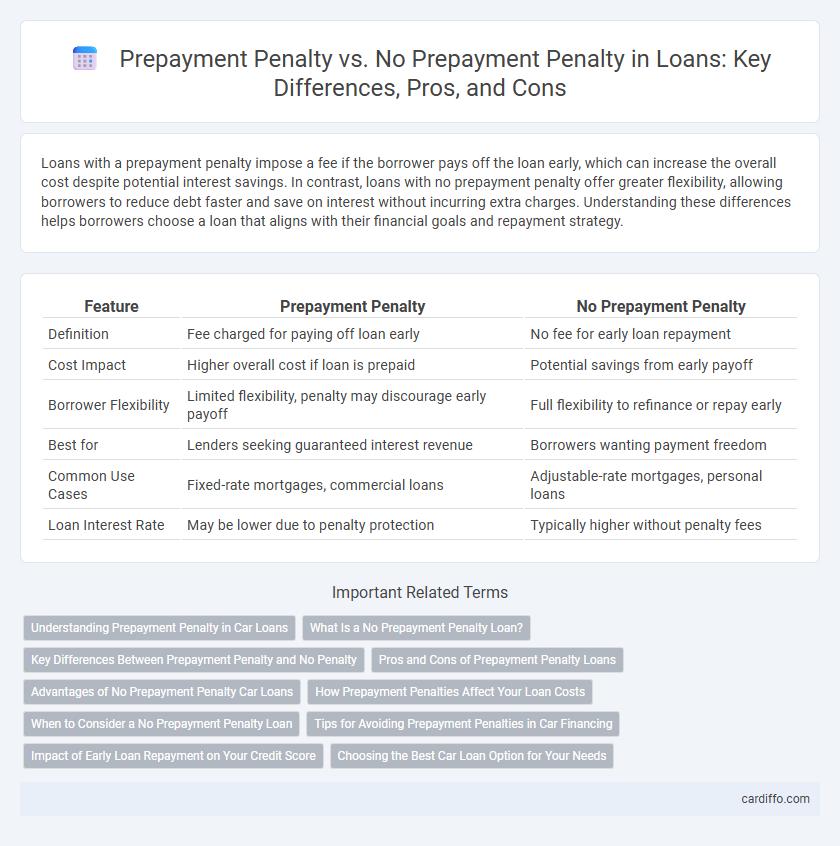

Loans with a prepayment penalty impose a fee if the borrower pays off the loan early, which can increase the overall cost despite potential interest savings. In contrast, loans with no prepayment penalty offer greater flexibility, allowing borrowers to reduce debt faster and save on interest without incurring extra charges. Understanding these differences helps borrowers choose a loan that aligns with their financial goals and repayment strategy.

Table of Comparison

| Feature | Prepayment Penalty | No Prepayment Penalty |

|---|---|---|

| Definition | Fee charged for paying off loan early | No fee for early loan repayment |

| Cost Impact | Higher overall cost if loan is prepaid | Potential savings from early payoff |

| Borrower Flexibility | Limited flexibility, penalty may discourage early payoff | Full flexibility to refinance or repay early |

| Best for | Lenders seeking guaranteed interest revenue | Borrowers wanting payment freedom |

| Common Use Cases | Fixed-rate mortgages, commercial loans | Adjustable-rate mortgages, personal loans |

| Loan Interest Rate | May be lower due to penalty protection | Typically higher without penalty fees |

Understanding Prepayment Penalty in Car Loans

Prepayment penalty in car loans refers to a fee charged by lenders when borrowers pay off their loan balance early, potentially increasing the overall loan cost despite early repayment. Understanding prepayment penalties is crucial as they impact the financial flexibility of car owners wishing to refinance or sell their vehicle before the loan term ends. Choosing a car loan with no prepayment penalty allows borrowers to save money on interest and avoid extra fees, promoting smarter debt management and faster loan payoff.

What Is a No Prepayment Penalty Loan?

A no prepayment penalty loan allows borrowers to repay their loan balance ahead of schedule without incurring additional fees or charges. This type of loan offers greater flexibility and potential savings by eliminating penalties that typically apply when paying off principal early. Borrowers benefit from reduced interest costs and enhanced control over their repayment timeline with a no prepayment penalty loan.

Key Differences Between Prepayment Penalty and No Penalty

Prepayment penalty loans impose fees when borrowers pay off their loan early, protecting lenders from lost interest revenue, while no prepayment penalty loans allow early repayment without extra charges. Prepayment penalties can increase overall loan costs and reduce borrower flexibility, whereas loans without penalties offer greater financial control and potential interest savings. Understanding these differences is crucial for selecting loan terms that align with long-term financial goals.

Pros and Cons of Prepayment Penalty Loans

Prepayment penalty loans typically impose a fee if the borrower pays off the loan early, which can discourage refinancing and reduce financial flexibility. However, these loans often offer lower interest rates and can benefit lenders by securing a predictable income stream. Borrowers should weigh the cost of potential penalties against interest savings when considering a loan with prepayment penalties.

Advantages of No Prepayment Penalty Car Loans

No prepayment penalty car loans provide borrowers the freedom to pay off their loans early without incurring additional fees, resulting in significant interest savings over the loan term. This flexibility supports faster debt elimination and improves financial planning by allowing extra payments whenever possible. Choosing a no prepayment penalty loan enhances overall affordability and reduces the total cost of vehicle financing.

How Prepayment Penalties Affect Your Loan Costs

Prepayment penalties increase overall loan costs by charging fees when borrowers pay off their loans early, reducing the financial benefit of refinancing or early repayment. Loans without prepayment penalties offer more flexibility, allowing borrowers to save on interest by paying off principal ahead of schedule without incurring extra charges. Understanding the impact of prepayment penalties is crucial for managing long-term loan expenses and optimizing repayment strategies.

When to Consider a No Prepayment Penalty Loan

Opt for a no prepayment penalty loan when planning to pay off the loan early or refinance to save on interest costs and gain financial flexibility. These loans eliminate extra fees typically charged for early repayment, making them ideal for borrowers expecting a change in income or a desire to reduce debt quickly. Evaluating loan terms carefully ensures that avoiding prepayment penalties aligns with long-term financial goals and potential savings.

Tips for Avoiding Prepayment Penalties in Car Financing

When securing car financing, carefully review the loan agreement for prepayment penalty clauses, which can increase costs if you pay off the loan early. Opt for lenders that offer no prepayment penalty loans to maintain financial flexibility and save on unnecessary fees. Consider making extra payments toward the principal when allowed without penalties to reduce interest over the loan term.

Impact of Early Loan Repayment on Your Credit Score

Prepayment penalties can affect your decision to repay a loan early, as these fees increase the overall cost, potentially discouraging early payoff despite positive credit implications. No prepayment penalty loans allow borrowers to settle their debt ahead of schedule without extra costs, which can improve credit utilization and credit score by reducing outstanding debt faster. Early repayment on penalty-free loans often signals financial responsibility to credit bureaus, enhancing creditworthiness over time.

Choosing the Best Car Loan Option for Your Needs

Selecting a car loan without a prepayment penalty allows borrowers to save on interest by paying off the loan early without extra fees. Loans with prepayment penalties often come with lower interest rates but can limit financial flexibility if you plan to repay ahead of schedule. Evaluating your repayment strategy and comparing loan terms helps determine the best option that aligns with your budget and long-term financial goals.

Prepayment Penalty vs No Prepayment Penalty Infographic

cardiffo.com

cardiffo.com