No down payment loans allow borrowers to finance the entire purchase price, increasing accessibility but often resulting in higher interest rates and private mortgage insurance costs. Loans with a down payment require an upfront cash contribution, reducing the loan amount and typically lowering monthly payments and overall interest expenses. Choosing between these options depends on financial stability, credit score, and long-term repayment goals.

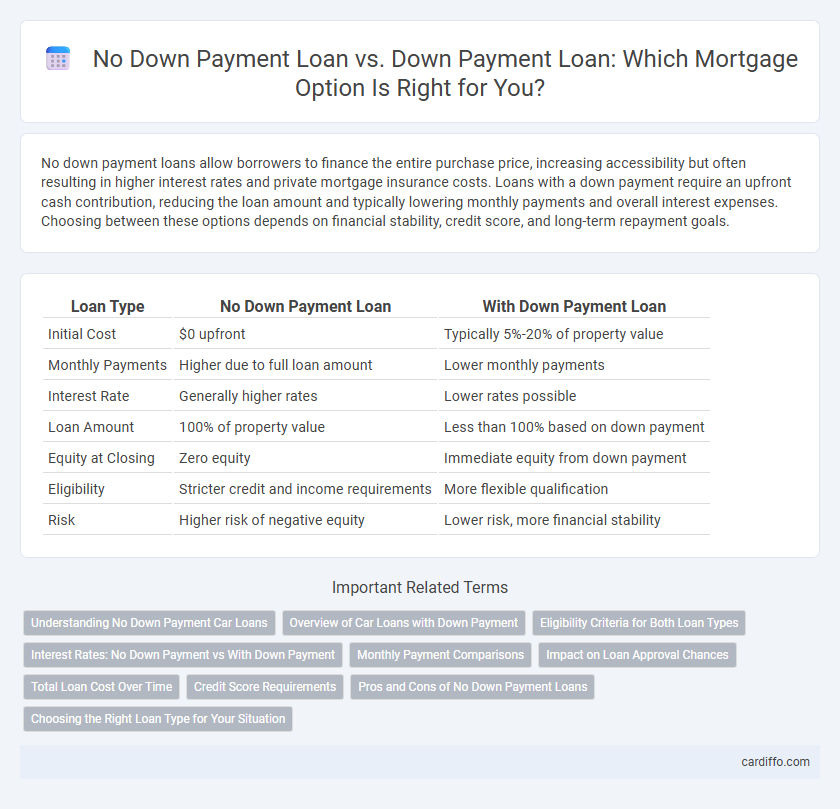

Table of Comparison

| Loan Type | No Down Payment Loan | With Down Payment Loan |

|---|---|---|

| Initial Cost | $0 upfront | Typically 5%-20% of property value |

| Monthly Payments | Higher due to full loan amount | Lower monthly payments |

| Interest Rate | Generally higher rates | Lower rates possible |

| Loan Amount | 100% of property value | Less than 100% based on down payment |

| Equity at Closing | Zero equity | Immediate equity from down payment |

| Eligibility | Stricter credit and income requirements | More flexible qualification |

| Risk | Higher risk of negative equity | Lower risk, more financial stability |

Understanding No Down Payment Car Loans

No down payment car loans allow borrowers to finance the entire vehicle price, eliminating the upfront cost typically required in traditional loans. Lenders may compensate for the increased risk by charging higher interest rates or imposing stricter credit requirements on no down payment loans. Understanding the terms, eligibility criteria, and long-term financial impact is essential before opting for a no down payment car loan.

Overview of Car Loans with Down Payment

Car loans with a down payment require an initial upfront payment that reduces the overall loan amount, leading to lower monthly installments and potentially better interest rates. This type of loan decreases lender risk and may increase the chances of approval for borrowers with less-than-perfect credit scores. A down payment typically ranges from 10% to 20% of the vehicle's purchase price, helping to build immediate equity in the car.

Eligibility Criteria for Both Loan Types

No down payment loans often require stricter eligibility criteria such as higher credit scores, stable income proof, and sometimes VA or USDA loan qualifications to minimize lender risk. Loans with a down payment typically have more flexible eligibility requirements, allowing borrowers with moderate credit scores and varied income sources to qualify more easily. Both loan types demand thorough verification of financial history, but down payment loans generally offer lower interest rates and reduced private mortgage insurance costs.

Interest Rates: No Down Payment vs With Down Payment

No down payment loans typically feature higher interest rates due to increased lender risk, while loans with a down payment often benefit from lower rates reflecting reduced loan-to-value ratios. Borrowers who choose no down payment loans may face higher monthly payments and increased overall interest costs over the loan term. Conversely, making a down payment can substantially decrease interest expenses and improve loan affordability by securing more favorable rate terms.

Monthly Payment Comparisons

No down payment loans generally result in higher monthly payments due to the full loan principal being amortized over the loan term, increasing the borrower's monthly financial obligation. In contrast, loans with down payments reduce the principal amount, leading to lower monthly payments and potentially better loan terms such as lower interest rates. Borrowers choosing no down payment options should carefully evaluate budget capacity, as monthly payments can significantly impact long-term affordability.

Impact on Loan Approval Chances

No down payment loans often increase the chances of loan approval for borrowers with limited upfront cash but may come with stricter credit score requirements and higher interest rates. Loans with down payments typically enhance approval odds by reducing lender risk and demonstrating borrower financial stability, leading to more favorable loan terms. Lenders prioritize factors such as credit history, debt-to-income ratio, and loan-to-value ratio to assess approval likelihood in both loan types.

Total Loan Cost Over Time

No down payment loans often result in higher total loan costs over time due to increased interest rates and longer repayment periods, increasing the overall financial burden. Loans with down payments reduce the principal amount borrowed, leading to lower interest accumulation and shorter loan terms, which decreases the total cost paid. Borrowers should evaluate interest rates, loan terms, and potential equity buildup when comparing no down payment loans to those requiring a down payment.

Credit Score Requirements

No down payment loans often require higher credit scores, typically 620 or above, to mitigate lender risk as there is no immediate equity from the borrower. In contrast, loans with a down payment usually accept lower credit scores, sometimes as low as 580, because the initial payment reduces lender exposure. Strong credit history remains crucial for favorable interest rates and approval regardless of down payment status.

Pros and Cons of No Down Payment Loans

No down payment loans offer the advantage of immediate homeownership without upfront capital, making them accessible to buyers with limited savings or cash flow. However, these loans often come with higher interest rates and private mortgage insurance (PMI) costs, increasing the overall loan expense. Borrowers should also consider potential stricter credit requirements and reduced equity buildup compared to loans with down payments.

Choosing the Right Loan Type for Your Situation

Choosing the right loan type depends on your financial stability and long-term goals. No down payment loans offer easier access and preserve cash flow but often come with higher interest rates and mortgage insurance. Loans with a down payment require upfront capital, reducing loan principal and interest costs while potentially improving approval chances and equity buildup.

No Down Payment Loan vs With Down Payment Loan Infographic

cardiffo.com

cardiffo.com