The loan term refers to the length of time you have to repay the loan in full, while the amortization period is the total span over which your loan payments are calculated to gradually pay off the principal and interest. A shorter loan term typically means higher monthly payments but less interest paid overall, whereas a longer amortization period lowers monthly payments but increases total interest costs. Understanding the difference helps borrowers choose the repayment schedule that best fits their financial goals.

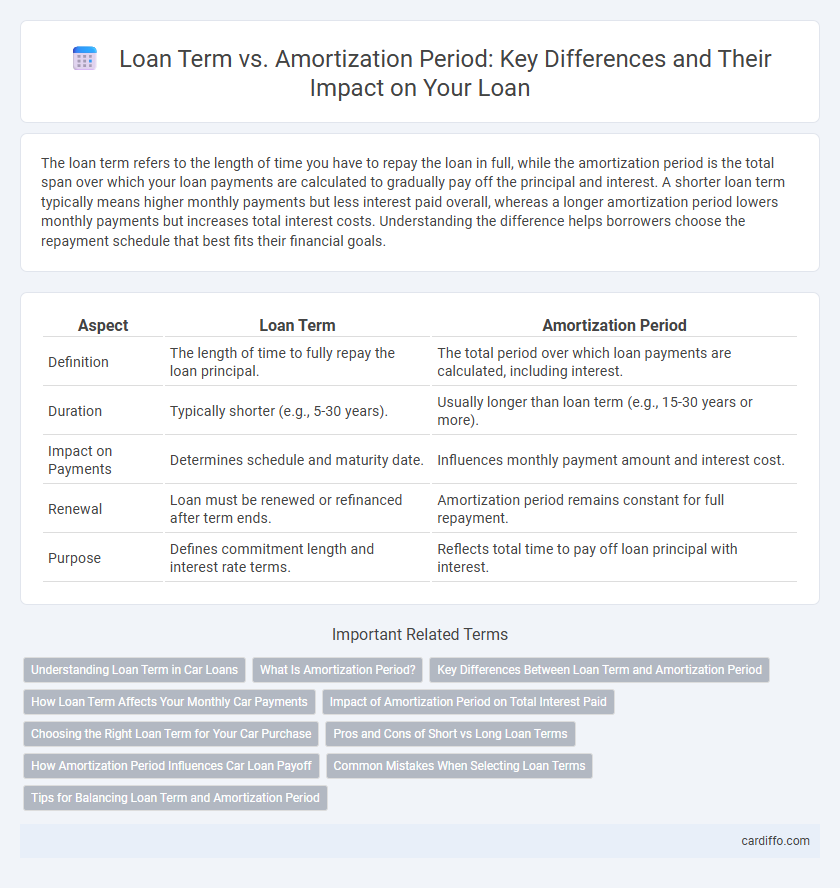

Table of Comparison

| Aspect | Loan Term | Amortization Period |

|---|---|---|

| Definition | The length of time to fully repay the loan principal. | The total period over which loan payments are calculated, including interest. |

| Duration | Typically shorter (e.g., 5-30 years). | Usually longer than loan term (e.g., 15-30 years or more). |

| Impact on Payments | Determines schedule and maturity date. | Influences monthly payment amount and interest cost. |

| Renewal | Loan must be renewed or refinanced after term ends. | Amortization period remains constant for full repayment. |

| Purpose | Defines commitment length and interest rate terms. | Reflects total time to pay off loan principal with interest. |

Understanding Loan Term in Car Loans

Loan term in car loans refers to the fixed period during which the borrower agrees to repay the principal amount and interest, typically ranging from 24 to 72 months. Understanding the loan term is crucial because it affects monthly payments and the total cost of borrowing; shorter terms usually mean higher payments but less interest paid overall. The amortization period may sometimes differ from the loan term, influencing how quickly the loan balance decreases and whether refinancing becomes necessary.

What Is Amortization Period?

The amortization period is the total length of time it takes to fully repay a loan through regular payments, including both principal and interest. It influences the size of monthly payments and the total interest paid over the life of the loan. Unlike the loan term, which is the duration before the loan must be renewed or paid off, the amortization period determines the repayment schedule and impact on long-term financial planning.

Key Differences Between Loan Term and Amortization Period

The loan term is the length of time you agree to repay the loan, typically ranging from 5 to 30 years, while the amortization period is the total time it takes to pay off the entire loan balance through scheduled payments, often 25 to 30 years. Loan term affects the interest rate and monthly payment amounts, whereas the amortization period determines the spread of those payments over time. Shorter loan terms usually result in higher monthly payments but less interest paid overall, contrasted with longer amortization periods that lower monthly costs but increase total interest.

How Loan Term Affects Your Monthly Car Payments

The loan term directly impacts your monthly car payments by determining the length over which you repay the loan principal. A shorter loan term results in higher monthly payments but reduces the total interest paid, while a longer amortization period lowers monthly payments but increases overall interest costs. Understanding this balance helps borrowers choose a loan structure that fits their budget and financial goals.

Impact of Amortization Period on Total Interest Paid

A longer amortization period reduces monthly loan payments but increases the total interest paid over the life of the loan due to prolonged principal repayment. Shorter amortization periods result in higher monthly payments but significantly lower total interest costs by accelerating principal reduction. Borrowers must balance affordability with interest savings when selecting an amortization period relative to the loan term.

Choosing the Right Loan Term for Your Car Purchase

Selecting the appropriate loan term for your car purchase directly impacts monthly payments and overall interest costs. Shorter loan terms typically result in higher monthly payments but lower total interest paid, while longer terms reduce payments but increase the overall cost. Understanding your budget and financial goals helps determine whether a 36, 48, or 60-month loan term aligns best with your car-buying plan.

Pros and Cons of Short vs Long Loan Terms

Short loan terms typically result in higher monthly payments but lower overall interest costs, allowing borrowers to pay off their loans faster and build equity more quickly. Long loan terms offer lower monthly payments, improving immediate cash flow and affordability, but they incur higher total interest costs and extend the repayment period. Choosing between short and long loan terms depends on balancing monthly budget constraints with long-term financial goals and interest expense considerations.

How Amortization Period Influences Car Loan Payoff

The amortization period directly affects the monthly payments and total interest paid on a car loan, with longer periods resulting in lower payments but higher overall interest costs. Shorter amortization periods accelerate loan payoff, reducing interest accumulation and increasing equity in the vehicle faster. Borrowers should balance affordability with interest savings when choosing the amortization period to optimize car loan repayment.

Common Mistakes When Selecting Loan Terms

Selecting a loan term shorter than the amortization period often leads to significantly higher monthly payments, causing financial strain and increased risk of default. Many borrowers mistakenly focus solely on lower monthly payments without considering the total interest paid over the life of the loan, resulting in higher long-term costs. Choosing an inappropriate loan term can also limit refinancing options and reduce flexibility in managing debt effectively.

Tips for Balancing Loan Term and Amortization Period

Choosing a loan term that aligns with your financial goals helps manage monthly payments while controlling total interest costs. Opt for an amortization period close to the loan term to prevent balloon payments and ensure predictable budgeting. Regularly reassessing your loan structure allows adjustments to stay on track with changing income or market conditions.

Loan Term vs Amortization Period Infographic

cardiffo.com

cardiffo.com