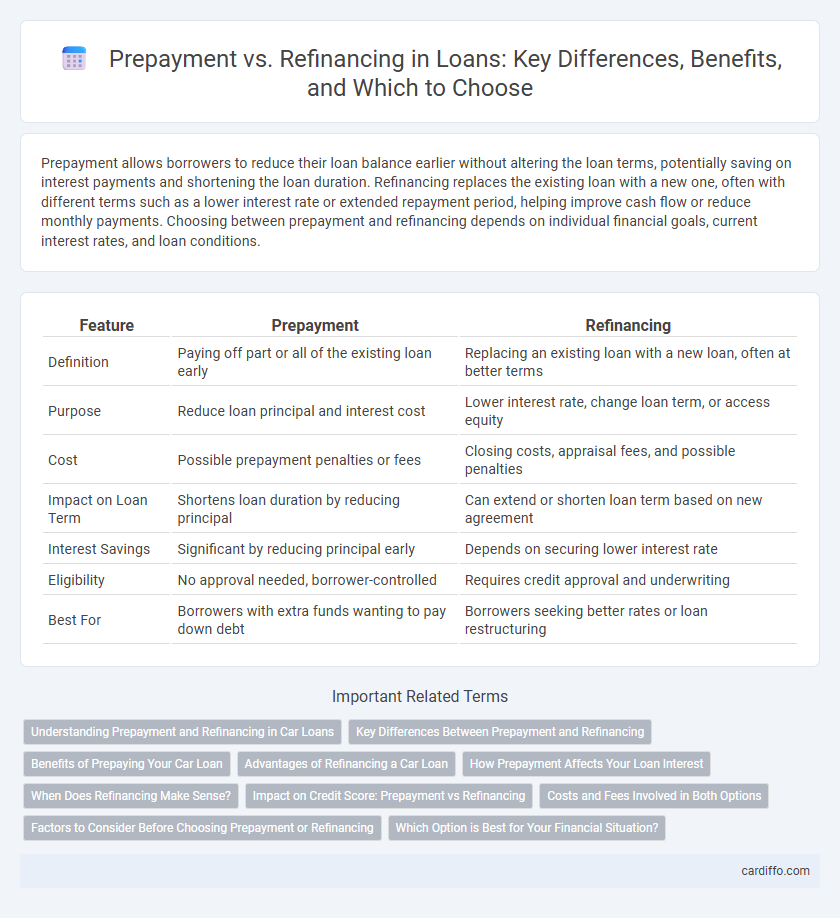

Prepayment allows borrowers to reduce their loan balance earlier without altering the loan terms, potentially saving on interest payments and shortening the loan duration. Refinancing replaces the existing loan with a new one, often with different terms such as a lower interest rate or extended repayment period, helping improve cash flow or reduce monthly payments. Choosing between prepayment and refinancing depends on individual financial goals, current interest rates, and loan conditions.

Table of Comparison

| Feature | Prepayment | Refinancing |

|---|---|---|

| Definition | Paying off part or all of the existing loan early | Replacing an existing loan with a new loan, often at better terms |

| Purpose | Reduce loan principal and interest cost | Lower interest rate, change loan term, or access equity |

| Cost | Possible prepayment penalties or fees | Closing costs, appraisal fees, and possible penalties |

| Impact on Loan Term | Shortens loan duration by reducing principal | Can extend or shorten loan term based on new agreement |

| Interest Savings | Significant by reducing principal early | Depends on securing lower interest rate |

| Eligibility | No approval needed, borrower-controlled | Requires credit approval and underwriting |

| Best For | Borrowers with extra funds wanting to pay down debt | Borrowers seeking better rates or loan restructuring |

Understanding Prepayment and Refinancing in Car Loans

Prepayment in car loans refers to paying off the loan balance before the scheduled due dates, which can reduce overall interest costs and shorten the loan term. Refinancing involves replacing an existing car loan with a new loan, often to secure lower interest rates, better terms, or reduced monthly payments. Evaluating prepayment penalties and comparing current interest rates are essential steps to determine if refinancing or prepayment will provide greater financial benefits.

Key Differences Between Prepayment and Refinancing

Prepayment involves paying off a portion or the entire loan balance before the scheduled due date, reducing interest costs without altering the original loan terms. Refinancing replaces the existing loan with a new one, often to secure lower interest rates, change loan duration, or adjust monthly payments. Key differences include the impact on loan structure, potential fees, and long-term financial benefits.

Benefits of Prepaying Your Car Loan

Prepaying your car loan reduces the total interest paid over the loan term, leading to significant cost savings and faster equity buildup. It improves your credit score by lowering your debt-to-income ratio and demonstrates financial responsibility to lenders. Early repayment enhances your financial flexibility by freeing up monthly cash flow for other expenses or investments.

Advantages of Refinancing a Car Loan

Refinancing a car loan can lower monthly payments by securing a reduced interest rate, making it easier to manage cash flow. It also offers the opportunity to extend the loan term, decreasing immediate financial burdens without affecting credit scores negatively. Refinancing may provide access to better loan terms or additional funds for other expenses, enhancing overall financial flexibility.

How Prepayment Affects Your Loan Interest

Prepayment reduces the principal balance of your loan, which lowers the total interest paid over the loan term by shortening the repayment period. Unlike refinancing, prepayment does not change your interest rate but accelerates loan payoff, decreasing the interest accrued daily. Making extra payments directly targets the principal, enhancing savings compared to simply adjusting terms through refinancing.

When Does Refinancing Make Sense?

Refinancing makes sense when interest rates are significantly lower than your current loan, allowing you to reduce monthly payments or pay off the loan faster. It is beneficial if the closing costs and fees are outweighed by the long-term savings over the life of the loan. Refinancing also suits borrowers seeking to change loan terms, such as switching from an adjustable-rate mortgage to a fixed-rate loan for more stability.

Impact on Credit Score: Prepayment vs Refinancing

Prepayment of a loan generally has a positive impact on credit score by reducing overall debt and demonstrating responsible financial behavior. Refinancing can temporarily lower credit scores due to credit inquiries and opening new accounts, but it may improve credit utilization and payment history in the long term. Understanding the effects on credit score helps borrowers choose between prepayment and refinancing to optimize their financial health.

Costs and Fees Involved in Both Options

Prepayment of a loan often involves early repayment penalties or administrative fees that can vary depending on the lender's terms and the loan type. Refinancing typically incurs closing costs, appraisal fees, and potential origination charges, which can total 2% to 6% of the loan amount. Evaluating these costs is essential to determine whether the financial benefit of refinancing outweighs the immediate expenses compared to prepayment fees.

Factors to Consider Before Choosing Prepayment or Refinancing

Evaluating prepayment versus refinancing requires analyzing interest rate differences, loan terms, and associated fees to determine which option offers greater financial savings. Consider the impact on credit score, loan duration, and flexibility, as prepayment reduces principal faster while refinancing restructures the loan under new terms. Assess personal financial goals, current market rates, and potential penalties to make an informed decision between these debt management strategies.

Which Option is Best for Your Financial Situation?

Prepayment reduces your loan principal faster, lowering overall interest costs and shortening your loan term without the need for new credit approval. Refinancing offers the opportunity to secure a lower interest rate or better loan terms, potentially reducing monthly payments and improving cash flow. Assess your current interest rate, remaining loan balance, credit score, and long-term financial goals to determine whether prepayment or refinancing offers the greatest benefit for your unique financial situation.

Prepayment vs refinancing Infographic

cardiffo.com

cardiffo.com