment loan. This option suits individuals with fluctuating cash flow or short-term vehicle ownership horizons who want to minimize initial expenses. Those expecting a financial boost or anticipating increased income at the end of the loan term may also benefit from this structure compared to a standard auto loan.

Early Payoff and End-of-Term Options

Balloon payment loans offer lower monthly payments with a large final payment due at the end, allowing early payoff flexibility by refinancing or making a lump-sum payment, but they require careful planning to avoid financial strain. Standard auto loans have fixed monthly payments with the loan fully amortized by term end, enabling predictable early payoff without a large balance remaining. End-of-term options for balloon loans often include paying off the balloon, refinancing, or trading in the car, while standard loans conclude with full ownership once all payments are made.

Choosing the Right Auto Loan for Your Needs

Balloon payment loans for auto financing offer lower monthly payments by deferring a large payment to the end of the term, ideal for buyers expecting a future cash influx or planning to refinance. Standard auto loans feature fixed monthly payments over a set period, providing predictable budgeting and full ownership once the loan is paid off. Evaluating your financial stability, cash flow, and long-term plans ensures the right choice between manageable monthly expenses and total loan payoff flexibility.

Balloon Payment Loan vs Standard Auto Loan Infographic

cardiffo.com

cardiffo.com