A down payment directly reduces the loan amount by the upfront cash paid, while a trade-in value is credited toward the purchase price of a new vehicle, lowering the total cost before financing. Down payments often strengthen loan approval chances and can decrease monthly payments, whereas trade-ins provide value by offsetting the sale price. Understanding the distinction between these two helps borrowers optimize their financing strategy and manage overall expenses effectively.

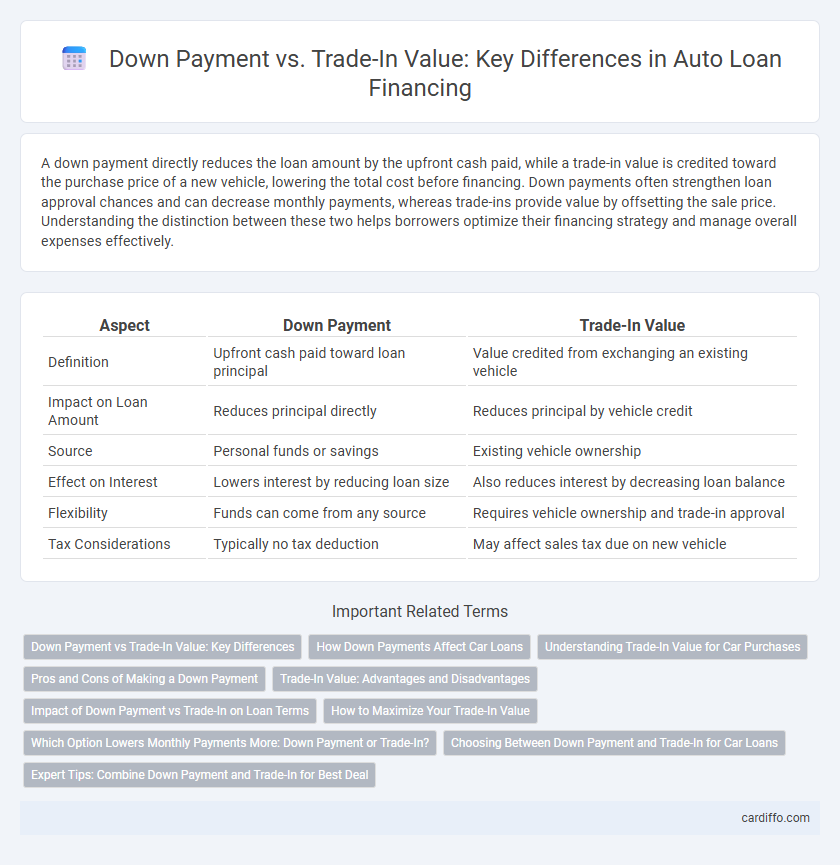

Table of Comparison

| Aspect | Down Payment | Trade-In Value |

|---|---|---|

| Definition | Upfront cash paid toward loan principal | Value credited from exchanging an existing vehicle |

| Impact on Loan Amount | Reduces principal directly | Reduces principal by vehicle credit |

| Source | Personal funds or savings | Existing vehicle ownership |

| Effect on Interest | Lowers interest by reducing loan size | Also reduces interest by decreasing loan balance |

| Flexibility | Funds can come from any source | Requires vehicle ownership and trade-in approval |

| Tax Considerations | Typically no tax deduction | May affect sales tax due on new vehicle |

Down Payment vs Trade-In Value: Key Differences

Down payment refers to the upfront cash amount a borrower pays toward the purchase price of a vehicle or property, directly reducing the loan principal. Trade-in value represents the appraised worth of an existing vehicle that can be applied as credit toward the new purchase, effectively lowering the loan balance but often involving negotiation and vehicle condition assessment. Understanding the key differences between down payment and trade-in value helps borrowers optimize financing options and minimize total loan costs.

How Down Payments Affect Car Loans

Down payments directly reduce the principal amount of a car loan, lowering monthly payments and overall interest paid. A higher down payment improves loan-to-value (LTV) ratio, increasing the chances of loan approval and securing better interest rates. Unlike trade-in value, which depends on the vehicle's condition and market demand, down payments are a guaranteed upfront cash contribution that immediately impacts loan terms.

Understanding Trade-In Value for Car Purchases

Trade-in value represents the amount a dealership offers for your current vehicle, which can directly reduce the loan amount required for your new car purchase. Unlike a down payment made from personal savings, the trade-in value depends on your car's make, model, condition, mileage, and market demand. Accurately assessing the trade-in value helps maximize your financing options and lowers overall loan interest costs.

Pros and Cons of Making a Down Payment

Making a down payment reduces the principal loan amount, resulting in lower monthly payments and decreased interest over the loan term, which can improve long-term financial stability. However, allocating a large sum upfront may strain immediate cash flow and limit liquidity for other expenses or emergencies. While a trade-in value can serve as a partial down payment, a direct cash down payment offers more flexibility in negotiating loan terms and potentially securing better interest rates.

Trade-In Value: Advantages and Disadvantages

Trade-in value offers the advantage of reducing the principal loan amount by applying the vehicle's worth directly to the new loan, lowering monthly payments and potentially improving loan approval odds. However, trade-in values are often lower than private sale prices, which might result in less overall equity compared to a larger down payment. Evaluating the trade-in value carefully against the anticipated loan benefits ensures an optimal financial decision when managing vehicle financing.

Impact of Down Payment vs Trade-In on Loan Terms

A higher down payment directly reduces the principal amount of the loan, leading to lower monthly payments and less interest paid over the loan term. Trade-in value also decreases the loan balance, but its impact depends on the appraisal and the dealer's offer, which may vary. Both factors affect loan-to-value (LTV) ratios, influencing interest rates and loan approval chances, with a substantial down payment typically having a more consistent positive effect on loan terms.

How to Maximize Your Trade-In Value

Maximizing your trade-in value begins with thorough research on your vehicle's current market price using resources like Kelley Blue Book or Edmunds to set realistic expectations. Maintaining your car's condition with regular cleaning, minor repairs, and updated maintenance records can significantly boost its appraisal value. Timing your trade-in during peak demand seasons or before new model releases also helps secure the highest possible trade-in offer.

Which Option Lowers Monthly Payments More: Down Payment or Trade-In?

A larger down payment directly reduces the principal loan amount, resulting in lower monthly payments due to decreased interest accrual over the loan term. Trade-in value acts as a credit toward the purchase price, similarly lowering the loan balance, but since trade-in offers can vary widely based on vehicle condition, down payments provide more predictable monthly payment reductions. Loans with substantial down payments typically achieve lower monthly obligations faster compared to relying solely on trade-in value, which may fluctuate and affect the final financing terms.

Choosing Between Down Payment and Trade-In for Car Loans

Choosing between a down payment and trade-in value significantly impacts car loan terms and monthly payments. A larger down payment reduces the principal loan amount directly, lowering interest over the loan period, while trading in a vehicle applies its value as credit toward the purchase price, potentially simplifying the transaction but not always reducing monthly payments as effectively. Evaluating current trade-in offer conditions, vehicle depreciation, and cash liquidity helps borrowers optimize overall financing costs and loan approval chances.

Expert Tips: Combine Down Payment and Trade-In for Best Deal

Combining a substantial down payment with a high trade-in value significantly reduces the loan principal, lowering monthly payments and total interest paid. Experts recommend evaluating your vehicle's trade-in appraisal alongside available cash to maximize upfront equity and negotiate better loan terms. This strategic approach enhances financing options and accelerates loan payoff, improving overall financial health.

Down Payment vs Trade-In Value Infographic

cardiffo.com

cardiffo.com