APR (Annual Percentage Rate) represents the yearly interest rate charged on a loan, expressed as a percentage, while the Money Factor is a decimal value used primarily in lease agreements to calculate interest. Converting the Money Factor to an equivalent APR involves multiplying it by 2,400, which helps compare leasing costs to traditional loan interest rates. Understanding the difference between APR and Money Factor allows borrowers to evaluate financing options more effectively and choose the most cost-efficient method.

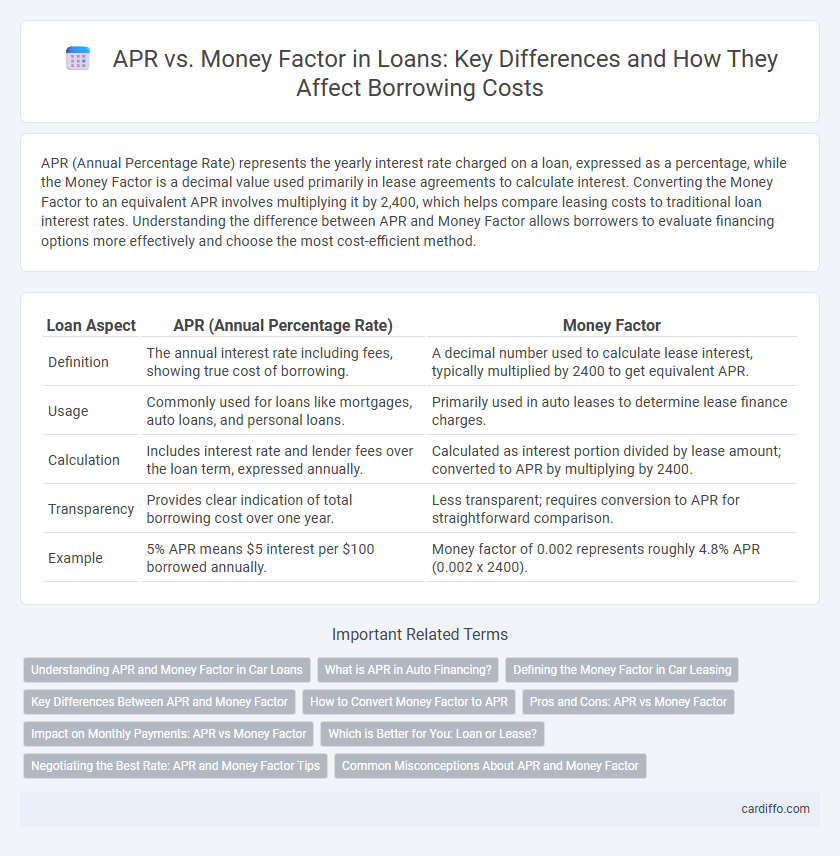

Table of Comparison

| Loan Aspect | APR (Annual Percentage Rate) | Money Factor |

|---|---|---|

| Definition | The annual interest rate including fees, showing true cost of borrowing. | A decimal number used to calculate lease interest, typically multiplied by 2400 to get equivalent APR. |

| Usage | Commonly used for loans like mortgages, auto loans, and personal loans. | Primarily used in auto leases to determine lease finance charges. |

| Calculation | Includes interest rate and lender fees over the loan term, expressed annually. | Calculated as interest portion divided by lease amount; converted to APR by multiplying by 2400. |

| Transparency | Provides clear indication of total borrowing cost over one year. | Less transparent; requires conversion to APR for straightforward comparison. |

| Example | 5% APR means $5 interest per $100 borrowed annually. | Money factor of 0.002 represents roughly 4.8% APR (0.002 x 2400). |

Understanding APR and Money Factor in Car Loans

APR (Annual Percentage Rate) represents the total yearly cost of a car loan, including interest and fees, expressed as a percentage, making it easier to compare different loan offers. Money Factor, used primarily in auto leasing, is a decimal number that, when multiplied by 2400, converts approximately to the APR, helping consumers understand lease financing costs. Understanding both APR and Money Factor is essential for evaluating car loans versus leases, ensuring more informed financial decisions.

What is APR in Auto Financing?

