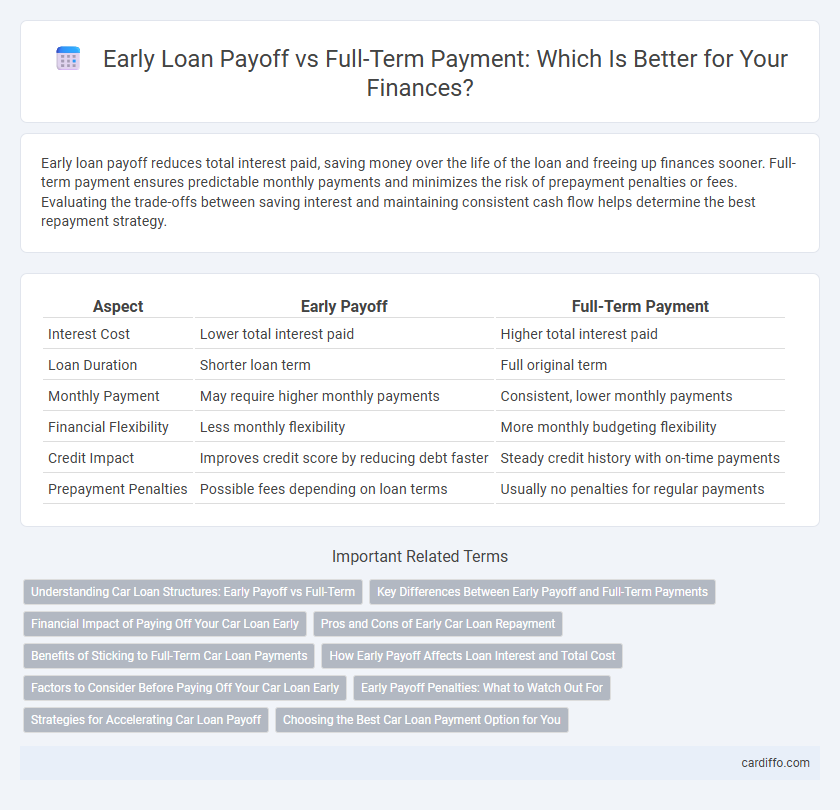

Early loan payoff reduces total interest paid, saving money over the life of the loan and freeing up finances sooner. Full-term payment ensures predictable monthly payments and minimizes the risk of prepayment penalties or fees. Evaluating the trade-offs between saving interest and maintaining consistent cash flow helps determine the best repayment strategy.

Table of Comparison

| Aspect | Early Payoff | Full-Term Payment |

|---|---|---|

| Interest Cost | Lower total interest paid | Higher total interest paid |

| Loan Duration | Shorter loan term | Full original term |

| Monthly Payment | May require higher monthly payments | Consistent, lower monthly payments |

| Financial Flexibility | Less monthly flexibility | More monthly budgeting flexibility |

| Credit Impact | Improves credit score by reducing debt faster | Steady credit history with on-time payments |

| Prepayment Penalties | Possible fees depending on loan terms | Usually no penalties for regular payments |

Understanding Car Loan Structures: Early Payoff vs Full-Term

Car loan structures typically offer options for early payoff or full-term payment, each impacting the total interest paid and loan duration. Early payoff reduces interest expenses by shortening the loan period, but some lenders may charge prepayment penalties that affect cost-effectiveness. Full-term payments follow the original loan schedule, spreading interest over time and maintaining consistent monthly payments without penalties.

Key Differences Between Early Payoff and Full-Term Payments

Early payoff of a loan reduces the total interest paid by shortening the loan duration, while full-term payments maximize interest accumulation over time. Early payoff requires higher monthly payments or lump sums, accelerating debt freedom, whereas full-term payments maintain consistent, lower installments until maturity. Lenders may impose prepayment penalties or fees on early payoff, affecting potential savings compared to adhering to full-term payment schedules.

Financial Impact of Paying Off Your Car Loan Early

Paying off your car loan early can significantly reduce the total interest paid over the life of the loan, leading to substantial financial savings. Early payoff decreases the principal balance faster, minimizing the accumulation of interest charges and improving your credit utilization ratio. However, some lenders may impose prepayment penalties, so reviewing the loan agreement for any fees is essential before making early payments.

Pros and Cons of Early Car Loan Repayment

Early payoff of a car loan reduces total interest paid, improving overall savings and freeing up monthly cash flow for other expenses or investments. However, some lenders impose prepayment penalties that can offset these financial benefits, making it essential to check loan terms beforehand. Maintaining full-term payments builds a consistent credit history and financial discipline but results in higher total interest costs over the life of the loan.

Benefits of Sticking to Full-Term Car Loan Payments

Sticking to full-term car loan payments allows borrowers to maximize cash flow flexibility, enabling the allocation of funds towards investments or emergency savings. It also helps build a stronger credit history by demonstrating consistent, on-time payments over the loan's duration. Financially, spreading payments over the entire term often results in better budgeting and less financial strain compared to the lump-sum impact of early payoff.

How Early Payoff Affects Loan Interest and Total Cost

Early payoff of a loan significantly reduces the total interest paid by decreasing the principal balance faster, which shortens the loan term and limits interest accrual. By paying off the loan early, borrowers can save thousands in interest costs, especially on long-term loans like mortgages or auto loans. This strategy results in a lower total cost of borrowing, providing financial relief and increased savings over the life of the loan.

Factors to Consider Before Paying Off Your Car Loan Early

Paying off your car loan early can save money on interest but may involve prepayment penalties depending on the loan agreement. Evaluate the remaining loan balance, interest rate, and penalty fees before deciding to pay off the loan ahead of schedule. Assessing your financial situation and potential investment returns offers insight into whether early payoff or full-term payment maximizes your overall savings.

Early Payoff Penalties: What to Watch Out For

Early payoff penalties are fees lenders may charge if a borrower repays a loan before the agreed term, reducing the lender's expected interest income. These penalties can significantly impact total savings when choosing to pay off a loan early, making it crucial to review the loan agreement for prepayment clauses. Understanding the exact terms and potential costs helps borrowers avoid unexpected fees and make informed decisions about managing loan repayment schedules.

Strategies for Accelerating Car Loan Payoff

Making extra monthly payments toward the principal balance significantly reduces interest costs and shortens the loan term. Biweekly payment strategies double the number of payments made annually, accelerating payoff without straining monthly budgets. Refinancing to a lower interest rate or shorter term can further enhance savings and speed up car loan repayment.

Choosing the Best Car Loan Payment Option for You

Evaluating early payoff against full-term payment involves considering total interest savings and monthly cash flow flexibility. Early loan payoff reduces overall interest expenses, enhancing financial freedom, while full-term payments maintain consistent budgeting with lower monthly commitments. Analyzing your income stability, financial goals, and potential investment returns helps determine the optimal car loan payment strategy.

Early Payoff vs Full-Term Payment Infographic

cardiffo.com

cardiffo.com