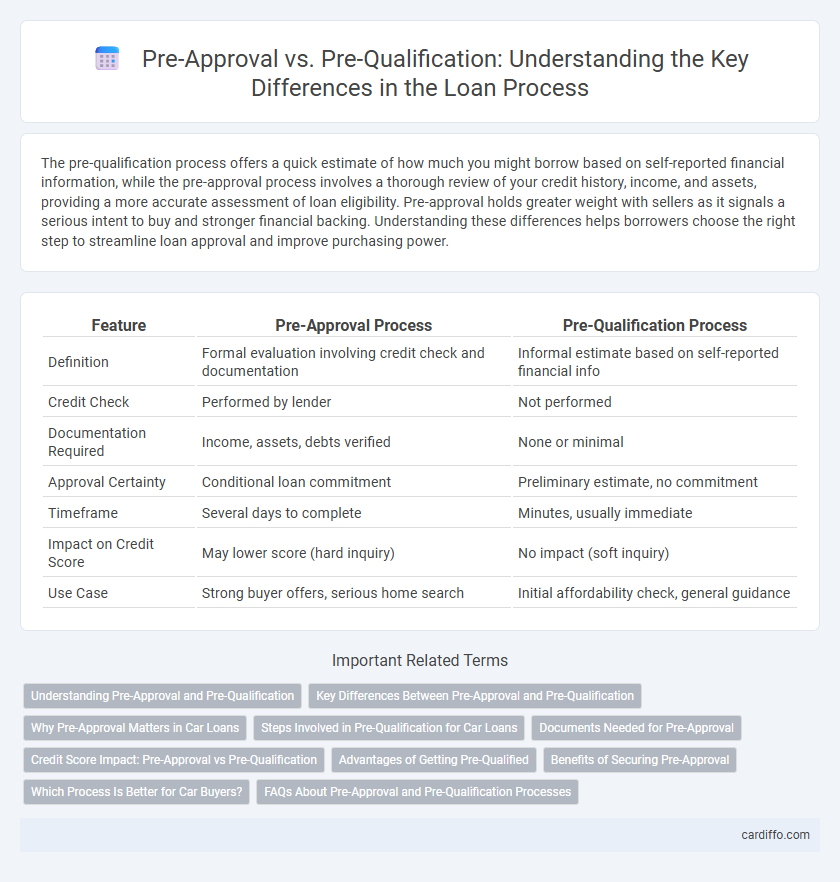

The pre-qualification process offers a quick estimate of how much you might borrow based on self-reported financial information, while the pre-approval process involves a thorough review of your credit history, income, and assets, providing a more accurate assessment of loan eligibility. Pre-approval holds greater weight with sellers as it signals a serious intent to buy and stronger financial backing. Understanding these differences helps borrowers choose the right step to streamline loan approval and improve purchasing power.

Table of Comparison

| Feature | Pre-Approval Process | Pre-Qualification Process |

|---|---|---|

| Definition | Formal evaluation involving credit check and documentation | Informal estimate based on self-reported financial info |

| Credit Check | Performed by lender | Not performed |

| Documentation Required | Income, assets, debts verified | None or minimal |

| Approval Certainty | Conditional loan commitment | Preliminary estimate, no commitment |

| Timeframe | Several days to complete | Minutes, usually immediate |

| Impact on Credit Score | May lower score (hard inquiry) | No impact (soft inquiry) |

| Use Case | Strong buyer offers, serious home search | Initial affordability check, general guidance |

Understanding Pre-Approval and Pre-Qualification

Understanding pre-approval involves a thorough evaluation of your financial background, including credit score, income, and debt-to-income ratio, resulting in a conditional commitment from a lender. Pre-qualification is a preliminary assessment based on self-reported information, providing an estimate of the loan amount you might qualify for without a detailed credit check. Knowing the distinction helps borrowers set realistic expectations and strengthens their position when negotiating with sellers.