APR (Annual Percentage Rate) in auto financing represents the yearly interest rate charged on a loan, including fees and costs, expressed as a percentage. It provides a standardized measure allowing borrowers to compare the overall cost of different loan offers. Unlike the money factor, which is often used in leasing and expressed as a decimal, APR gives a straightforward view of the true cost of borrowing over a year.

Defining the Money Factor in Car Leasing

The Money Factor in car leasing is a decimal figure representing the interest rate used to calculate the lease's finance charge, often much lower numerically than an APR but directly convertible by multiplying by 2,400 to approximate the equivalent APR. Unlike APR, which includes interest and fees expressed as an annual percentage rate, the Money Factor strictly quantifies the cost of borrowing in a lease, affecting monthly payments without reflecting the full cost of financing. Understanding the Money Factor helps lessees compare lease offers accurately, ensuring better financial decisions when selecting car lease terms.

Key Differences Between APR and Money Factor

APR (Annual Percentage Rate) represents the total yearly cost of a loan, including interest and fees, expressed as a percentage. Money Factor, primarily used in auto leasing, is a decimal figure that, when multiplied by 2,400, approximates the APR, reflecting the lease's interest rate. Key differences include APR's use in purchases with fixed rates versus Money Factor's application in leases with monthly payments and the distinct calculation methods affecting overall cost transparency.

How to Convert Money Factor to APR

To convert a money factor to APR, multiply the money factor by 2,400. For example, a money factor of 0.00125 equals an APR of 3.0%. This conversion helps compare lease rates with traditional loan APRs for better financial decisions.

Pros and Cons: APR vs Money Factor

APR represents the annual percentage rate, providing borrowers a clear, standardized metric to compare loan costs, often reflecting the true interest paid over a year, whereas the money factor is a decimal used primarily in lease calculations to determine interest costs. APR's advantage lies in its transparency and ease of understanding, making it ideal for traditional loans, while money factor offers precise interest calculation for lease terms but can be less intuitive for consumers. The main drawback of APR is occasional higher rates due to compounding, whereas money factor's cons include difficulty in directly comparing it to conventional interest rates, potentially confusing borrowers.

Impact on Monthly Payments: APR vs Money Factor

APR directly influences monthly loan payments by representing the annual cost of borrowing, incorporating interest and fees, resulting in fixed, predictable payments over the loan term. Money factor, commonly used in leases, is a decimal that, when multiplied by 2400, approximates the APR and determines the finance charge portion of monthly lease payments, often leading to lower monthly costs compared to traditional loans. Understanding the distinction between APR and money factor is crucial for accurately comparing monthly payment impacts and total borrowing costs in loans versus leases.

Which is Better for You: Loan or Lease?

APR (Annual Percentage Rate) reflects the total cost of borrowing on a loan, including interest and fees, making it transparent for comparing financing options. Money Factor, used in leases, represents the interest rate in a decimal format and can be converted to an APR by multiplying by 2, providing insight into the lease's financing cost. Choosing between a loan or lease depends on your financial goals: loans offer ownership and equity build-up with clearer APR costs, while leases often have lower monthly payments but rely on the money factor and come with mileage and wear restrictions.

Negotiating the Best Rate: APR and Money Factor Tips

When negotiating the best loan rate, understanding the difference between APR and money factor is crucial; APR represents the annual percentage rate reflecting the total cost of borrowing, including interest and fees, while money factor is a decimal used primarily in lease agreements to calculate interest. Focus on comparing the APR for loans to ensure transparency and true cost, as a lower money factor in leasing translates to a better interest rate but requires converting to APR by multiplying by 2400 for accurate comparison. Negotiate by leveraging competitive APR offers and requesting detailed disclosures of all fees to avoid hidden costs and secure the lowest financing expense.

Common Misconceptions About APR and Money Factor

Many borrowers confuse APR and money factor when comparing loan costs, but APR represents the annual interest rate including fees, while money factor is a lease-specific decimal value that must be multiplied by 2,400 to approximate APR. Misunderstanding money factor as a simple interest rate leads to incorrect cost assumptions, especially since it excludes certain fees included in APR calculations. Clear differentiation between APR and money factor improves financial decisions in loan versus lease evaluations.

APR vs Money Factor Infographic

cardiffo.com

cardiffo.com