Precomputed interest calculates the total interest at the start of the loan term and adds it to the principal, resulting in fixed payments that do not decrease as the loan balance decreases. Simple interest is calculated on the outstanding principal balance each period, meaning the interest cost reduces as payments are made. Choosing between precomputed interest and simple interest affects the loan's total cost and payment structure, with simple interest often being more cost-effective for borrowers who make early repayments.

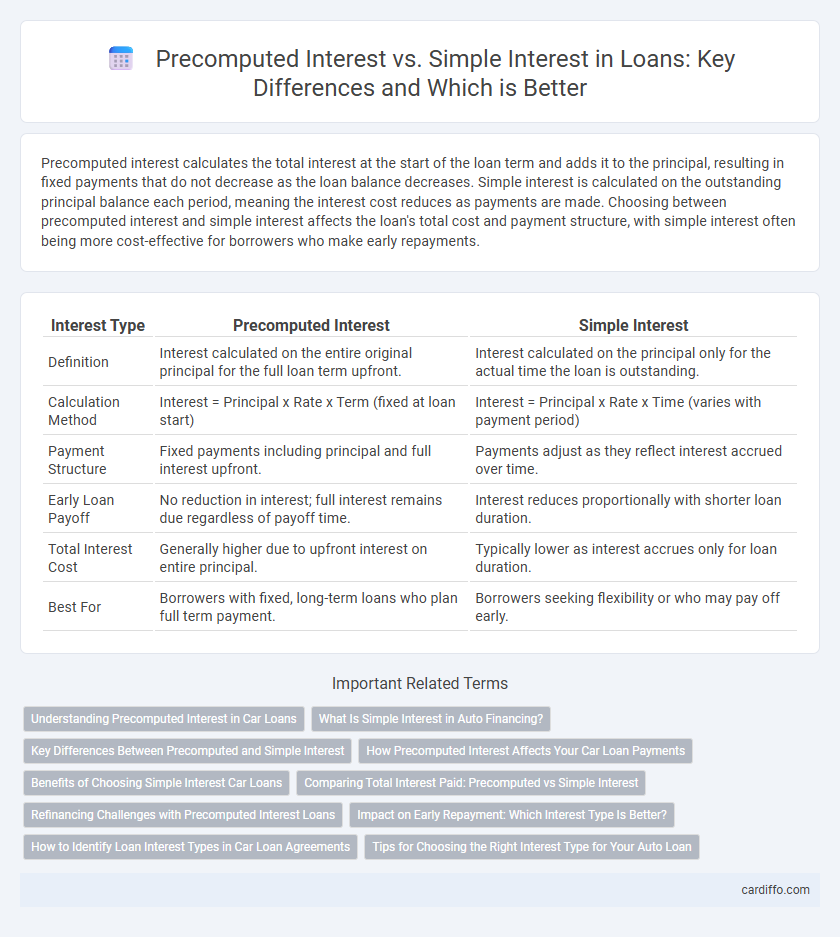

Table of Comparison

| Interest Type | Precomputed Interest | Simple Interest |

|---|---|---|

| Definition | Interest calculated on the entire original principal for the full loan term upfront. | Interest calculated on the principal only for the actual time the loan is outstanding. |

| Calculation Method | Interest = Principal x Rate x Term (fixed at loan start) | Interest = Principal x Rate x Time (varies with payment period) |

| Payment Structure | Fixed payments including principal and full interest upfront. | Payments adjust as they reflect interest accrued over time. |

| Early Loan Payoff | No reduction in interest; full interest remains due regardless of payoff time. | Interest reduces proportionally with shorter loan duration. |

| Total Interest Cost | Generally higher due to upfront interest on entire principal. | Typically lower as interest accrues only for loan duration. |

| Best For | Borrowers with fixed, long-term loans who plan full term payment. | Borrowers seeking flexibility or who may pay off early. |

Understanding Precomputed Interest in Car Loans

Precomputed interest in car loans is calculated upfront on the entire principal balance and added to the loan amount, resulting in fixed total interest regardless of early repayment. Unlike simple interest, which accrues daily on the outstanding balance, precomputed interest often leads to higher costs if a borrower pays off the loan early because interest is not recalculated. Understanding this difference is crucial to avoid unexpected financial burdens and to choose the most cost-effective auto financing option.

