Refinancing a loan pet focuses on replacing an existing loan with a new one that offers better interest rates or terms, ultimately reducing monthly payments. Trade-in financing involves exchanging a current pet loan for a new loan when acquiring a different pet, potentially combining the old loan balance with new financing. Choosing between refinancing and trade-in financing depends on financial goals, existing loan terms, and the desire to upgrade or change pets.

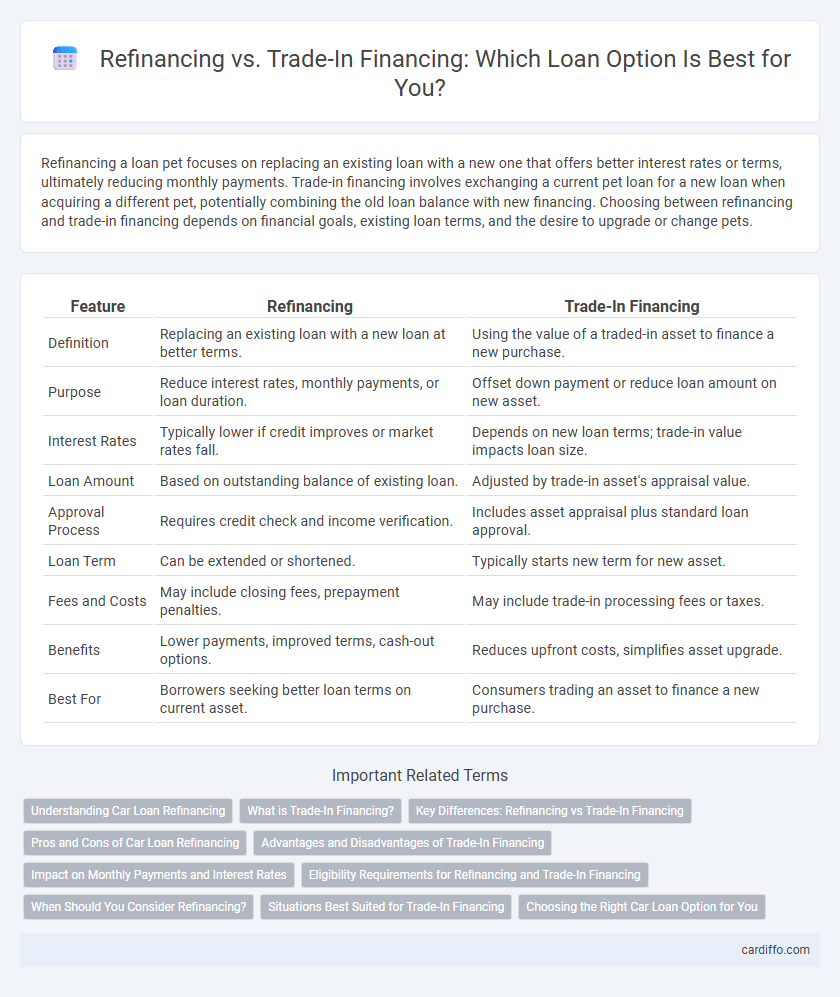

Table of Comparison

| Feature | Refinancing | Trade-In Financing |

|---|---|---|

| Definition | Replacing an existing loan with a new loan at better terms. | Using the value of a traded-in asset to finance a new purchase. |

| Purpose | Reduce interest rates, monthly payments, or loan duration. | Offset down payment or reduce loan amount on new asset. |

| Interest Rates | Typically lower if credit improves or market rates fall. | Depends on new loan terms; trade-in value impacts loan size. |

| Loan Amount | Based on outstanding balance of existing loan. | Adjusted by trade-in asset's appraisal value. |

| Approval Process | Requires credit check and income verification. | Includes asset appraisal plus standard loan approval. |

| Loan Term | Can be extended or shortened. | Typically starts new term for new asset. |

| Fees and Costs | May include closing fees, prepayment penalties. | May include trade-in processing fees or taxes. |

| Benefits | Lower payments, improved terms, cash-out options. | Reduces upfront costs, simplifies asset upgrade. |

| Best For | Borrowers seeking better loan terms on current asset. | Consumers trading an asset to finance a new purchase. |

Understanding Car Loan Refinancing

Car loan refinancing involves replacing an existing auto loan with a new one, often to secure a lower interest rate or better repayment terms, which can reduce monthly payments and total interest paid over the loan term. This process differs from trade-in financing, where the value of a current vehicle is applied as a down payment towards purchasing a new car, establishing a new loan agreement. Understanding car loan refinancing helps borrowers evaluate cost savings opportunities and improve loan conditions without needing to trade in their vehicle.

