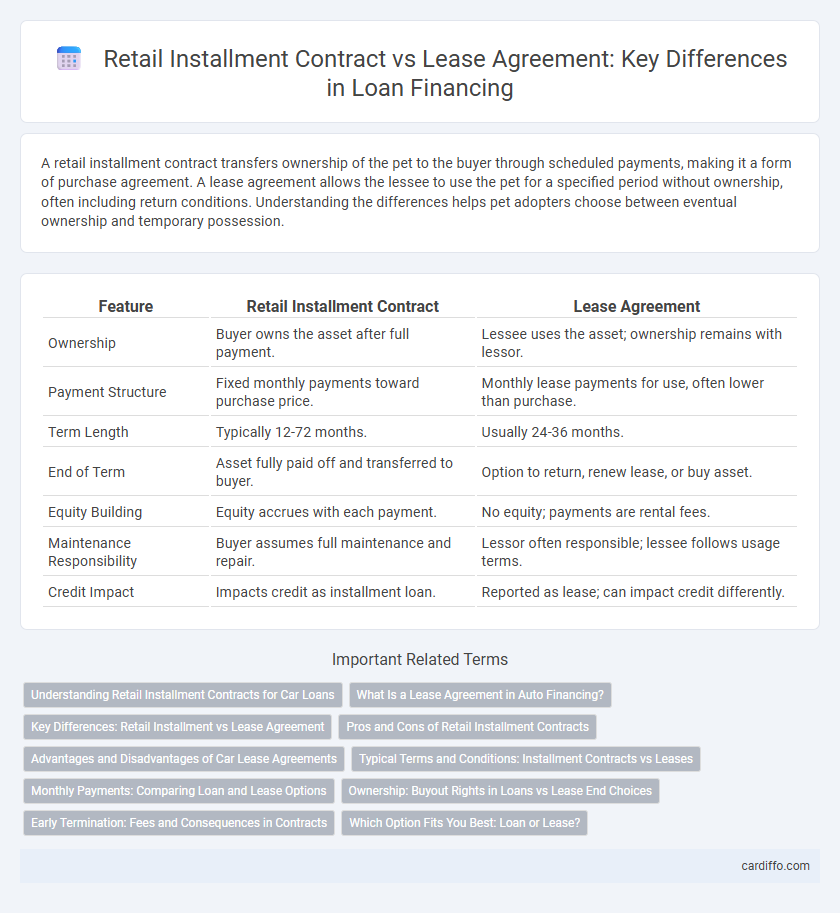

A retail installment contract transfers ownership of the pet to the buyer through scheduled payments, making it a form of purchase agreement. A lease agreement allows the lessee to use the pet for a specified period without ownership, often including return conditions. Understanding the differences helps pet adopters choose between eventual ownership and temporary possession.

Table of Comparison

| Feature | Retail Installment Contract | Lease Agreement |

|---|---|---|

| Ownership | Buyer owns the asset after full payment. | Lessee uses the asset; ownership remains with lessor. |

| Payment Structure | Fixed monthly payments toward purchase price. | Monthly lease payments for use, often lower than purchase. |

| Term Length | Typically 12-72 months. | Usually 24-36 months. |

| End of Term | Asset fully paid off and transferred to buyer. | Option to return, renew lease, or buy asset. |

| Equity Building | Equity accrues with each payment. | No equity; payments are rental fees. |

| Maintenance Responsibility | Buyer assumes full maintenance and repair. | Lessor often responsible; lessee follows usage terms. |

| Credit Impact | Impacts credit as installment loan. | Reported as lease; can impact credit differently. |

Understanding Retail Installment Contracts for Car Loans

A retail installment contract for car loans outlines the terms for purchasing a vehicle through scheduled payments over time, transferring ownership to the buyer once the loan is fully paid. Unlike a lease agreement where the borrower only has the right to use the car without ownership, a retail installment contract involves the buyer taking on the risk and benefits of ownership, including responsibility for maintenance and potential equity. Understanding the total cost, interest rates, and payment schedule in a retail installment contract is crucial for borrowers to evaluate affordability and long-term financial impact.