What Is Simple Interest in Auto Financing?

Simple interest in auto financing refers to the method of calculating interest on the principal loan amount only, without compounding over time. This means borrowers pay interest solely on the original amount borrowed, resulting in predictable monthly payments and total interest costs. Precomputed interest loans differ as they calculate total interest upfront, often leading to higher overall payments and less flexibility in early payoff options.

Key Differences Between Precomputed and Simple Interest

Precomputed interest calculates the total interest owed at the start of the loan term and includes it in the principal, leading to higher effective costs if the loan is paid off early. Simple interest accrues only on the outstanding principal balance over time, resulting in lower interest payments when loans are repaid ahead of schedule. Understanding these key differences helps borrowers evaluate total loan costs and repayment flexibility.

How Precomputed Interest Affects Your Car Loan Payments

Precomputed interest on car loans calculates the total interest upfront based on the original principal and loan term, causing monthly payments to remain fixed regardless of early repayments. This method often results in higher overall costs, as borrowers do not benefit from paying off the loan early or reducing principal faster. Understanding precomputed interest is crucial to assessing actual car loan expenses compared to simple interest, which accrues interest only on the outstanding balance.

Benefits of Choosing Simple Interest Car Loans

Simple interest car loans offer transparency by calculating interest solely on the principal amount, making it easier for borrowers to understand total repayment costs. This method often results in lower interest expenses compared to precomputed interest loans, especially when early repayment or refinancing occurs. Borrowers benefit from greater flexibility and potential savings, as interest does not compound over the loan term.

Comparing Total Interest Paid: Precomputed vs Simple Interest

Precomputed interest loans require paying the total interest upfront based on the original principal and loan term, leading to higher overall costs if the loan is paid off early. Simple interest loans calculate interest on the remaining principal balance, reducing total interest paid with early repayments. Comparing total interest paid, simple interest loans typically result in lower costs, especially when borrowers make extra payments or settle the loan ahead of schedule.

Refinancing Challenges with Precomputed Interest Loans

Precomputed interest loans pose refinancing challenges because the borrower pays interest upfront on the entire loan principal, making early payoff adjustments complex and often leading to higher effective costs. Refinancing these loans can result in the borrower losing unearned interest, reducing potential savings compared to simple interest loans where interest accrues only on the remaining balance. This inflexibility hinders cost-effective refinancing options and limits financial agility for borrowers seeking lower rates or improved terms.

Impact on Early Repayment: Which Interest Type Is Better?

Precomputed interest results in fixed total interest charged upfront, making early repayment less beneficial since the borrower still owes the full interest amount regardless of loan duration. In contrast, simple interest accrues only on the outstanding principal over time, allowing borrowers to save money by paying off the loan early and reducing total interest paid. For early repayment scenarios, loans with simple interest are generally more cost-effective, minimizing overall borrowing costs.

How to Identify Loan Interest Types in Car Loan Agreements

Car loan agreements often specify the interest calculation method in the terms section, highlighting whether precomputed or simple interest applies. Precomputed interest loans calculate total interest upfront based on the principal and loan term, resulting in fixed payments, whereas simple interest loans accrue interest daily on the outstanding balance, allowing for potential interest savings with early repayment. To identify the loan interest type, examine the payment schedule and disclosure statements for keywords such as "precomputed," "add-on," or "simple interest," and confirm if interest is charged on the original principal or the declining balance.

Tips for Choosing the Right Interest Type for Your Auto Loan

When selecting between precomputed interest and simple interest for an auto loan, consider your payment flexibility and loan term. Simple interest loans calculate interest daily on the outstanding balance, often saving money if you pay early or make extra payments. Precomputed interest loans charge interest upfront on the total principal, which can result in higher costs if you pay off the loan early or miss payments.

Precomputed Interest vs Simple Interest Infographic

cardiffo.com

cardiffo.com