What is Trade-In Financing?

Trade-in financing is a lending option that uses the value of an existing asset, such as a car or equipment, as partial payment towards a new loan, effectively reducing the amount financed. This method simplifies the purchasing process by applying the trade-in equity directly to the new loan balance, often resulting in lower monthly payments and improved loan terms. Unlike refinancing, which restructures an existing loan, trade-in financing combines asset trade-in value with new financing to facilitate asset upgrades.

Key Differences: Refinancing vs Trade-In Financing

Refinancing a loan involves replacing an existing loan with a new one, often to secure a lower interest rate or better terms, while trade-in financing applies when financing a new vehicle purchase using the value of a current vehicle as a down payment. Refinancing typically affects the loan's interest rate, monthly payments, and loan duration without changing the vehicle, whereas trade-in financing directly impacts the purchase price and loan amount of the new vehicle. Understanding these key differences helps borrowers choose between reducing payment costs through refinancing or leveraging vehicle equity toward acquiring a new car with trade-in financing.

Pros and Cons of Car Loan Refinancing

Car loan refinancing can lower monthly payments by securing a lower interest rate or extending the loan term, enhancing cash flow for borrowers. However, refinancing may incur fees and potentially increase the total interest paid over the life of the loan if the term is extended. It also requires sufficient creditworthiness and may not be beneficial for those with very short remaining loan terms or negative equity situations.

Advantages and Disadvantages of Trade-In Financing

Trade-in financing offers the advantage of reducing the loan principal by applying the vehicle's trade-in value directly, which can lower monthly payments and improve loan eligibility. However, its disadvantages include potentially lower trade-in appraisals compared to private sales and the risk of rolling negative equity into the new loan, increasing overall debt. Evaluating the trade-in offer carefully against current market values is crucial to avoid unfavorable financing terms.

Impact on Monthly Payments and Interest Rates

Refinancing typically lowers monthly payments by securing a new loan with a lower interest rate or extended term, reducing overall borrowing costs. Trade-in financing often combines the remaining balance on the old loan with the cost of a new purchase, which can increase monthly payments despite potential promotional rates. Interest rates for refinancing depend on credit score and market conditions, while trade-in financing rates may vary based on dealer offers and the vehicle's equity value.

Eligibility Requirements for Refinancing and Trade-In Financing

Refinancing eligibility typically requires a strong credit score, stable income, and a low debt-to-income ratio to qualify for better loan terms. Trade-in financing often demands proof of vehicle ownership, acceptable trade-in value, and may have more flexible credit requirements due to the collateral nature of the transaction. Both options require documentation of financial stability, but refinancing prioritizes creditworthiness while trade-in financing hinges on the vehicle's market value and condition.

When Should You Consider Refinancing?

Consider refinancing when your current loan carries a higher interest rate than what is available in the market, enabling significant monthly savings and reduced overall debt cost. Refinancing is beneficial if your credit score has improved since the original loan, allowing access to better loan terms and lower interest rates. It's also ideal when you want to adjust the loan duration to better fit your financial goals or need to consolidate multiple debts into one manageable payment.

Situations Best Suited for Trade-In Financing

Trade-in financing is best suited for borrowers who want to leverage the value of their current vehicle as a down payment on a new loan, reducing the overall loan amount and monthly payments. It is ideal when selling a car and purchasing another simultaneously, simplifying the transaction process by combining sale and financing into one. This option benefits buyers seeking convenience and immediate equity application in financing their next vehicle purchase.

Choosing the Right Car Loan Option for You

Refinancing a car loan can lower your interest rate and monthly payments by replacing your current loan with a better one, while trade-in financing involves using the value of your current vehicle as a down payment for a new car loan. Evaluating factors such as interest rates, loan terms, credit score, and the total cost of ownership helps determine the best option. Selecting the right car loan depends on your financial goals, whether reducing monthly expenses or upgrading to a newer vehicle.

Refinancing vs Trade-In Financing Infographic

cardiffo.com

cardiffo.com