Principal reduction lowers the loan balance directly, reducing the amount of interest paid over time and shortening the loan term. Interest-only payments cover just the interest, keeping the principal unchanged and resulting in no equity build-up during that period. Choosing principal reduction enhances long-term savings by decreasing total interest expense, while interest-only payments offer short-term cash flow flexibility without reducing debt.

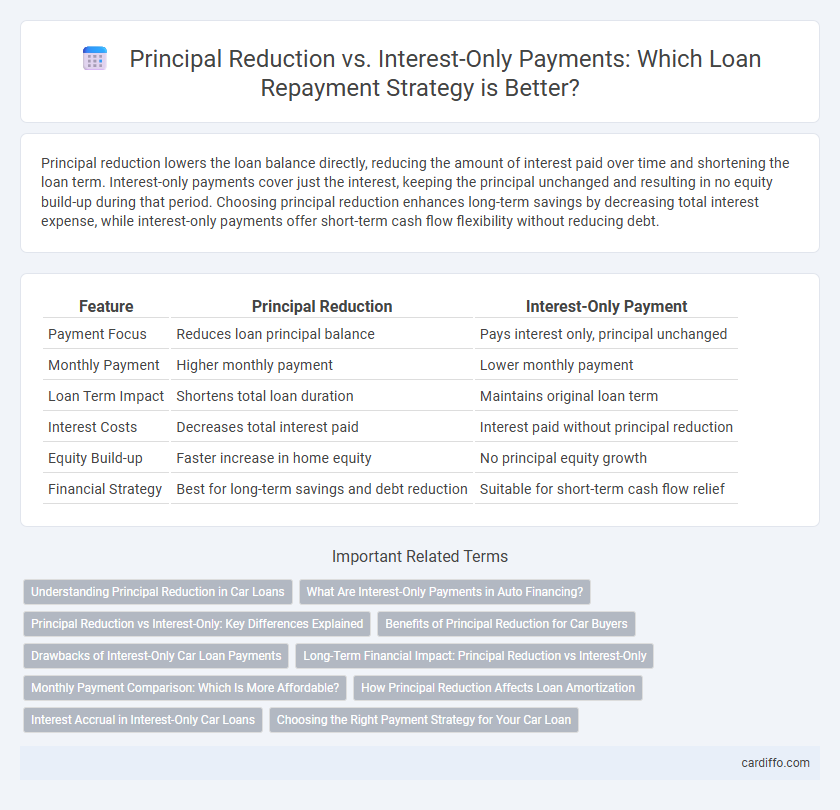

Table of Comparison

| Feature | Principal Reduction | Interest-Only Payment |

|---|---|---|

| Payment Focus | Reduces loan principal balance | Pays interest only, principal unchanged |

| Monthly Payment | Higher monthly payment | Lower monthly payment |

| Loan Term Impact | Shortens total loan duration | Maintains original loan term |

| Interest Costs | Decreases total interest paid | Interest paid without principal reduction |

| Equity Build-up | Faster increase in home equity | No principal equity growth |

| Financial Strategy | Best for long-term savings and debt reduction | Suitable for short-term cash flow relief |

Understanding Principal Reduction in Car Loans

Principal reduction in car loans decreases the outstanding loan balance by applying extra payments directly to the principal amount, which shortens the loan term and reduces total interest paid over time. Unlike interest-only payments that temporarily lower monthly costs without reducing the principal, principal reduction builds equity in the vehicle faster and improves creditworthiness. Understanding this strategy helps borrowers save money and pay off their car loans more efficiently.

What Are Interest-Only Payments in Auto Financing?

Interest-only payments in auto financing allow borrowers to pay only the interest on the loan for a predetermined period, usually the first few years, without reducing the principal balance. This structure results in lower monthly payments initially but does not build equity in the vehicle, as the principal remains unchanged during the interest-only phase. Once the interest-only term ends, payments increase significantly as borrowers begin repaying both principal and interest.

Principal Reduction vs Interest-Only: Key Differences Explained

Principal reduction lowers the outstanding loan balance directly, reducing future interest accrual and overall repayment amount. Interest-only payments cover just the interest charged, leaving the principal unchanged and extending the loan term. Choosing principal reduction accelerates equity building, while interest-only payments provide short-term cash flow relief without decreasing debt principal.

Benefits of Principal Reduction for Car Buyers

Principal reduction lowers the outstanding loan balance, which decreases overall interest costs and shortens the loan term for car buyers. This strategy boosts equity in the vehicle quicker, providing better financial flexibility and improving loan-to-value ratios. Car buyers benefit from reduced monthly payments over time and a stronger position for refinancing or selling the car without owing more than its worth.

Drawbacks of Interest-Only Car Loan Payments

Interest-only car loan payments result in slower principal reduction, extending the loan term and increasing total interest paid over time. This payment structure risks negative equity, where the car's value drops below the remaining loan balance. Borrowers remain vulnerable to substantial financial strain once principal payments begin, often leading to higher monthly costs and potential default.

Long-Term Financial Impact: Principal Reduction vs Interest-Only

Principal reduction decreases the loan balance, directly lowering future interest costs and shortening the loan term, which leads to substantial long-term savings and faster equity building. Interest-only payments minimize monthly expenses initially but defer principal repayment, resulting in higher interest paid over the life of the loan and extended debt duration. Choosing principal reduction over interest-only payments enhances financial stability by reducing total interest obligations and accelerating loan payoff.

Monthly Payment Comparison: Which Is More Affordable?

Principal reduction lowers the loan balance, directly decreasing monthly payments by cutting down the amount on which interest is charged, leading to sustained affordability over the loan term. Interest-only payments reduce monthly expenses initially by covering only the interest portion without reducing the principal, but this can result in higher payments later and increased total interest paid. Comparing monthly payments, principal reduction offers more consistent affordability, while interest-only payments provide short-term relief that may increase financial burden over time.

How Principal Reduction Affects Loan Amortization

Principal reduction directly decreases the outstanding loan balance, accelerating the amortization process by reducing the total interest paid over the loan term. Each payment applied toward the principal shortens the repayment period and increases the equity in the property or asset. In contrast to interest-only payments, principal reduction ensures faster loan payoff and lower overall borrowing costs.

Interest Accrual in Interest-Only Car Loans

Interest-only car loans allow borrowers to pay only the interest for a set period, causing the principal balance to remain unchanged and interest to accrue on the full loan amount. This structure can lead to higher total interest costs over the life of the loan compared to principal reduction payments, which gradually decrease the loan balance and reduce interest accrual. Understanding the impact of interest accrual is crucial for managing long-term loan expenses and avoiding balloon payments once the interest-only period ends.

Choosing the Right Payment Strategy for Your Car Loan

Choosing the right payment strategy for your car loan depends on your financial goals and cash flow. Principal reduction payments lower the loan balance faster, reducing interest paid over time and shortening the loan term. Interest-only payments offer lower monthly costs initially but do not reduce the principal, potentially resulting in higher total interest and extending the loan duration.

Principal Reduction vs Interest-Only Payment Infographic

cardiffo.com

cardiffo.com