Buy here pay here dealerships offer in-house financing, allowing buyers with poor credit to obtain loans directly from the seller, often with higher interest rates and shorter terms. Traditional dealership financing involves third-party lenders providing loans, typically offering more competitive rates and flexible repayment options based on creditworthiness. Buyers should weigh the convenience and accessibility of buy here pay here against the potential cost savings and credit benefits of traditional financing.

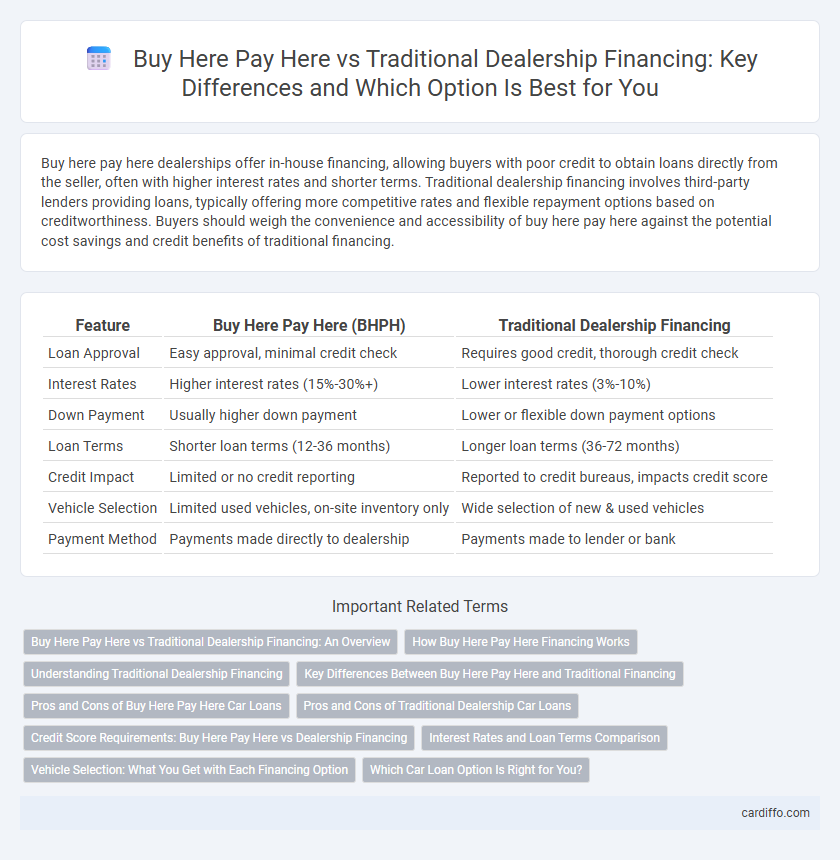

Table of Comparison

| Feature | Buy Here Pay Here (BHPH) | Traditional Dealership Financing |

|---|---|---|

| Loan Approval | Easy approval, minimal credit check | Requires good credit, thorough credit check |

| Interest Rates | Higher interest rates (15%-30%+) | Lower interest rates (3%-10%) |

| Down Payment | Usually higher down payment | Lower or flexible down payment options |

| Loan Terms | Shorter loan terms (12-36 months) | Longer loan terms (36-72 months) |

| Credit Impact | Limited or no credit reporting | Reported to credit bureaus, impacts credit score |

| Vehicle Selection | Limited used vehicles, on-site inventory only | Wide selection of new & used vehicles |

| Payment Method | Payments made directly to dealership | Payments made to lender or bank |

Buy Here Pay Here vs Traditional Dealership Financing: An Overview

Buy Here Pay Here (BHPH) financing allows customers to purchase vehicles directly from dealers who also provide in-house loans, often catering to buyers with poor credit or limited financing options. Traditional dealership financing involves third-party lenders, such as banks or credit unions, offering loans with finalized terms and generally lower interest rates for buyers with established credit histories. BHPH loans typically feature higher interest rates, shorter repayment periods, and more flexible approval criteria compared to traditional dealership financing.