Key Differences Between Pre-Approval and Pre-Qualification

Pre-approval involves a thorough evaluation of a borrower's financial background, including credit checks and income verification, providing a more accurate loan amount estimate. Pre-qualification is a preliminary assessment based on self-reported information, offering a general idea of loan eligibility without in-depth verification. Lenders consider pre-approval a stronger indicator of loan readiness compared to pre-qualification, impacting borrowing power and negotiation leverage.

Why Pre-Approval Matters in Car Loans

Pre-approval in car loans provides borrowers with a clear understanding of their financing limits, enabling more confident negotiation and faster closing. Unlike pre-qualification, which offers a preliminary estimate based on self-reported information, pre-approval involves a thorough credit check and documentation verification, increasing lender commitment. This process enhances buyer credibility with dealerships and helps secure better interest rates and loan terms.

Steps Involved in Pre-Qualification for Car Loans

The pre-qualification process for car loans involves submitting basic financial information such as income, employment status, and credit score to the lender, who then provides an initial estimate of loan eligibility and terms. This step requires minimal documentation and offers a quick assessment without a hard credit check, helping buyers understand potential loan amounts and interest rates. Unlike pre-approval, pre-qualification is less binding and serves primarily as a preliminary evaluation to guide prospective borrowers.

Documents Needed for Pre-Approval

The pre-approval process for a loan requires comprehensive documentation including proof of income such as pay stubs or tax returns, credit history reports, bank statements, and identification documents like a driver's license or passport. Lenders analyze these documents to assess the borrower's financial stability and creditworthiness more thoroughly compared to the pre-qualification process, which typically relies on self-reported information and a preliminary credit check. Submitting complete and accurate documents during pre-approval expedites the loan approval timeline and provides a more reliable estimate of loan terms.

Credit Score Impact: Pre-Approval vs Pre-Qualification

Pre-approval involves a thorough credit check, resulting in a hard inquiry that can slightly lower your credit score, whereas pre-qualification relies on self-reported financial information without impacting your credit score. Lenders use pre-approval to verify your creditworthiness, making it a stronger indication of loan eligibility compared to pre-qualification, which provides a general estimate. Understanding these differences helps borrowers manage their credit impact while navigating the loan application process effectively.

Advantages of Getting Pre-Qualified

Getting pre-qualified accelerates the loan approval timeline by providing a preliminary assessment of your creditworthiness based on basic financial information. This step offers clarity on potential loan amounts and interest rates without impacting your credit score, enabling better budgeting and home search strategies. Pre-qualification also helps identify any financial issues early, allowing you to address them before formal application submission.

Benefits of Securing Pre-Approval

Securing pre-approval provides a clear understanding of your borrowing capacity, enhancing confidence in the home-buying process and speeding up the final loan approval. It allows you to make stronger offers, as sellers view pre-approved buyers as more credible and financially prepared. Pre-approval also helps identify potential credit issues early, giving you time to address them before finalizing the mortgage.

Which Process Is Better for Car Buyers?

The pre-approval process offers car buyers a more accurate understanding of their loan eligibility and budget by involving a detailed credit check and financial review, making it easier to negotiate prices confidently. In contrast, pre-qualification provides a quick estimate without guaranteeing loan approval, which can lead to unexpected financing issues later. For car buyers seeking clarity and stronger bargaining power, pre-approval is generally the better option.

FAQs About Pre-Approval and Pre-Qualification Processes

The pre-approval process involves a thorough review of a borrower's financial documents, credit history, and income verification, providing a more accurate estimate of loan eligibility compared to the pre-qualification process, which is typically based on self-reported information. Pre-approval increases a buyer's credibility with sellers by demonstrating serious intent and financial readiness, whereas pre-qualification offers a preliminary idea of borrowing potential without formal verification. Common FAQs address the differences in timeframes, with pre-approval taking longer due to documentation requirements, and the impact on credit scores, since pre-approval usually involves a hard credit inquiry while pre-qualification often uses a soft inquiry.

Pre-Approval Process vs Pre-Qualification Process Infographic

cardiffo.com

cardiffo.com