A cosigner agrees to take responsibility for a loan if the primary borrower defaults, without having ownership rights to the loan or asset. A co-borrower shares equal responsibility and has ownership rights, meaning both parties have a legal claim to the asset purchased with the loan. Understanding the distinction between a cosigner and co-borrower is crucial for managing financial liability and credit impact when obtaining a pet loan.

Table of Comparison

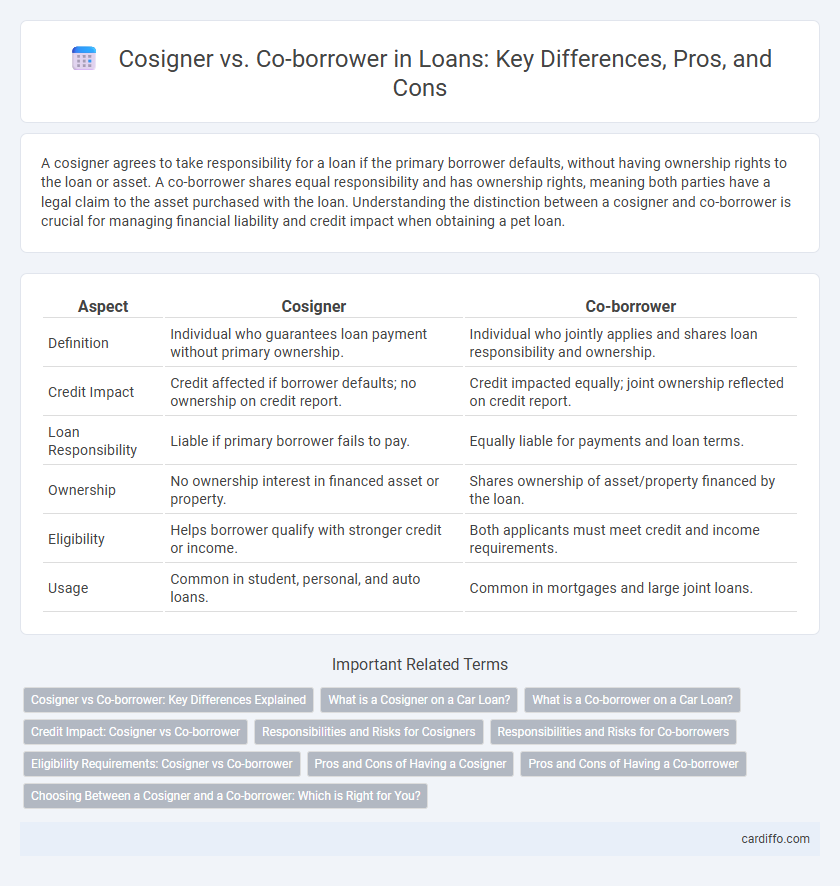

| Aspect | Cosigner | Co-borrower |

|---|---|---|

| Definition | Individual who guarantees loan payment without primary ownership. | Individual who jointly applies and shares loan responsibility and ownership. |

| Credit Impact | Credit affected if borrower defaults; no ownership on credit report. | Credit impacted equally; joint ownership reflected on credit report. |

| Loan Responsibility | Liable if primary borrower fails to pay. | Equally liable for payments and loan terms. |

| Ownership | No ownership interest in financed asset or property. | Shares ownership of asset/property financed by the loan. |

| Eligibility | Helps borrower qualify with stronger credit or income. | Both applicants must meet credit and income requirements. |

| Usage | Common in student, personal, and auto loans. | Common in mortgages and large joint loans. |

Cosigner vs Co-borrower: Key Differences Explained

A cosigner is someone who agrees to pay back a loan if the primary borrower defaults, without having ownership rights to the purchased asset, whereas a co-borrower shares equal responsibility for the loan and has legal ownership of the asset. Credit scores and income of both cosigners and co-borrowers are evaluated during loan approval, but co-borrowers typically influence the loan terms more directly due to their ownership stake. Understanding these distinctions is crucial for clarifying financial liability and ownership in loan agreements.

What is a Cosigner on a Car Loan?

A cosigner on a car loan is an individual who agrees to take legal responsibility for the loan if the primary borrower defaults, without having ownership rights to the vehicle. The cosigner's credit history and income enhance the loan application, improving approval chances and securing better interest rates. Unlike a co-borrower, a cosigner is not equally responsible for loan repayment but serves as a backup payer to reduce lender risk.

What is a Co-borrower on a Car Loan?

A co-borrower on a car loan is an individual who shares equal responsibility for repaying the loan along with the primary borrower, contributing to the loan approval process with their creditworthiness and income. Unlike a cosigner, a co-borrower has ownership interest in the vehicle and appears on the title. This joint liability means both parties are legally accountable for the debt, impacting credit scores and financial obligations.

Credit Impact: Cosigner vs Co-borrower

A cosigner's credit is directly impacted if the primary borrower misses payments since they are legally responsible for the loan, potentially lowering their credit score. A co-borrower's credit is equally affected as they share equal responsibility for repayment and the loan appears on both credit reports. Both roles carry significant risks, but co-borrowers have more control over the loan terms and usage compared to cosigners.

Responsibilities and Risks for Cosigners

Cosigners take on full legal responsibility for a loan if the primary borrower defaults, making them equally liable for repayment obligations. They face significant risks, including damage to credit scores and potential financial loss if the borrower fails to pay. Unlike co-borrowers, cosigners often have no ownership or direct benefit from the loan proceeds but remain accountable to lenders.

Responsibilities and Risks for Co-borrowers

Co-borrowers share equal responsibility for repaying the loan, making them legally liable for the full debt amount alongside the primary borrower. Their credit scores are directly impacted by the loan's payment history, with missed or late payments potentially lowering their credit ratings. Unlike cosigners, co-borrowers have ownership rights to the asset or property purchased with the loan, increasing both their financial risk and involvement.

Eligibility Requirements: Cosigner vs Co-borrower

Cosigners typically need a strong credit score and steady income to guarantee the loan but do not have ownership rights to the property or asset purchased. Co-borrowers share equal responsibility for loan repayment and usually must meet the same eligibility criteria, including income verification, creditworthiness, and debt-to-income ratio. Lenders assess co-borrowers as primary applicants, which can improve approval chances, whereas cosigners act as secondary guarantors without ownership benefits.

Pros and Cons of Having a Cosigner

Having a cosigner can improve loan approval chances and secure lower interest rates by leveraging the cosigner's strong credit profile. However, this arrangement carries risks such as the cosigner's credit being affected if payments are missed and potential strain on personal relationships. Unlike a co-borrower who shares equal responsibility and benefits, a cosigner is primarily liable only if the primary borrower defaults, which can limit their involvement in the loan terms and repayment decisions.

Pros and Cons of Having a Co-borrower

Having a co-borrower can improve loan approval chances by combining incomes and credit profiles, potentially securing better interest rates and higher loan amounts. However, both borrowers share equal responsibility for repayment, meaning missed payments can harm both credit scores, and financial disputes may arise. Co-borrowing disputes may complicate loan management, especially if one party defaults or fails to contribute financially.

Choosing Between a Cosigner and a Co-borrower: Which is Right for You?

Choosing between a cosigner and a co-borrower depends on your financial goals and credit situation. A cosigner provides credit support without ownership rights, improving loan approval chances, while a co-borrower shares equal responsibility and ownership of the loan and property. Assessing credit scores, income stability, and desired control over the asset helps determine whether a cosigner or co-borrower best suits your loan needs.

Cosigner vs Co-borrower Infographic

cardiffo.com

cardiffo.com