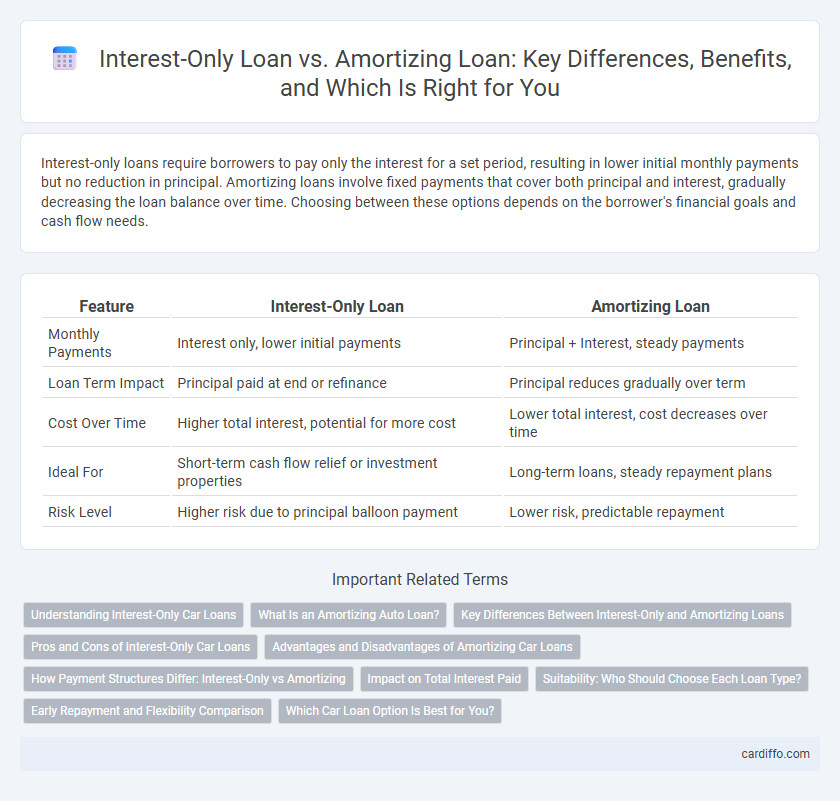

Interest-only loans require borrowers to pay only the interest for a set period, resulting in lower initial monthly payments but no reduction in principal. Amortizing loans involve fixed payments that cover both principal and interest, gradually decreasing the loan balance over time. Choosing between these options depends on the borrower's financial goals and cash flow needs.

Table of Comparison

| Feature | Interest-Only Loan | Amortizing Loan |

|---|---|---|

| Monthly Payments | Interest only, lower initial payments | Principal + Interest, steady payments |

| Loan Term Impact | Principal paid at end or refinance | Principal reduces gradually over term |

| Cost Over Time | Higher total interest, potential for more cost | Lower total interest, cost decreases over time |

| Ideal For | Short-term cash flow relief or investment properties | Long-term loans, steady repayment plans |

| Risk Level | Higher risk due to principal balloon payment | Lower risk, predictable repayment |

Understanding Interest-Only Car Loans

Interest-only car loans require borrowers to pay only the interest for a set period, typically 3 to 5 years, resulting in lower initial monthly payments compared to amortizing loans that combine principal and interest. These loans provide short-term affordability but lead to higher payments later when principal repayment begins, and no equity is built during the interest-only phase. Borrowers should weigh this against amortizing loans, which steadily reduce the loan balance and build ownership from the start, offering long-term financial stability.

What Is an Amortizing Auto Loan?

An amortizing auto loan requires regular payments that cover both principal and interest, gradually reducing the loan balance over time until it reaches zero at the end of the term. Monthly installments remain consistent, helping borrowers budget effectively and build equity in the vehicle. This structure contrasts with interest-only loans, where the principal remains unchanged during the interest-only period.

Key Differences Between Interest-Only and Amortizing Loans

Interest-only loans require borrowers to pay only the interest during the initial period, resulting in lower monthly payments but no reduction in the principal balance. Amortizing loans combine principal and interest payments, gradually reducing the loan balance over time. Key differences include payment structure, overall cost, and impact on equity accumulation, with amortizing loans building equity faster while interest-only loans offer short-term cash flow flexibility.

Pros and Cons of Interest-Only Car Loans

Interest-only car loans offer lower initial monthly payments since borrowers only pay the interest for a set period, improving short-term cash flow. However, these loans can lead to higher total costs over time because the principal remains untouched and must be paid in full later, increasing financial risk if the car's value depreciates. Borrowers benefit from lower payments initially but face potential payment shocks and lack of equity buildup compared to amortizing loans, which gradually reduce principal and interest simultaneously.

Advantages and Disadvantages of Amortizing Car Loans

Amortizing car loans provide the advantage of predictable monthly payments that cover both principal and interest, helping borrowers build equity over the life of the loan while reducing overall interest costs. These loans minimize the risk of owing a large balance at the end of the term, unlike interest-only loans where the principal remains unchanged for an initial period. However, amortizing loans typically have higher monthly payments compared to interest-only options, potentially limiting cash flow in the short term.

How Payment Structures Differ: Interest-Only vs Amortizing

Interest-only loans require borrowers to pay solely the interest for a set period, resulting in lower initial monthly payments but no reduction in principal balance. Amortizing loans combine both principal and interest payments from the start, gradually reducing the loan balance over time. This fundamental difference in payment structure impacts total interest cost and loan duration, with amortizing loans typically leading to full repayment by the end of the term.

Impact on Total Interest Paid

Interest-only loans require borrowers to pay only the interest for a set period, resulting in lower initial payments but higher total interest paid over the loan term. Amortizing loans combine principal and interest payments, reducing the loan balance over time and minimizing total interest costs. Choosing between the two impacts the overall cost of borrowing, with interest-only loans typically leading to greater total interest expenses.

Suitability: Who Should Choose Each Loan Type?

Interest-only loans suit borrowers seeking lower initial payments and flexibility, such as real estate investors or individuals expecting increased future income. Amortizing loans are ideal for those prioritizing gradual equity buildup and predictable monthly payments, often suitable for first-time homebuyers or long-term homeowners. Choosing the right loan depends on financial stability, risk tolerance, and long-term goals.

Early Repayment and Flexibility Comparison

Interest-only loans offer greater early repayment flexibility by allowing borrowers to pay only interest for a set period before principal payments begin, reducing initial monthly obligations and enabling faster principal reduction when desired. Amortizing loans require consistent principal and interest payments from the start, ensuring steady equity build-up but less flexibility in adjusting repayment amounts early on. Borrowers prioritizing cash flow management or potential early loan payoff may find interest-only loans more adaptable, whereas amortizing loans provide structured repayment stability.

Which Car Loan Option Is Best for You?

Choosing between an interest-only loan and an amortizing loan depends on your financial goals and budget. Interest-only loans offer lower initial payments, making them suitable for short-term ownership or temporary cash flow relief, while amortizing loans build equity gradually through fixed payments over time. Evaluating your ability to manage rising payments and your long-term ownership plans helps determine which car loan option aligns best with your financial strategy.

Interest-Only Loan vs Amortizing Loan Infographic

cardiffo.com

cardiffo.com