How Buy Here Pay Here Financing Works

Buy Here Pay Here (BHPH) financing allows customers to purchase vehicles directly from dealerships that offer in-house loans, bypassing traditional credit checks and banks. Payments are made directly to the dealership, often on a weekly or bi-weekly schedule, with flexible terms tailored to buyers with poor or no credit history. This model provides immediate vehicle availability and simplified approval processes but typically involves higher interest rates compared to traditional dealership financing that relies on third-party lenders.

Understanding Traditional Dealership Financing

Traditional dealership financing involves securing an auto loan through the dealership's partnered lenders, typically banks or credit unions, offering competitive interest rates based on the buyer's credit score. This method often requires a thorough credit check and provides flexible loan terms, including down payment options and repayment schedules tailored to the borrower's financial profile. Buyers benefit from the convenience of one-stop shopping, where the vehicle purchase and financing are handled simultaneously, often resulting in better loan rates compared to alternative financing options like Buy Here Pay Here lots.

Key Differences Between Buy Here Pay Here and Traditional Financing

Buy Here Pay Here (BHPH) dealerships provide in-house financing directly to customers, often catering to buyers with poor credit by offering more flexible approval criteria and quicker loan processing. Traditional dealership financing involves third-party lenders or banks, typically requiring stronger credit scores, longer approval timelines, and potentially lower interest rates. Key differences include credit requirements, loan terms, and payment structures, where BHPH loans commonly have higher interest rates but simplified qualification compared to traditional financing.

Pros and Cons of Buy Here Pay Here Car Loans

Buy here pay here (BHPH) car loans offer immediate financing options without relying on credit scores, benefiting buyers with poor or no credit history. However, BHPH loans often come with higher interest rates and limited vehicle selection compared to traditional dealership financing, which provides a wider range of loan terms and competitive rates through third-party lenders. Borrowers should weigh the convenience and accessibility of BHPH against the potential for higher costs and less favorable loan conditions.

Pros and Cons of Traditional Dealership Car Loans

Traditional dealership car loans offer competitive interest rates and flexible loan terms, often backed by established financial institutions, providing borrowers with reliable credit options and potential rewards for good credit history. However, these loans typically require higher credit scores and more stringent approval processes, which can exclude subprime borrowers or result in longer wait times for loan approval. While traditional financing provides more transparency and regulatory protection, it often involves down payments and hidden fees that may increase the total cost of the vehicle.

Credit Score Requirements: Buy Here Pay Here vs Dealership Financing

Buy Here Pay Here (BHPH) dealerships typically accept lower credit scores, often below 600, making them accessible to buyers with poor or no credit history. Traditional dealership financing generally requires higher credit scores, usually above 620, to qualify for competitive interest rates and loan terms. BHPH loans may carry higher interest rates and shorter terms due to increased risk, while dealership financing offers broader options for credit approval based on individual scores.

Interest Rates and Loan Terms Comparison

Buy Here Pay Here dealerships often charge higher interest rates compared to traditional dealership financing due to increased risk and limited credit checks. Loan terms at Buy Here Pay Here lots typically feature shorter durations with more frequent payments, while traditional financing offers longer terms with lower interest rates, improving affordability. Borrowers with strong credit profiles benefit from traditional loans, whereas Buy Here Pay Here caters to those with poor or no credit but at higher overall borrowing costs.

Vehicle Selection: What You Get with Each Financing Option

Buy here pay here lots typically offer a limited inventory of vehicles, often older models with higher mileage, catering to buyers with poor credit or limited financing options. Traditional dealership financing provides access to a broader range of new and certified pre-owned vehicles, including the latest models and extensive warranty options. Financing through traditional dealers often allows customers to choose from various makes and models, improving the chances of finding a vehicle that aligns with specific preferences and needs.

Which Car Loan Option Is Right for You?

Buy here pay here dealerships offer in-house financing with easier approval for buyers with poor credit, often requiring higher interest rates and smaller loan terms. Traditional dealership financing provides competitive rates and longer repayment plans through third-party lenders but demands better credit and more extensive documentation. Choosing the right car loan depends on your credit score, budget, and willingness to navigate either flexible but costly terms or structured, credit-dependent financing options.

Buy here pay here vs Traditional dealership financing Infographic

cardiffo.com

cardiffo.com