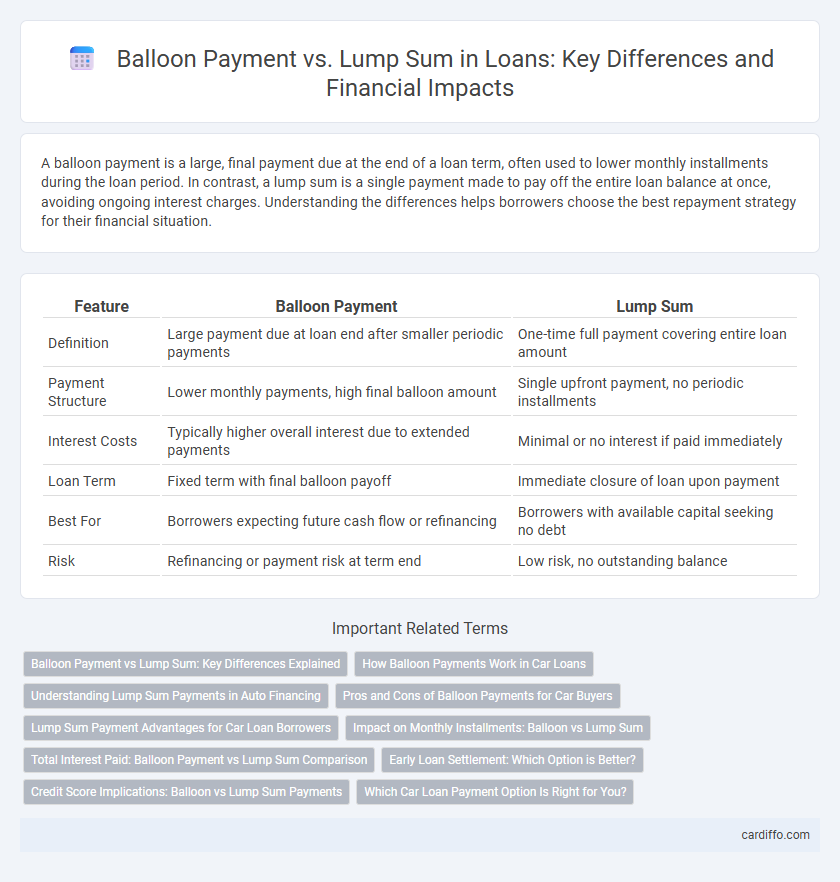

A balloon payment is a large, final payment due at the end of a loan term, often used to lower monthly installments during the loan period. In contrast, a lump sum is a single payment made to pay off the entire loan balance at once, avoiding ongoing interest charges. Understanding the differences helps borrowers choose the best repayment strategy for their financial situation.

Table of Comparison

| Feature | Balloon Payment | Lump Sum |

|---|---|---|

| Definition | Large payment due at loan end after smaller periodic payments | One-time full payment covering entire loan amount |

| Payment Structure | Lower monthly payments, high final balloon amount | Single upfront payment, no periodic installments |

| Interest Costs | Typically higher overall interest due to extended payments | Minimal or no interest if paid immediately |

| Loan Term | Fixed term with final balloon payoff | Immediate closure of loan upon payment |

| Best For | Borrowers expecting future cash flow or refinancing | Borrowers with available capital seeking no debt |

| Risk | Refinancing or payment risk at term end | Low risk, no outstanding balance |

Balloon Payment vs Lump Sum: Key Differences Explained

A balloon payment is a large, final loan payment due at the end of a loan term, often significantly higher than regular installments, while a lump sum refers to a one-time full repayment made at any point during the loan period. Balloon payments typically reduce monthly payment amounts but require borrowers to plan for the substantial end payment, contrasting with lump sum payments that allow early debt reduction without altering scheduled installments. Understanding these differences helps borrowers manage cash flow and loan payoff strategies effectively.

How Balloon Payments Work in Car Loans

Balloon payments in car loans involve making lower monthly installments throughout the loan term, with a substantially larger payment due at the end. This large final payment helps reduce initial monthly costs but requires planning to cover the lump sum or refinance before the term ends. Borrowers benefit from lower early payments but must ensure they can afford the balloon payment or negotiate terms with the lender.

Understanding Lump Sum Payments in Auto Financing

Lump sum payments in auto financing refer to a single, large payment made to reduce or pay off the remaining balance of a loan, often used to lower overall interest costs. Unlike balloon payments, which are scheduled as a large final installment after a series of smaller payments, a lump sum can be made at any point during the loan term. This flexibility helps borrowers save on interest by cutting down the principal faster and potentially shortening the loan duration.

Pros and Cons of Balloon Payments for Car Buyers

Balloon payments allow car buyers to reduce their monthly installments by deferring a large portion of the loan balance to the end of the term, improving short-term cash flow. However, this structure can lead to financial strain when the lump payment is due, requiring buyers to either refinance or have significant savings on hand. The risk of negative equity is higher if the car's depreciation outpaces the loan reduction, making balloon payments less favorable for those seeking long-term ownership.

Lump Sum Payment Advantages for Car Loan Borrowers

Lump sum payments for car loans reduce overall interest costs by decreasing the principal balance early in the loan term, leading to faster loan payoff and improved credit scores. Borrowers gain flexibility in financial planning without the pressure of a large final balloon payment, minimizing the risk of refinancing or default. This approach enhances loan affordability and supports better long-term financial stability for car buyers.

Impact on Monthly Installments: Balloon vs Lump Sum

Balloon payments reduce monthly installments by deferring a large portion of the principal to the loan's end, resulting in lower monthly amounts compared to lump sum payments. Lump sum repayment requires higher monthly installments as the entire loan balance amortizes evenly throughout the term, improving loan equity but increasing monthly financial burden. Borrowers seeking lower initial cash flow prefer balloon payments, whereas lump sum structures benefit those aiming for steady, consistent repayment schedules.

Total Interest Paid: Balloon Payment vs Lump Sum Comparison

Total interest paid on a balloon payment loan typically exceeds that of a lump sum loan because interest accrues over the entire loan term before the large final payment is made. Lump sum loans reduce total interest costs by allowing borrowers to pay off the principal in one payment early, minimizing the time interest accumulates. Comparing these options highlights that balloon payments often result in higher long-term interest expenses, while lump sum payments lead to lower overall interest due to shorter loan durations.

Early Loan Settlement: Which Option is Better?

Early loan settlement through a balloon payment often lowers monthly installments but requires a large final payment, ideal for borrowers expecting a cash influx. A lump sum settlement demands a one-time full repayment, eliminating future interest and reducing overall loan costs. Choosing between balloon payments and lump sums depends on cash flow, financial stability, and long-term savings goals.

Credit Score Implications: Balloon vs Lump Sum Payments

Balloon payments can impact credit scores differently than lump sum payments due to the large outstanding balance remaining until the final payment, potentially leading to higher credit utilization ratios and perceived risk by lenders. Lump sum payments typically reduce the principal more quickly, improving credit utilization and signaling strong repayment ability, which benefits credit scores. Understanding the timing and size of these payments is crucial for managing credit health effectively in loan agreements.

Which Car Loan Payment Option Is Right for You?

Choosing between balloon payment and lump sum options for a car loan depends on your financial stability and cash flow preferences. Balloon payments offer lower monthly installments with a large final payment, ideal if you expect a future cash influx or plan to refinance, while lump sum payments involve consistent, higher monthly payments without a substantial end balance. Evaluate your budget, future income projections, and loan terms to determine the most suitable car loan payment structure for your situation.

Balloon Payment vs Lump Sum Infographic

cardiffo.com

cardiffo.com