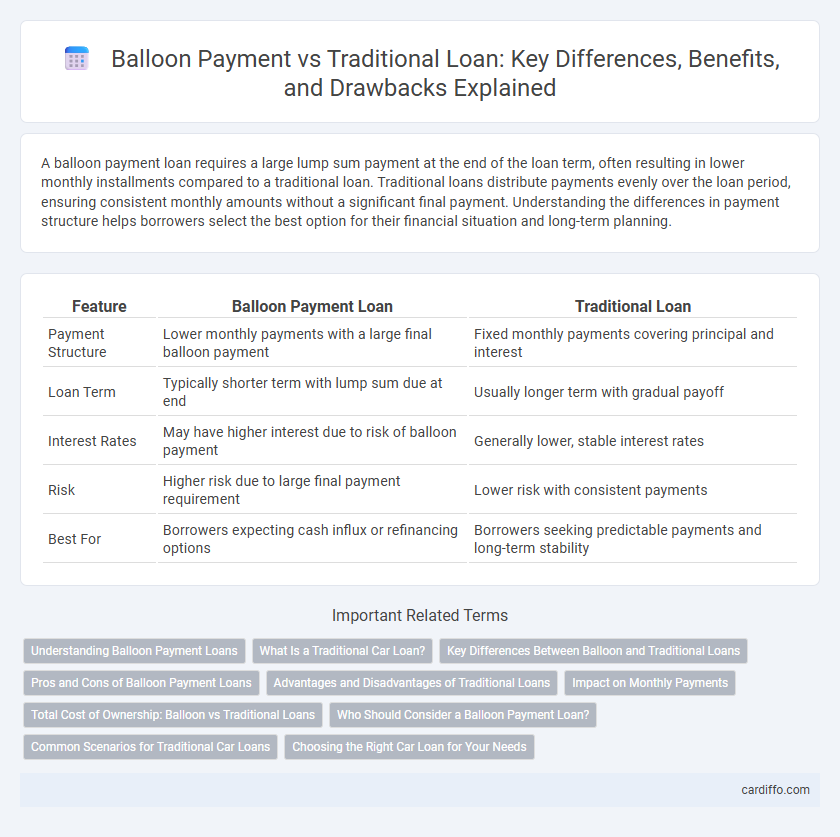

A balloon payment loan requires a large lump sum payment at the end of the loan term, often resulting in lower monthly installments compared to a traditional loan. Traditional loans distribute payments evenly over the loan period, ensuring consistent monthly amounts without a significant final payment. Understanding the differences in payment structure helps borrowers select the best option for their financial situation and long-term planning.

Table of Comparison

| Feature | Balloon Payment Loan | Traditional Loan |

|---|---|---|

| Payment Structure | Lower monthly payments with a large final balloon payment | Fixed monthly payments covering principal and interest |

| Loan Term | Typically shorter term with lump sum due at end | Usually longer term with gradual payoff |

| Interest Rates | May have higher interest due to risk of balloon payment | Generally lower, stable interest rates |

| Risk | Higher risk due to large final payment requirement | Lower risk with consistent payments |

| Best For | Borrowers expecting cash influx or refinancing options | Borrowers seeking predictable payments and long-term stability |

Understanding Balloon Payment Loans

Balloon payment loans feature smaller monthly installments with a large lump sum due at the end of the term, contrasting traditional loans that spread payments evenly over the loan duration. Borrowers benefit from lower initial payments but must prepare for the substantial final balloon amount, which may require refinancing or a sale. Understanding the payment structure and potential risks is crucial for managing cash flow and total loan costs effectively.

What Is a Traditional Car Loan?

A traditional car loan is a type of auto financing where the borrower makes fixed monthly payments that cover both principal and interest over a set term, usually ranging from 36 to 72 months. Unlike balloon payment loans, traditional loans fully amortize the vehicle's purchase price by the end of the loan term, eliminating large lump-sum payments. This structure provides predictable budgeting and clear ownership transfer once all payments are complete.

Key Differences Between Balloon and Traditional Loans

Balloon loans feature smaller monthly payments with a large lump sum due at the end, whereas traditional loans have consistent, fully amortized payments throughout the loan term. The key difference lies in the repayment structure, with balloon loans often appealing for short-term financing or lower monthly costs but carrying higher risk at maturity. Traditional loans provide predictable budgeting with steady amortization, reducing the risk of large final payments.

Pros and Cons of Balloon Payment Loans

Balloon payment loans offer lower initial monthly payments compared to traditional loans, making them attractive for borrowers seeking short-term affordability or expecting increased future income. However, the large lump-sum payment due at the end poses significant financial risk and may require refinancing or asset liquidation. This structure benefits borrowers with fluctuating cash flow but carries potential downsides like higher overall cost and credit risk if the balloon payment cannot be met.

Advantages and Disadvantages of Traditional Loans

Traditional loans offer fixed monthly payments and predictable repayment schedules, providing borrowers with financial stability and ease of budgeting. However, they often come with higher monthly payments compared to balloon loans, potentially straining cash flow for some borrowers. The longer amortization period can result in higher total interest paid over the life of the loan despite the steady repayment structure.

Impact on Monthly Payments

Balloon payments significantly reduce monthly payments compared to traditional loans by deferring a large portion of the principal to the end of the loan term. Traditional loans require consistent monthly payments of principal and interest, resulting in higher but predictable monthly costs. Borrowers seeking lower monthly expenses often choose balloon loans but must prepare for the substantial lump-sum payment due at maturity.

Total Cost of Ownership: Balloon vs Traditional Loans

Balloon loans often feature lower monthly payments but culminate in a large lump-sum payment, which can significantly increase the total cost of ownership if refinancing options are limited or interest rates rise. Traditional loans spread repayments evenly over the loan term, providing predictable monthly payments and potentially lower long-term interest costs. Borrowers must evaluate the total loan amount, interest rate, repayment term, and potential fees to accurately compare the overall financial impact of balloon versus traditional loans.

Who Should Consider a Balloon Payment Loan?

Borrowers with confident future cash flow or upcoming income boosts should consider a balloon payment loan to benefit from lower initial monthly payments compared to traditional loans. This loan type suits individuals expecting a significant lump sum, such as a bonus, inheritance, or property sale, enabling them to pay off the balloon amount at maturity. Balloon loans benefit self-employed borrowers or business owners who prefer short-term financing with manageable payments before a large final settlement.

Common Scenarios for Traditional Car Loans

Traditional car loans are commonly used by buyers seeking fixed monthly payments over a set term, typically ranging from 36 to 72 months, which simplifies budgeting and financial planning. These loans often feature fully amortized payments, meaning the entire loan balance is paid off by the end of the term without a large final payment. Borrowers who prefer predictable expenses and clear payoff schedules usually choose traditional loans over balloon payment options, which require a sizable lump sum at the end.

Choosing the Right Car Loan for Your Needs

Balloon payment car loans offer lower monthly payments by deferring a large sum to the end of the term, making them suitable for buyers who expect a higher future income or plan to refinance. Traditional loans have consistent monthly payments with no large lump sum at the end, providing predictable budgeting and full ownership once paid off. Evaluating your financial stability, future income projections, and risk tolerance is essential when choosing between balloon payment and traditional car loans to ensure affordable and manageable payments.

Balloon Payment vs Traditional Loan Infographic

cardiffo.com

cardiffo.com