What Is a Lease Agreement in Auto Financing?

A lease agreement in auto financing is a contract where the lessee pays monthly installments to use a vehicle for a specified term without ownership transfer at the end. Unlike a retail installment contract, a lease focuses on depreciation and mileage limits, often resulting in lower monthly payments but no equity buildup. Key elements include residual value, mileage restrictions, and options to purchase or return the vehicle upon lease expiration.

Key Differences: Retail Installment vs Lease Agreement

A retail installment contract involves the buyer making fixed monthly payments to eventually own the asset, while a lease agreement allows the lessee to use the asset for a specified term without ownership. In retail installment contracts, the borrower assumes full ownership and responsibility for the vehicle or item once payments are completed, contrasting with lease agreements where the asset must be returned at the end of the lease period unless a purchase option is exercised. Lease agreements typically have mileage limits and maintenance requirements, whereas retail installment contracts do not impose such restrictions.

Pros and Cons of Retail Installment Contracts

Retail installment contracts offer consumers the ability to own a product by making fixed monthly payments, building equity over time and avoiding mileage limits common in lease agreements. They often come with higher monthly payments and responsibility for maintenance and depreciation, unlike leases where the asset is returned at the end of the term. This option suits buyers seeking long-term ownership and eventual asset acquisition without restrictions on usage.

Advantages and Disadvantages of Car Lease Agreements

Car lease agreements offer lower monthly payments compared to retail installment contracts, making them attractive for drivers seeking affordable access to new vehicles without long-term commitment. They typically include maintenance coverage and allow easy vehicle upgrades, but mileage limits and potential excess wear-and-tear charges can increase costs at lease end. Unlike purchase agreements, leases do not build ownership equity, posing disadvantages for consumers prioritizing long-term asset accumulation.

Typical Terms and Conditions: Installment Contracts vs Leases

Retail installment contracts typically require fixed monthly payments over a specified term, with the buyer gaining ownership upon completion, while lease agreements involve periodic payments for the use of an asset without transferring ownership. Installment contracts often include interest rates, late payment penalties, and default clauses that affect the buyer's credit, whereas lease agreements specify mileage limits, wear-and-tear standards, and options to purchase or renew at lease end. Both contracts outline terms for early termination, but installment contracts may impose payoff penalties, and leases generally charge fees for excessive use or damage.

Monthly Payments: Comparing Loan and Lease Options

Monthly payments for retail installment contracts typically cover principal and interest, resulting in ownership after the loan term ends. Lease agreements often feature lower monthly payments since they only cover vehicle depreciation and interest for the lease duration, with no ownership equity. Evaluating monthly payment amounts alongside total cost of ownership helps determine the most cost-effective choice.

Ownership: Buyout Rights in Loans vs Lease End Choices

Retail installment contracts provide borrowers with immediate ownership of the asset, with monthly payments contributing toward full title transfer. Lease agreements do not confer ownership during the term, but often include buyout rights at lease end, allowing lessees to purchase the asset for a predetermined price. The key difference lies in the financing structure, where installment contracts build equity through payments, while leases offer temporary use with optional ownership through end-of-term buyout options.

Early Termination: Fees and Consequences in Contracts

Early termination of a retail installment contract typically incurs a payoff amount that reflects the remaining loan balance plus any accrued interest and fees, often requiring full payment to avoid repossession. Lease agreements usually impose early termination penalties calculated as a percentage of remaining lease payments and may also include charges for excessive wear or mileage. Understanding these financial consequences is crucial for borrowers to anticipate costs and protect their credit standing during early contract termination.

Which Option Fits You Best: Loan or Lease?

Retail installment contracts offer ownership through fixed monthly payments, allowing borrowers to build equity and eventually own the asset outright. Lease agreements provide lower monthly costs with the option to return or buy the asset at the end of the term, ideal for those seeking flexibility and minimal long-term commitment. Choosing between a loan or lease depends on financial goals, budget, and whether long-term ownership or short-term use is preferred.

Retail installment contract vs lease agreement Infographic

cardiffo.com

cardiffo.com