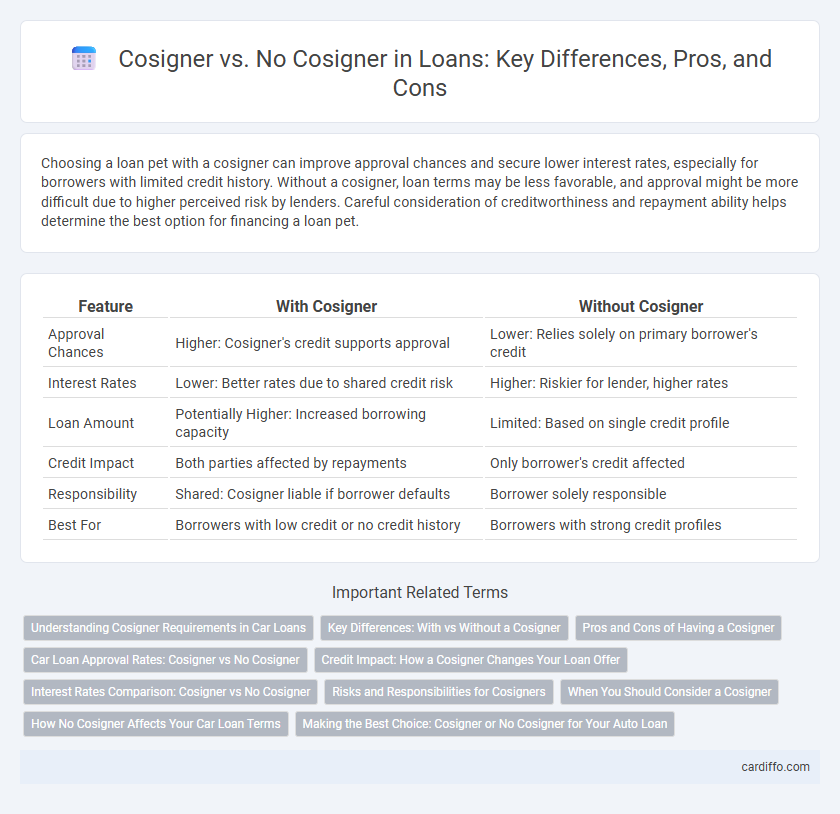

Choosing a loan pet with a cosigner can improve approval chances and secure lower interest rates, especially for borrowers with limited credit history. Without a cosigner, loan terms may be less favorable, and approval might be more difficult due to higher perceived risk by lenders. Careful consideration of creditworthiness and repayment ability helps determine the best option for financing a loan pet.

Table of Comparison

| Feature | With Cosigner | Without Cosigner |

|---|---|---|

| Approval Chances | Higher: Cosigner's credit supports approval | Lower: Relies solely on primary borrower's credit |

| Interest Rates | Lower: Better rates due to shared credit risk | Higher: Riskier for lender, higher rates |

| Loan Amount | Potentially Higher: Increased borrowing capacity | Limited: Based on single credit profile |

| Credit Impact | Both parties affected by repayments | Only borrower's credit affected |

| Responsibility | Shared: Cosigner liable if borrower defaults | Borrower solely responsible |

| Best For | Borrowers with low credit or no credit history | Borrowers with strong credit profiles |

Understanding Cosigner Requirements in Car Loans

Lenders often require a cosigner on car loans when the primary borrower has a low credit score or limited credit history to reduce the risk of default. A cosigner must have strong credit, stable income, and a good debt-to-income ratio to meet lender qualifications and improve loan approval chances. Without a cosigner, borrowers may face higher interest rates, larger down payments, or loan denial due to insufficient creditworthiness.

Key Differences: With vs Without a Cosigner

A loan with a cosigner typically offers lower interest rates and higher approval chances due to the added credit security, while a loan without a cosigner often requires a stronger individual credit profile and may come with higher rates or stricter terms. Cosigners share legal responsibility for repayment, reducing the lender's risk, whereas borrowers without cosigners carry full liability and face greater scrutiny during approval. The presence or absence of a cosigner significantly impacts loan accessibility, credit requirements, and financial obligations throughout the loan lifecycle.

Pros and Cons of Having a Cosigner

Having a cosigner can improve loan approval chances and secure lower interest rates by boosting the borrower's creditworthiness. However, involving a cosigner also means shared financial responsibility, where missed payments affect both parties' credit scores and strain personal relationships. Loans without a cosigner rely solely on the borrower's credit profile, which may result in higher interest rates or loan denials but ensure complete financial independence.

Car Loan Approval Rates: Cosigner vs No Cosigner

Car loan approval rates significantly improve with a cosigner, as lenders view the additional party's creditworthiness as a risk reduction, increasing approval likelihood by up to 40%. Without a cosigner, applicants with poor or limited credit history face higher rejection rates and may encounter higher interest rates or stricter loan terms. Cosigners contribute to lower monthly payments and better loan conditions by leveraging their stronger credit profile.

Credit Impact: How a Cosigner Changes Your Loan Offer

A cosigner can significantly improve your loan offer by boosting the application with their higher credit score, potentially lowering your interest rate and increasing approval chances. Without a cosigner, lenders rely solely on your credit history, which may result in higher interest rates or loan denial if your credit is weak. The cosigner's credit risk is shared, so any missed payments impact both parties' credit scores, emphasizing the importance of trust and communication in cosigned loans.

Interest Rates Comparison: Cosigner vs No Cosigner

Loan interest rates are generally lower with a cosigner, as lenders perceive reduced risk when an additional responsible party agrees to repay the debt. Without a cosigner, borrowers often face higher interest rates or may be denied credit due to limited or poor credit history. Comparing average interest rates, loans with cosigners can save borrowers several percentage points, significantly lowering total repayment costs.

Risks and Responsibilities for Cosigners

Cosigners assume significant financial risks by agreeing to repay the loan if the primary borrower defaults, which can negatively impact their credit score and increase their debt-to-income ratio. They share equal responsibility for timely payments, making them liable for the full loan balance in case of missed or late payments, potentially leading to collections or legal action. Understanding these obligations is crucial before cosigning, as it can affect the cosigner's ability to obtain future credit or loans.

When You Should Consider a Cosigner

A cosigner should be considered when your credit score is low, your income is insufficient, or you lack a strong credit history, as they provide additional assurance to lenders. Loans with a cosigner often have better approval rates and lower interest rates due to reduced risk. Without a cosigner, you may face higher interest rates or loan denials, especially for large loans like mortgages or student loans.

How No Cosigner Affects Your Car Loan Terms

Opting for a car loan without a cosigner usually leads to higher interest rates because lenders assess greater risk when approving loans solely based on the primary borrower's credit history. Loan terms without a cosigner often include stricter approval criteria and potentially larger down payment requirements to offset the perceived risk. This can result in increased monthly payments and overall loan costs compared to loans secured with a cosigner who has strong credit credentials.

Making the Best Choice: Cosigner or No Cosigner for Your Auto Loan

Choosing between a cosigner and no cosigner for your auto loan significantly impacts loan approval chances, interest rates, and monthly payments. Borrowers with limited credit history or lower credit scores benefit from a cosigner, as lenders consider shared credit profiles, often resulting in better loan terms. Opting for no cosigner requires stronger creditworthiness but simplifies the loan process and retains full financial responsibility.

Cosigner vs No cosigner Infographic

cardiffo.com

cardiffo.com